Fight against inflation is not over yet, Bank of England says

>

The fight against inflation is not over yet, Bank of England chief economist says… while hinting he favors more rate hikes

- Huw Pill said energy prices may stabilize, but other issues will remain

- Staff shortages and supply chain issues allowed inflation to persist

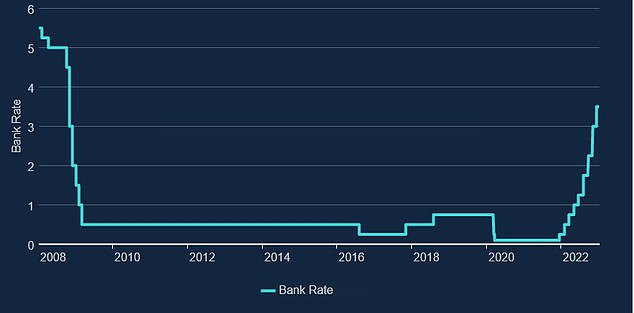

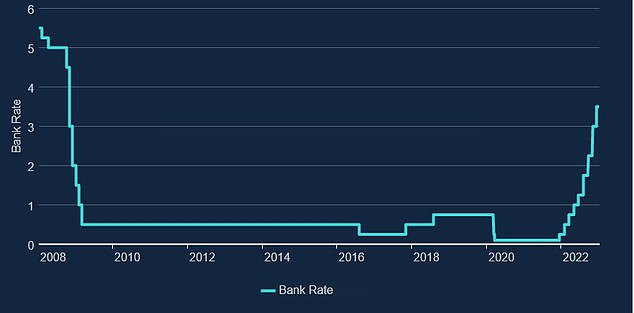

- The Bank has already raised rates from 0.1% just over a year ago to 3.5%

<!–

<!–

<!–<!–

<!–

<!–

<!–

The battle against inflation is not yet over, said the chief economist of the Bank of England last night.

Huw Pill said he is in favor of further rate hikes and warned that even as energy prices stabilized, labor shortages and supply chain issues could “prove inflation more sustainable.”

The bank is expected to implement a further rate hike of half a percentage point next month.

It has already raised rates from 0.1 percent just over a year ago to 3.5 percent now.

Huw Pill (pictured) warned that even if energy prices stabilized, labor shortages and supply chain problems could ‘turn out more expensive’ inflation

In his New York speech, Mr. Pill argued that in the fight to beat inflation, some workers and companies must accept lower wages and profits.

He said: “The distinctive context prevailing in the UK – of higher natural gas prices with a tight labor market, unfavorable supply developments and bottlenecks in the goods market – creates the possibility of inflation becoming more persistent.”

While experts broadly agree that the Bank will raise rates by half a point in February, there is less certainty about how much further they will go, as some MPC members are already choosing not to vote for the most recent increases.

Pill said his analysis on continued inflation would “strongly influence” his decision on interest rates in the coming months.

It puts him in the aggressive camp that will likely call for more raises.

That would hurt both mortgage lenders and businesses more at a time when consumers and businesses are already struggling to stay afloat.

It comes at a time when workers across the economy are calling for big pay cuts as they face a major increase in the cost of living.

Still, Pill argued that in the battle to beat inflation, workers — as well as companies willing to pass on higher costs — would have to accept that their wages or profits are falling in real terms.

“The longer companies try to maintain real profit margins and workers try to keep real wages at pre-energy price shock levels, the more likely it is that domestically generated inflation will gain its own self-sustaining momentum,” said Pill. .

The Bank of England raised interest rates repeatedly last year, with the base rate reaching 3.5%

Pill’s speech argued that the UK differentiated itself from other countries by facing a series of inflationary challenges at the same time.

Labor shortages in much of the economy, coupled with companies’ ability to pass on higher costs by raising prices, increase the risk that inflation will persist, he argued.

Pill apparently also took a swipe at MPC predecessors, who left interest rates near zero in the aftermath of the financial crisis.

“It was unusual to see policy rates fall close to zero for so long,” he said.