Famous economist who predicted 2008 recession issues VERY grim warning over future of the US economy

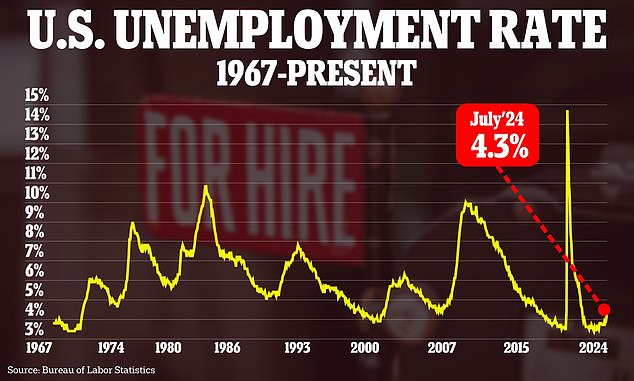

A legendary economist says the shrinking labor market is the ultimate indicator that the US economy is headed for a recession.

David Rosenberg, who predicted the 2008 recession when he was chief economist at Merrill Lynch, recently told his clients that the U.S. economy created 818,000 fewer jobs last year than originally reported. That’s the biggest downgrade since the Great Recession.

According to the U.S. Bureau of Labor Statistics, job growth figures from March 2023 to March 2024 were actually 30 percent lower than the original figure of 2.9 million. Rosenberg says this blow could lead to disaster in the near future.

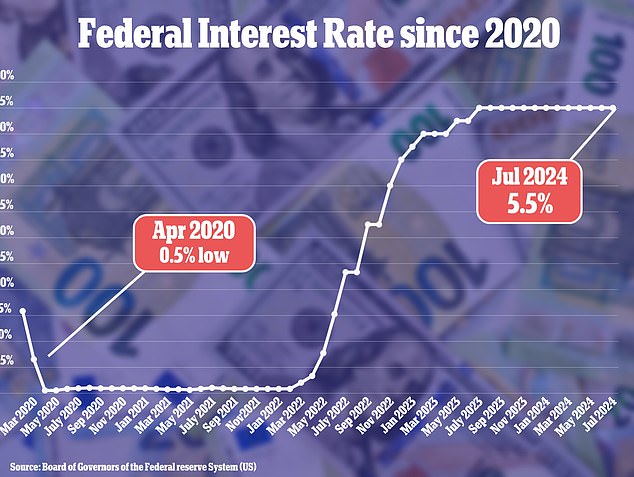

Rosenberg, founder of financial research firm Rosenberg Research, also directed his ire at the Federal Reserve for stubbornly refusing to cut rates since July 2023.

The Fed’s policy “has been too tight, for too long, to prevent an economic slowdown,” he wrote in a note distributed to clients last week that was shared by Company Insider.

David Rosenberg has warned in recent years that the US is on the brink of a recession, but has been more vocal about his fears in 2024

He also attacked the Fed for raising rates so much, something Fed Chairman Jerome Powell committed to doing at 11 consecutive meetings from March 2022 to July 2023.

The current federal interest rate is 5.5 percent, the highest level in 23 years.

This percentage also affects consumer credit. When the percentage is higher, mortgage interest and annual credit card fees also increase.

The Fed was forced to raise interest rates to curb consumer spending and tame inflation, which fell to 2.9 percent in July.

The Fed still targets an inflation rate of 2 percent.

“It is unbelievable that the Fed raised rates by 500 basis points when it was wrongly assumed — by more than a million people — that the labor market was robust,” Rosenberg wrote.

Rosenberg has been warning in recent years that the US is on the brink of a recession, but in 2024 he has made his concerns extra loud and clear.

Despite adding 206,000 jobs to the economy, according to the June nonfarm employment report, Rosenberg pointed out that the number of full-time jobs has fallen 1.2 percent since the beginning of the year.

When it was announced in May that 63,000 fewer jobs had been added in April, Rosenberg even warned the Fed about upcoming revisions to the employment figures.

“It will be a shock to the Fed — and it will be a shock to the markets,” Rosenberg said at the time.

Rosenberg predicts that the U.S. economy is headed for another recession, with a struggling labor market as a catalyst. A Lehman Brothers employee is pictured leaving the office on September 15, 2008, the day the bankrupt financial services company filed for bankruptcy.

After news of the 818,000 jobs downgrade broke, major indexes including the S&P 500 and the Dow Jones briefly lost gains, but by Friday’s close the markets had fully recovered.

However, Rosenberg points to two models that he says paint a bleak picture of the longer-term future of the economy as a whole.

One goal is to improve the yield curve, a tool used to measure bond investors’ risk appetite, and turn it into a recession indicator.

The model takes into account the ability of US companies to repay debt, also known as corporate bonds, and the Fed’s strategy. National Financial Condition Indexa weighted average of a large number of factors believed to assess the tightness or looseness of the economy.

This combined measure currently gives a 57 percent chance of a downturn.

Unemployment rose to 4.3 percent in July, the highest level in nearly three years

The Federal Reserve kept interest rates between 5.25 and 5.5 percent at its last meeting

The other model Rosenberg refers to was created by economists Pascal Michaillat and Emmanuel Saez. This model focuses on the number of vacancies.

It shows the US is in ‘possible recession’ territory, with the chart trending upwards towards ‘certain recession’.

However, there are those who disagree and argue that last week’s downward revision to employment numbers is not as positive as it seems.

Ian Shepherdson, chief economist at Pantheon Macroeconomics, said average monthly job growth remains strong despite the revisions.

“It tells us nothing about wages since March and has no impact on the unemployment rate, which is measured by a separate household survey,” Shepherdson said in a note to clients.

He continued: ‘The monthly profile of benchmark revisions will be released in February next year, but the overall figure broadly suggests that payrolls grew at a still-respectable average pace of around 175,000 in the 12 months to March, compared with 232,000 previously.’

Federal Reserve Chairman Jerome Powell (left), Bank of Canada Governor Tiff Macklem (center) and Bank of England Governor Andrew Bailey pose for a photo during the Fed’s annual meeting in Jackson Hole on August 23, 2024. During the meeting, Powell indicated that a policy shift is coming

While Rosenberg believes the Fed is acting too late to contain the economic fallout, Powell appears intent on taking action.

“It is time for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the changing outlook and the balance of risks,” Powell said Friday at the Fed’s annual retreat in Jackson Hole, Wyoming.

The next meeting of the Federal Open Market Committee, where interest rate decisions are made, is scheduled for September 17 and 18.

The Fed is expected to cut rates by at least 25 basis points, and the consensus on Wall Street remains that the economy will make a soft landing. This essentially means that we will narrowly avoid a recession.

Still, a soft landing depends almost entirely on employment numbers in the coming months. And if the labor market weakens further, Rosenberg expects a bumpy ride.