Expert explains why Heinz, Coca-Cola, Nestle and Hellman’s can keep prices higher than supermarket own label – and customers are partly to blame

With government inflation numbers showing signs of cooling, many consumers may be wondering when they’ll experience some respite at the grocery store.

But experts warn that high prices are here to stay, especially for household brands.

It comes after a host of major companies, including Pepsi, indicated that rising prices over the past two years have started to ‘normalise’ rather than fall.

Such companies are under no pressure to cut costs because their different tastes or fan followings mean they face less competition from private label labels, experts say.

Instead, consumers are only turning to off-brand alternatives for simpler products.

The premium shoppers pay for household brands is often high. DailyMail analyzed products for sale on Walmart’s website

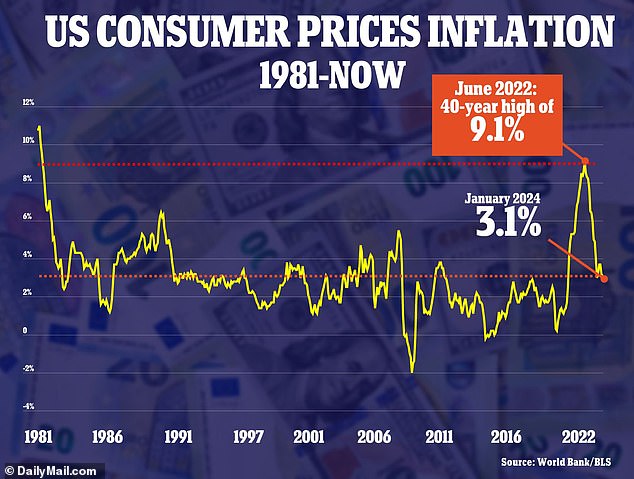

Inflation first started rising in the US in 2021, following Russia’s invasion of Ukraine. It peaked at 9.1 percent in June 2022

It’s one reason why Kraft Heinz sold its Planters nut business — which had a less loyal following than, say, ketchup — to Hormel three years ago.

Arun Sundaram, an analyst at CFRA Research, said CNBC: ‘I think it will take some time before prices for packaged food go down.

‘The more ingredients there are in the product, the more pricing power you generally have.’

The premium shoppers pay for household brands is often high. For example, a 30 Oz bottle of Heinz Tomato Ketchup costs $4.76 at Walmart.

But a bottle of the same size of own-brand ‘Great Value’ ketchup currently costs $1.94 on the retailer’s website.

Likewise, a 2-liter bottle of Coca Cola would cost a customer $2.74, while a Sam’s Cola costs only $1.48.

Meanwhile, a 30oz jar of Hellman’s mayo – made by Unilever – costs $5.98 on Walmart’s website, while the ‘Great Value’ equivalent is $3.34.

Inflation first started rising in the US in 2021, following Russia’s invasion of Ukraine. It peaked at 9.1 percent in June 2022.

In January, annual inflation hovered around 3.1 percent — above the 2.9 percent forecast by economists and still higher than the Federal Reserve’s 2 percent target.

Annual inflation was 3.1 percent in January, down from 3.4 percent in December but still 0.2 percent higher than expected

After a period of hot inflation, two trends can emerge: deflation and disinflation.

Deflation means that prices fall outright – meaning annualized inflation falls below zero – while disinflation means that they continue to rise, but at a more stable rate.

Late last year, Walmart CEO Doug McMillion claimed that deflation was coming for some major grocery items.

However, the retailer seems to have already gone back on that promise.

Chief Financial Officer John David Rainey told CNBC: “There is deflation in certain categories – the opportunity remains overall – but prices are more stable than where they were three months ago.”

Similarly, Gregory Daco, chief economist at EY, told the paper: “You rarely see prices falling on a uniform basis outside of recessions or deep recessions.”

In a recent earnings call, Home Depot bosses said the prices of their items had “stabilized” rather than fallen.

During an earnings call earlier this month, McDonald’s CEO Chris Kempczinski admitted that consumers are spending less than $45,000 a year at restaurants

Similarly, Pepsi CEO Ramon Laguart noted in a recent earnings call that the company would not increase costs above “normal price levels.”

A slew of companies have blamed high inflation for dampening their sales this year.

McDonald’s CEO Chris Kempczinski admitted that consumers are spending less than $45,000 a year at restaurants.

“Eating at home has become more affordable,” he said.

‘The battleground certainly lies with those consumers with a low income. I think what you’re going to see as you get into 2024 is probably more of a focus on what I would describe as affordability.”

McDonald’s increased menu prices in the U.S. by about 10 percent in 2023 and made similar increases the year before.

The chain came under fire last year after one of its restaurants in Connecticut was busted for selling a Big Mac meal for $17.59.