Europe is avoiding a recession for the time being, despite a stagnation in GDP in the last quarter of 2023

- Predict matching and better than expected results for the entire block

- Even Germany is avoiding a technical recession as third quarter figures are revised upwards

The eurozone successfully avoided a recession in 2023 after Britain’s biggest trading partner reported flat GDP growth for the final quarter of the year.

European Central Bank figures show the bloc beat market forecasts of a 0.1 percent decline for the quarter, while even weak heavyweights France and Germany beat expectations.

But a preliminary estimate of GDP growth of 0.5 percent for both the eurozone and the European Union as a whole stands in stark contrast to the 3 percent growth in the US, and puts pressure on the ECB to consider interest rate cuts to to help strengthen the economy. economy.

Market prices indicate that the ECB will start cutting rates in the second quarter of 2024, followed by four more cuts before the end of the year.

ECB chief Christine Lagarde warned last week that talk of interest rate cuts was “premature.”

Significantly, Germany managed to avoid a technical recession despite a 0.3 percent GDP decline in the fourth quarter, after Q3 figures were revised upwards from a 0.1 percent decline to a flat grow.

Separate figures on Wednesday also showed that German consumer price inflation fell more than expected in January, from 3.8 percent in December to 3.1 percent.

Similarly, French GDP stagnated in the fourth quarter, while a 0.1 percent decline in the third quarter was revised upwards to flat GDP growth.

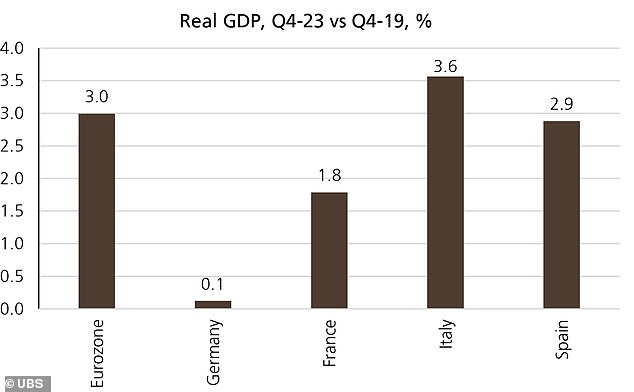

How the Eurozone economies have performed since 2020

Data also showed on Wednesday that French inflation fell more than expected, reaching 3.1 percent for January, down from 3.7 percent in December.

Meanwhile, Tuesday’s figures showed better-than-expected fourth-quarter GDP growth of 0.2 and 0.6 percent in Spain and Italy respectively.

Charles Hepworth, investment director at GAM Investments, said: ‘There is much whining and gnashing of teeth that the fourth quarter would see a similar decline and result in the classic definition of a technical, if superficial, recession across Europe. However, the block managed to escape this in the nick of time.’

But Hepworth warned that the lackluster growth figures are “unlikely to encourage the doves at the ECB”, which is more likely to keep interest rates “higher for longer” if there is no more severe recession.

It echoes comments from ECB chief Christine Lagarde, who warned last week that talk of rate cuts was “premature”.

The ECB has left interest rates unchanged at a record high of 4 percent since September.

Economist Hugo Le Damany of AXA Investment Managers and Eurozone senior economist François Cabau said the fourth-quarter GDP data “reinforced the view that interest rate cuts are justified sooner or later,” with a cut expected at the ECB meeting in April’ is certainly in the offing’.

They added: ‘(The data) makes it clear that monetary tightening (in the past) is the overwhelming downward force.

‘In the context of uninspiring business and consumer confidence, we maintain our consensus (of 0.5 percent) and ECB staff GDP forecast (of 0.8 percent) which is below GDP growth in 2024, and we foresee little sequential growth this year that is consistent with GDP growth in 2024. at 0.3 percent.’

Analysts at UBS said: ‘Looking ahead, the eurozone growth outlook remains challenging over the coming quarters, with key headwinds from the ECB’s restrictive monetary policy, a weak external environment and fiscal consolidation.

‘At the same time, the resilience of the labor market and the recovery in real wage growth should support household consumption and thus broader GDP growth.

“We forecast that Eurozone GDP growth will reach 0.6 percent in 2024, before recovering to 1.2 percent in 2025.”

The German economy is only 0.1 percent larger than in the last quarter of 2019