Equity release borrowing DOUBLES in five years: Older homeowners drew £6.2bn from properties in 2022

>

Equity release loans double in five years: Figures show homeowners foreclosed on property worth £6.2bn in cash by 2022, despite higher rates

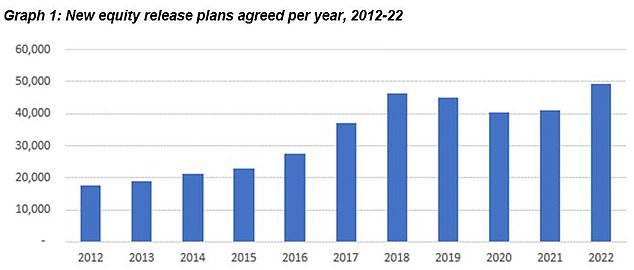

- Records show that 50,000 new equity release plans were closed last year

- A total of 93,421 clients used equity release plans, an increase of 23% from 2021

- However, higher interest rates delayed the release of equity at the end of the year

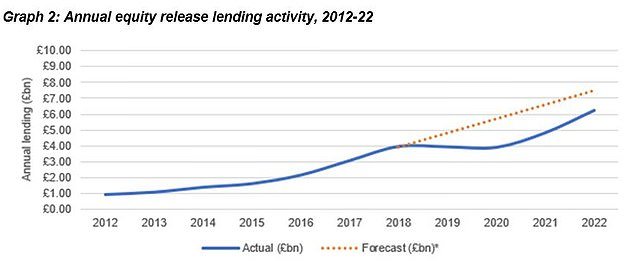

Older homeowners borrowed £6.2 billion against the value of their properties last year through equity releases, up 29 per cent from 2021.

The figure means the market has more than doubled in size since 2017, when £3.06 billion was released, data from the Equity Release Council shows.

A total of 93,421 clients chose to release their assets from their properties last year, an increase of 23 percent from the previous year. The number of newly concluded equity release plans increased by a fifth to 50,000 in 2022.

Rise: Equity loan releases have increased as more senior citizens move their wealth out of their homes

Home equity release loans allow people over 55 to access some of the value built up in their home in the form of tax-free cash. The money must be paid back with interest through the sale of the property when they die or take long-term care.

In March, regulations were introduced for all new All Equity Release Council-approved share release plans, giving clients the right to make voluntary, penalty-free partial redemptions to reduce interest costs.

Board-approved plans also guarantee borrowers the right to remain in their property for life, and have no negative equity guarantee, meaning that if the amount left after the property is sold is not enough to repay the outstanding loan, the estate will not be liable to pay any more.

David Burrowes, Chairman of the Equity Release Council, said: “We saw a glimpse of the potential of the equity release market in 2022 as it returned to its previous growth path with a growing customer base leveraging enhanced products and additional protections.

‘In an environment in which retirement income has to stretch even longer, real estate is just as important to many people’s financial well-being as their retirement.

Despite the overall increase in the amount of money borrowed through equity releases, the number of agreed plans in the last three months of 2022 is down 17 percent from the previous quarter.

Up: The number of new equity release plans closed has increased by a fifth to 50,000 by 2022

Source of cash: Homeowners will have taken £6.2bn worth of assets from their homes by 2022

This reflects the sudden increase in equity releases and easing mortgage interest rates following the September mini budget.

Between July and September 2022, the typical equity release interest rate was 4.54 percent, but by the last three months of the year, it had risen to 5.7 percent, according to stock release broker Key Later Life Finance. .

On an annual basis, the increase is even greater. At the end of 2021, the average rate for equity release products was just 3.07 percent.

“Factors beyond the industry’s control caused 2022 to end unusually quietly in December as the mini-budget spiked rates and tightened criteria,” Burrowes added.

However, equity release is not a choice you make on the spur of the moment, and we are encouraged by signals that customers are pausing to assess their options.

“In the best of times, it is essential to get informed financial advice and independent legal advice from companies that endorse the Board’s standards, and now more than ever.”

Breaking down the numbers, 52 percent of new customers opted for flat-rate plans, where all money is received in one go, up from 43 percent in 2021.

The average new lump sum plan was £128,382 in October to December, down 4 per cent from £133,770 in July to September, while the average first term of a withdrawal plan fell 6 per cent from £88,340 to £82,643.

Will Hale, CEO of Key Later Life Finance, added: “Increased product flexibility and choice has seen the market double since 2017 as more people look to improve their retirement finances using equity.

“While rates have increased post-mini budget, customers can take a more active approach to managing their loans through the option to pay interest or make ad hoc principal repayments, which is now common with modern lifetime mortgages.”