Early retirement is increasingly the preserve of the rich, IFS study shows

- About one in four wealthy people manage to retire early, the IFS report said

- They are disproportionately likely to start working after the age of 70 because they enjoy it

- Becoming too sick to work is much more common among the poorest fifth of the population

When will you retire? More and more people continue to work until the state pension age of 66

Rich people are likely to retire earlier and poorer workers will give up for health reasons, while those in the middle will work well into their 60s, new research shows.

Among people about to retire, employment rates have risen dramatically in recent decades for those with only average levels of wealth.

According to the influential think tank the Institute for Fiscal Studies, in the early 2000s the percentage of people who had retired by the time they reached the age of 55 to 64 was no matter how well off you were.

But early retirement is increasingly the domain of the wealthy, unless you are forced to give up work because you become permanently ill or disabled, or if you take up work as a caregiver.

Being too sick to work is much more common among the poorest fifth of the population. In England it affects 39 percent of 55-64 year olds, compared to just 9 percent of those in the middle and most affluent groups.

The IFS finds that the employment and pension picture is changing for people in their early 70s, at which point wealthy people will disproportionately be in paid work.

“This is consistent with existing research showing that those who work beyond state pension age often do so because they enjoy work or to stay active, and not for financial reasons,” the think tank says.

‘People who work above the state pension age have a disproportionate chance of being self-employed or working less than 16 hours a week.’

The IFS says it is difficult to say whether the post-pandemic decline in employment rates among people just before and after the current state pension age of 66 will continue.

But the report emphasizes that this recent change in direction is very small compared to longer-term trends that began in the mid-1990s and have increased the labor force participation of older men and women.

‘From the perspective of policymakers, most would probably want a higher employment rate, both before and after the state pension age. This generates higher tax revenues and makes less demand on the state for financial support.

“But it is notable that the trends in employment at older ages have not occurred in a way that would clearly ease pressure on the state.”

That’s because the biggest increases in employment have been among middle-class people, not among low-wealth people who are most dependent on state benefits.

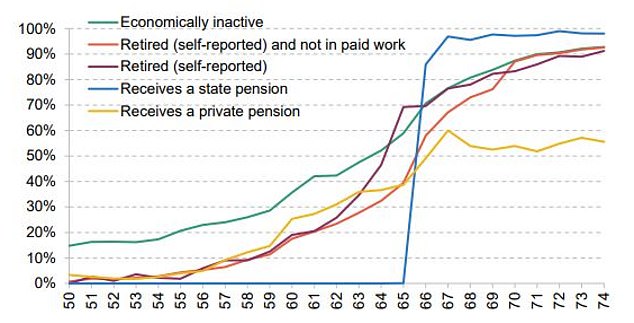

Stopping work: Percentage of retirees by age (Source: IFS)

The employment rate of the middle fifth in terms of wealth rose sharply from 59 percent in 2002-2003 to 76 percent in 2018-2019, the report notes.

By then, labor force participation was 46 percent among the poorest fifth and 65 percent among the richest fifth.

In 2002-2003, 20 percent of the poorest fifth of 55 to 64-year-olds, 24 percent of the middle fifth and 28 percent of the richest fifth were retired.

In 2018-2019, this was 7 percent of the poorest, 14 percent of those with middle wealth and 24 percent of the richest.

The IFS analyzed figures from the English Longitudinal Study of Aging and used the 2018-2019 period as a cut-off, because there is no later information on people’s prosperity, and there have been only small changes in employment trends since then.

Jonathan Cribb, deputy director at the IFS, said: ‘As some accumulate high levels of wealth in their late 50s and early 60s, they are seizing the opportunity to retire early.

‘In contrast, the poorest in this age group often stop working for other reasons, particularly poor health, and spend long periods on government benefits.

‘One of the most remarkable changes of the past twenty years has been the large increase in the number of people with an average level of wealth who continue to work into their mid-sixties, and this is not just due to the increase in the state pension age.

‘These people often do not have the financial security to retire; for example, many have an outstanding mortgage.’