Dying Spirit? Budget airline notorious for brawls is at risk of BANKRUPTCY as shares plummet 17% after court threw out $3.8 billion merger with rival JetBlue

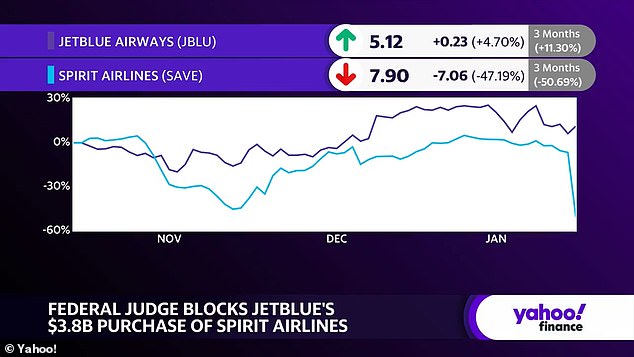

Shares of discount Spirit Airlines fell 17 percent in morning trading on Wednesday, a day after a US judge blocked the airline’s planned $3.8 billion merger with rival JetBlue Airways.

The company hasn’t made any money since the pandemic, ticket sales haven’t recovered as quickly as the airline expected, and dozens of planes will be grounded intermittently this year due to a problem with the engines.

A sale to JetBlue provided a lifeline for Spirit, which must pay off $1.1 billion in debt next year.

But a federal judge in Boston scuttled that plan, ruling Tuesday that JetBlue’s $3.8 billion proposal to buy Spirit violates antitrust law.

Now some Wall Streeters who follow Spirit are throwing around the B-word: bankruptcy. The judge had even hinted at such an outcome during the trial.

Shares of discount Spirit Airlines fell 17 percent in morning trading on Wednesday, a day after a US judge blocked the airline’s planned $3.8 billion merger with rival JetBlue Airways.

After Judge William Young’s ruling on Tuesday, Spirit could look for another buyer, or it could remain independent and try to push through a tough environment for budget airlines.

But “a more likely scenario is a Chapter 11 filing followed by a liquidation,” wrote Helane Becker, a veteran aviation analyst for the financial services firm Cowen.

“We recognize that this sounds alarmist and harsh, but the reality is that we believe there are limited scenarios that would allow Spirit to restructure.”

JPMorgan analyst Jamie Baker wasn’t willing to go that far, but he too painted a grim picture for Spirit, which has the ticker symbol “SAVE.”

“We do not (yet) predict an immediate SAVE Chapter 11 filing, but only an acknowledgment that we cannot reasonably identify a viable return to profitability in the near term,” Baker and colleagues wrote in a letter to clients .

Baker noted that Spirit recently raised $419 million by mortgaging many of its aircraft.

But, he added, “from here, the liquidity-boosting box doesn’t look robust.”

Spirit did not immediately respond to those comments. A spokesperson for the airline pointed to a regulatory filing two weeks ago in which the airline announced it had raised $419 million through sale-and-leaseback deals for 25 aircraft.

The company hasn’t made any money since before the pandemic, ticket sales haven’t recovered as quickly as the airline expected, and dozens of its planes will be grounded intermittently this year due to a problem with the engines.

A sale to JetBlue provided a lifeline for Spirit, which must pay down $1.1 billion in debt next year

In a joint statement Tuesday, Spirit and JetBlue said they disagreed with the ruling blocking their merger and are considering their next legal step.

Judge Young refused to grant the government’s request for a permanent injunction against any merger between JetBlue and Spirit.

During the trial, Young expressed concern that such a sweeping order would be too restrictive in the ever-changing aviation industry.

“We won’t get anywhere if you win, the merger isn’t approved and Spirit goes bankrupt,” the judge told a Justice Department attorney during closing arguments in December.

Spirit, based in Miramar, Florida, last posted a full-year profit in 2019. Since then, the company has lost more than $1.6 billion.

The company is notorious for unfortunate, chaotic scenes at terminals and on planes.

Last February, Spirit Airlines officers traded blows with unruly passengers as they boarded a flight in a wild video exclusively obtained by DailyMail.com.

In December, an impatient passenger was in such a hurry to disembark that he stepped over the man next to him.

Shocking video obtained by DailyMail.com shows a mother, 39, and daughter, 17, exchanging arguments with Spirit airline agents after being hit with baggage fees at the gate at Philadelphia airport in February

Video footage shows Que Maria Scott, 29, tackling Jasmine Rhoden at an airport gate in Atlanta

Perhaps most shockingly, in May, a six-month pregnant passenger attacked a Spirit Airlines employee after she was told she could not board a plane after threatening a gate agent.

On Wednesday, Bank of America analysts downgraded Spirit’s stock to “underperform,” indicating there is a risk the airline will default on its debt by September 2025.

Spirit is also hampered by necessary inspections and possible replacement of Pratt & Whitney engines on many of its Airbus jets due to a manufacturing defect.

The airline has predicted that this will be the case an average of 26 grounded aircraft – more than 10 percent of the fleet – by 2024, causing “a dramatic decline in the company’s near-term growth forecasts.”

Frontier Airlines tried to buy Spirit before JetBlue started a bidding war last year — and won. But Frontier has its own challenges and is not in a position to resume merger talks with Spirit now, Baker said.

Spirit shares fell 22 percent Wednesday afternoon after falling 47 percent on Tuesday.

JetBlue shares fell a more modest 8 percent on Wednesday, which could indicate that investors are breathing a sigh of relief that the Spirit purchase appears to be dead, at least for now.

Baker said “JetBlue dodged a bullet” because of the federal judge’s ruling. Under CEO Robin Hayes – who steps down next month – JetBlue wanted the planes and pilots it would have gained from purchasing Spirit, but “the price was simply too much to pay,” Baker said.

An angry man in a black hoodie was in such a hurry to disembark that he stepped over the man sitting next to him

Like Spirit, JetBlue hasn’t had a profitable year since 2019, before the pandemic.

But relative to its size, JetBlue’s losses are more manageable than Spirit’s, and it has a stronger balance sheet, according to analysts.

Investors are also trying to gauge what the ruling against the JetBlue-Spirit deal means for Alaska Airlines’ ongoing proposal to buy Hawaiian Airlines.

The Biden administration has not said whether it will also file a lawsuit to block that deal.

Deutsche Bank analyst Michael Linenberg said the government’s success in blocking both the JetBlue-Spirit deal and an earlier deal partnership between JetBlue and American Airlines ‘will likely cast a shadow over future airline activity (mergers and acquisitions), with the Alaska-Hawaii deal potentially in the crosshairs of regulators.’