Doomsday CEO who correctly predicted the retail apocalypse issues another stark warning about the U.S. economy: ‘Ready to crack’

The fault lines of the US economy are about to burst – that’s the stark warning from Bob Nardelli, one of America’s top CEOs.

The former boss of Home Depot and Chrysler says the Biden administration’s policy mistakes could pose significant challenges for the next president.

“What I have seen over the past three and a half years is that a series of debacles and missteps have put enormous pressure on the fault lines of our economy, and they are on the verge of bursting,” Nardelli said. FOX business.

“Whoever gets the next stint in the White House will be hit with a wrecking ball as they attempt to right the missteps and overspending of this current administration.

“So we’re going to have a tough time, I would say.”

Former Home Depot CEO said the U.S. economy is facing a “difficult time.”

In April last year, Nardelli warned of problems for retailers, saying: “We’re going to see a lot of bankruptcies.”

He was right. More than 5,500 stores closed in 2023 and in the first four months of this year alone the retail carnage has continued, with 2,600 closing.

His accuracy on that makes his latest warning even more worrying.

Nardelli was asked on FOX what he thought of Biden’s green agenda since taking office in January 2021.

Critics have described the policy as a “war on fossil fuels” and have pushed up energy prices. Americans are also struggling with higher expenses on groceries and rent.

“The inflation pipeline has a long tail and I’ve seen it in many areas, both in commodities and labor,” Nardelli said.

He noted that apartment rents have soared, citing an example from downtown Atlanta, where the cost of a two-bedroom apartment has risen to about $3,500 per month — double what it was three years ago.

“It’s really depressing to see the impact on the family’s wealth and income level,” Nardelli continued.

“Even though we have seen a 40 percent increase in wages in some cases, this is completely absorbed by inflation and the cost of living.”

A recent Wall Street Journal analysis found that US household net worth has stagnated during Biden’s term in office.

Nardelli’s warning is the latest warning about the US economy in recent weeks.

Bob Nardelli – former Home Depot boss – said the fault lines of the US economy are ‘about to burst’

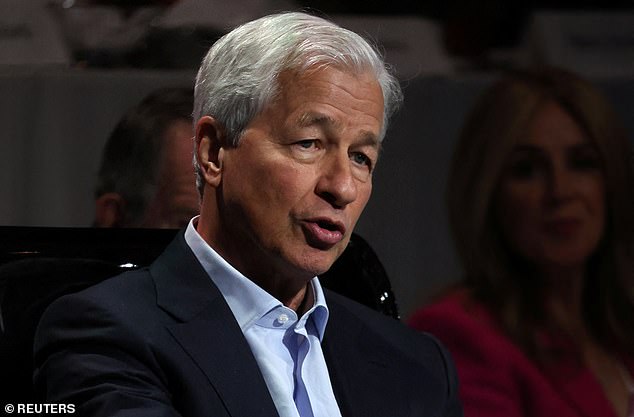

Last week, Jamie Dimon, head of the world’s largest bank JPMorgan Chase, said he cannot rule out a “hard landing” for the US economy.

A ‘hard landing’ occurs when there is a clear economic slowdown after a period of rapid growth.

When asked about the worrying prospect during a CNBC During an interview this morning, Dimon said, “Can we actually see one? Of course, how can anyone who reads history say there is no chance?’

America’s most influential banker also said the worst outcome for the US economy would be “stagflation” – which is when inflation continues to rise but unemployment is high and growth is slowing.

Economists consider stagflation, last seen in the US in the 1970s, as worse than a recession. It would drive down stock prices, hitting 401(K)s and other retirement savings.

The billionaire banker chimed in another interview Last month, he worried that the U.S. economy “looks more like the 1970s than we’ve ever seen before.”

JPMorgan Chase CEO Jamie Dimon has said he cannot rule out a ‘hard landing’ for the US

Citigroup’s top economist Andrew Hollenhorst has warned of how a deteriorating labor market is showing cracks in the US economy

Dimon’s warning comes after an analyst working for him at JPMorgan warned that the stock market could soon become volatile despite hitting record highs this year.

Meanwhile, Citigroup’s top US economist Andrew Hollenhorst also warned last week of cracks in the economy – saying the problems could ‘snowball’.

This was said by the chief economist of the bank, the fourth largest in the US CNBC in an interview this week how this could mean the economy ‘snowballing’ into a ‘hard landing’.

While many argue that the labor market data in recent months does not necessarily indicate that the economy is souring, Hollenhorst says it may be less positive than people realize.