Do drivers named Mohammed really pay more for car insurance than the average name John?

It was one of the more bizarre claims in a list of demands made to Keir Starmer by a fringe Muslim group, which threatened to oppose Labor MPs at the general election earlier this month.

The pro-Gaza activist group Muslim Vote handed the opposition leader an extraordinary list of 18 demands in early May, which they claimed he must agree to implement in order to win the support of Britain’s four million Muslim voters.

This list stated that Sir Keir would ensure that people with the name Mohammed did not pay more for insurance than others based solely on their first name.

It has been common knowledge for years that insurance customers are quoted differently based on several factors, including their age, zip code and medical history.

Insurance companies have taken this personal data into account when calculating premiums and use it as a tool to estimate the risk they run when taking out a policy.

Mo money? The Muslim Vote group demands Labor leader Kier Starmer ensures men called Mohammed don’t pay more for insurance than others

But can it really be true that a person’s first name can affect the amount he or she is charged?

Money Mail investigated the claim and put it to the test to see whether two people with identical details – living at the same address, with the same car and job – but with different first names, would get different premiums for the same level of car insurance cover.

We found that, contrary to Muslim Vote’s claims, people named Mohammed pay the same as people with other common names – and, surprisingly, in many cases, less on their car insurance than people named John.

From the dozens of quotes we pulled from the price comparison website GoCompare, it appears that someone named John Smith typically paid slightly more than someone named Muhammad Smith.

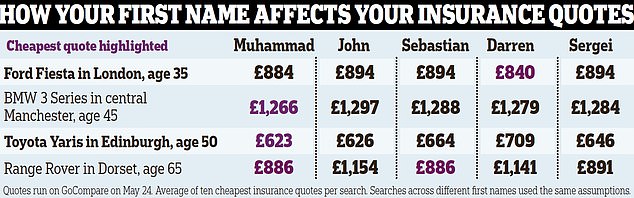

We used identical details in our searches in four different scenarios, changing only the first name. The first names we used were Muhammad, John, Sebastian, Darren and Sergei.

In the most shocking example, Mohammed had to pay £553.89 less than John and Darren for the same level of cover.

When 65-year-old Muhammad Smith, who lived in Dorset, requested a quote for cover for his Range Rover, he was charged around a third less than John Smith for five of the ten cheapest quotes.

In another test, we looked for a 35-year-old man driving a Ford Fiesta, working as an IT consultant and living in Hammersmith, West London.

Of the top ten cheapest quotes on comparison website GoCompare, seven were cheaper for Muhammad than John, while two asked the same and only one was more expensive. Meanwhile, John was quoted at the same level as Sebastian and Sergei.

Sometimes running multiple searches from the same computer can lead to fraud alerts. However, Money Mail ran the name searches in random order to ensure there was no bias. GoCompare was contacted for comment.

On comparison site MoneySuperMarket, John Smith and Muhammad Smith were quoted the same premiums in most of our searches.

However, in one case, 35-year-old Muhammad, driving a Ford Fiesta in Hammersmith, was charged £188 less than John. A spokesperson for MoneySuperMarket said: ‘We are a price comparison site that collects customer information.

Results: Of the top 10 cheapest quotes on GoCompare, seven were cheaper for Muhammad than John, while two charged the same premium and only one was more expensive

‘This information is shared with insurers who use their own pricing models to calculate insurance premiums. The pricing models that insurers use are commercially sensitive and usually include information such as location, type of car and driving history.’

Mark Wilkinson, managing director at Norton Insurance Brokers, says using first names to calculate a premium could be considered discriminatory.

He adds: “I have been in the industry for over twenty years and have never come across an occasion where someone’s first name has been questioned for a quote. We deal with all nationalities and that is simply not the case: everyone is treated equally, regardless of his or her first name.’

However, he suggests that the areas where people named Mohammed live could have an influence.

‘What I think could happen is that certain areas where people of the name or ethnicity live could have a higher claim frequency.

‘So instead of their name having an effect, it’s their home address and insurers may be able to charge more as a result. The name could be an effect rather than a cause.’

When developing a quote, insurance companies use information about you, your vehicle and how you drive. Your personal information is used to predict how likely you are to make a claim, and therefore how much they will charge you for cover.

Personal Information: It has been common knowledge for years that insurance customers are quoted differently based on several factors, including their age, zip code and medical history

According to insurer the RAC, living in built-up areas increases the likelihood of accidents because there will be more vehicles on the road.

It says: ‘If you live in an area with a high crime rate, you may see the additional risk to your car reflected in your premium as vandalism and theft become more common.’

The weather in your area can also play a role. For example, if you live on the coast or near a river that is prone to flooding, your insurance benefits will take into account the cost of potential water damage.

Leader: The activist group The Muslim Vote presented Kier Starmer with an extraordinary list of 18 demands

Likewise, your occupation will play a role in your final premium, the RAC says. ‘Occupations that involve high levels of stress are considered ‘higher risk’. So while a higher position may indicate responsibility, some insurers may charge high-net-worth professionals a more expensive insurance premium.” For jobs that involve a lot of driving, costs also tend to be higher.

Price comparison website Comparethemarket says even similar job titles can lead to different premiums. For example, construction worker and bricklayer, or chef and kitchen staff.

It says: ‘If your job title fits into more than one category, it may be worth looking at quotes for all categories. But remember that the details you provide must be as accurate as possible and not misleading, otherwise you could invalidate your policy.’

A spokesperson for the Association of British Insurers said: ‘Insurers will take into account a wide range of risk-related factors such as age, driving experience and type of vehicle when calculating the price of car insurance.

‘First and last names themselves are not used as a rating factor, but a person’s full name can be compared against other databases to gain insight into their driving record or claims history. Insurers cannot and should not use ethnicity as a factor in setting prices and our members comply with the Equality Act 2010.”

The city’s watchdog, the Financial Conduct Authority, said it wrote to insurers last year ‘to make it clear that they must ensure themselves that their prices are not discriminatory in accordance with the Equality Act 2010’.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.