Disturbing new study reveals how the number of hours each adult uses each day could be an early indicator of Alzheimer’s

Experts warn that a financial tool that millions of Americans rely on, the so-called credit score, could be hiding a dark secret about your brain health.

A new study from the New York Federal Reserve and Georgetown University finds a disturbing link between declining credit scores and the onset of Alzheimer’s disease and related dementias (ADRD).

The study, which analyzed data from more than 2.4 million Americans between 2000 and 2017, found that credit scores begin to deteriorate as early as five years before an official dementia diagnosis.

The research also revealed a host of other financial warning signs, including the fact that mortgage arrears start increasing three years before diagnosis.

Credit card balances in delinquency also shoot up by more than 50 percent just a year before diagnosis, likely because sufferers of the degenerative brain disorder forget to pay their bills on time.

A financial tool millions of Americans rely on, known as a credit score, could be hiding a sinister secret about your brain health, experts warn

And mortgage balances in default are 11 percent higher than they were a year before diagnosis.

Researchers estimate that as many as 600,000 cases of default will occur over the next decade due to undiagnosed ADRD.

“Our findings support the potential utility of credit reporting data for early identification of people at risk for memory impairment,” the researchers wrote.

Wilbert van der Klaauw, economic research advisor at the New York Fed, said CBS that family members should be on their guard.

“It is important for family and friends to realize that this is happening before diagnosis so they can look more holistically at the financial and payment decisions that seniors may be making,”

A new study from the New York Federal Reserve and Georgetown University has revealed a disturbing link between declining credit scores and the onset of Alzheimer’s disease and related dementias (ADRD).

“Family members should be alert to situations like, ‘Does this person suddenly have a new credit card?’,” the economist advises.

Dementia affects approximately 15 percent of American adults over age 70, with 5.8 million Americans suffering from Alzheimer’s disease and related dementias.

In June, researchers revealed that people are more likely to develop Alzheimer’s if their mother was diagnosed with it than if their father had the disease.

The study found that people whose fathers were diagnosed with the degenerative condition early (before age 65) may be at greater risk of developing the disease than the average patient.

Researchers in Massachusetts made the discovery after analyzing brain scans of 4,400 adults with an average age of 70 and no cognitive impairment.

A study shows that you are more likely to develop dementia if your mother had the disease at some point in her life

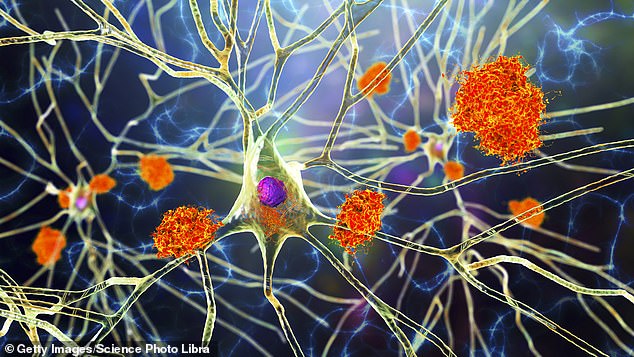

Each brain was scanned for amyloid plaques, a buildup of toxic proteins thought to be a precursor to Alzheimer’s disease, the most common form of dementia.

Researchers found that people with higher levels of plaques in the brain were more likely to have a family history of the disease on their mother’s side.

However, higher than average amyloid levels were also found in the brains of people whose fathers were diagnosed with Alzheimer’s at age 65 or younger.

Amyloid plaques are thought to cause the disease by disrupting communication between brain cells, causing the organ to malfunction.