Disney ‘has defeated activist investor Nelson Peltz’s hostile takeover attempt after billionaire claimed entertainment giant has lost its way’

Disney has reportedly secured enough shareholder votes to defeat a challenge to the board from activist investor Nelson Peltz.

Sources said Reuters Enough votes had been cast Tuesday evening to give Disney board members a safe lead over their challengers. The results will be announced on Wednesday at the company’s annual shareholder meeting.

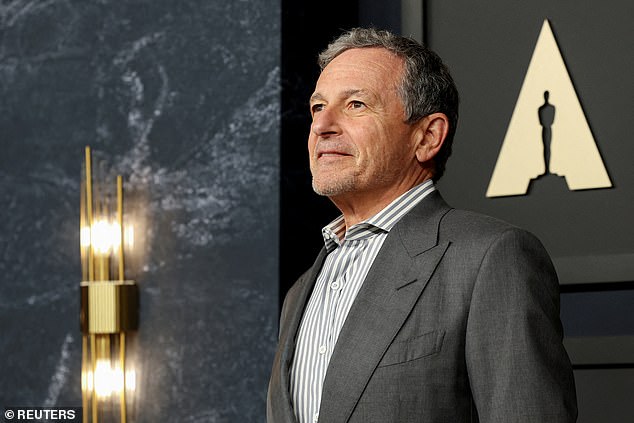

Peltz had nominated himself and former Disney CFO Jay Rasulo to the entertainment giant’s board of directors, labeling CEO Bob Iger as “underperforming.”

His company, Trian Fund Management, which owns about $2.5 billion worth of Disney stock, filed in January, sparking Peltz’s second proxy war within the company in just two years.

The company is backed by the influential consultancy Institutional Shareholder Services, which recommends that its clients vote in favor of Peltz.

Disney has reportedly secured enough shareholder votes to defeat a challenge against Nelson Peltz’s board

Peltz is a supporter of Donald Trump and a longtime critic of Disney’s move toward “woke” messaging

He launched his first proxy war last January, calling on Disney to “restore the magic” and being critical of CEO Bob Iger

Peltz nominated himself and former Disney CFO Jay Rasulo (right) to the entertainment giant’s board of directors, calling Iger “underperforming”

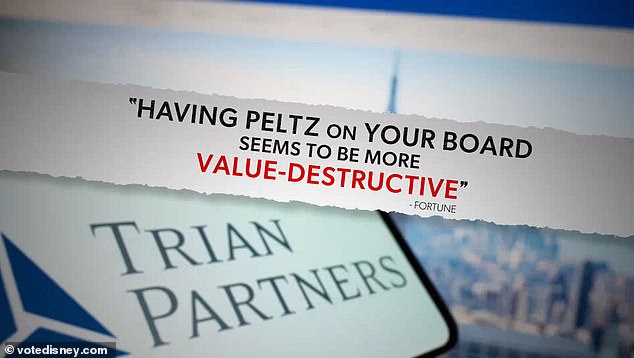

Disney lashed out with a political-style video that trashed the activist shareholder’s motivations and qualifications.

The video states that Peltz has a long history of “attacking corporations at the expense of shareholders” and that it would be “disruptive” and “value destroying” to involve him and his friend Jay Rasulo.

“Disney could suffer the same fate as other major companies Peltz has previously infiltrated, such as GE and DuPont. Nelson Peltz has a long history of attacking corporations at the expense of shareholder value,” the narrator claims.

It said Peltz’s search for a board seat “seems more about vanity than a belief in Disney.”

In the video and regulatory filing, Disney underscored Peltz’s connection to former Marvel Entertainment chairman Ike Perlmutter, describing it as a “disgruntled former employee” with a personal grudge against Iger.

Peltz, Brooklyn Beckham’s father-in-law, argued in his own presentation that Disney was slow to adapt to industry changes, including in streaming, made mistakes in its acquisition strategy and bungled succession planning.

The billionaire is a Trump supporter and a longtime critic of Disney’s move toward “woke.”

In an interview with the Financial Times, he recently criticized Disney for its all-female and all-black casts.

“Why do I have to have an all-female Marvel? Not that I have anything against women, but why do I have to do that? Why can’t I have miracles that are both? Why do I need an all-black cast?’ Peltz said.

He launched his first proxy war last January, calling on Disney to “restore the magic” amid criticism that the media conglomerate had become too political.

He withdrew from the initial fight after Iger unveiled a cost-cutting plan that involved 7,000 layoffs and restructuring to save about $5.5 billion.

However, Disney shares tumbling 12.5 percent over the past year have prompted the activist investor to renew his bid for power.

Trian Investment Fund owns approximately 33 million shares, making it one of the largest investors of Disney’s 1.8 billion shares.

Disney said Peltz has a long history of “attacking companies at the expense of shareholders” and said it would be “disruptive” to involve him and his friend Jay Rasulo.

Peltz recently lambasted Disney in an interview with the Financial Times for its all-female and all-black casts

Iger is said to be “overwhelmed and exhausted” after extending his contract for another three years as he battled falling stock prices and challenges to his leadership.

In September, Iger revealed that the company will “calm the noise around cultural issues” as it has proven to be bad for business.

The company is embroiled in a legal battle with Florida Gov. and Ron DeSantis after former CEO Bob Chapek criticized the so-called “Don’t Say Gay” bill.

DeSantis targeted Disney World’s special tax district, replacing its board with his allies and leading the charge to change the name from the Reedy District to the Central Florida Tourism Oversight District.

Before DeSantis’ chosen board took control, Disney created a development contract for future investments. These were thrown out by the new administration, leading to a federal lawsuit.

Disney has since dropped much of its federal lawsuit against Florida’s governor.

Iger has extended his contract until 2026 and hinted that he will retire at that time, once a good successor has been found and appointed.