Disgraced FTX founder Sam Bankman-Fried will REMAIN in jail amid witness tampering allegations ahead of his trial in October, appeals court rules

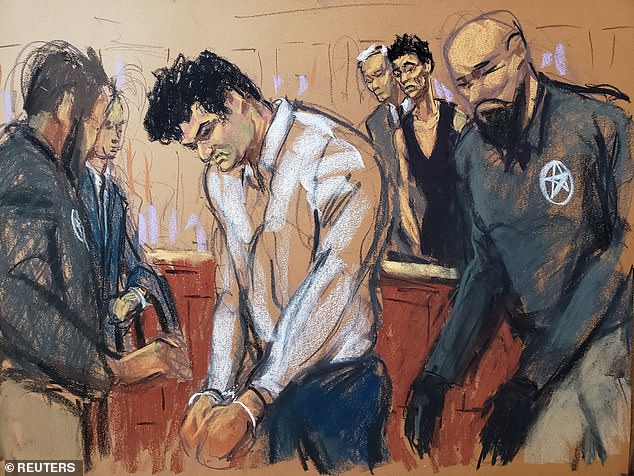

Disgraced FTX founder Sam Bankman-Fried will remain in jail pending his trial in October after a US appeals court upheld a judge’s decision to deny his release.

The decision was issued Thursday by the 2nd U.S. Circuit Court of Appeals in Manhattan.

In a written statement, a three-judge panel said it agreed with U.S. District Judge Lewis Kaplan’s finding that the suspect had likely attempted to tamper with witnesses.

This comes just hours after the former crypto billionaire lost another ruling, preventing him from calling expert witnesses to the hearing.

This marks the latest setback as Bankman-Fried awaits trial. In August, District Judge Lewis Kaplan revoked his $250 million bail after finding probable cause to believe the suspect likely tampered with witnesses.

Disgraced FTX founder Sam Bankman-Fried will remain in jail ahead of his October trial after a US appeals court upheld a judge’s decision to deny his release

Bankman-Fried is being held at the Metropolitan Detention Center in Brooklyn

The decision was issued Thursday by the 2nd U.S. Circuit Court of Appeals in Manhattan

He emphasized that he wanted to share the personal writings of the former CEO of his hedge fund Alameda Research, Caroline Ellison, with a New York Times reporter.

But Bankman-Fried’s attorney, Mark Cohen, said his client was merely exercising his right to free speech when he spoke to a New York Times reporter about the case, Bloomberg Reported.

The appeals court argued Thursday that there was “probable cause” and that he had “engaged in witness tampering” by sharing the private writings of Caroline Ellison, his former girlfriend who was CEO of Alameda Research.

Also on Thursday, Bankman-Fried’s father was linked to a so-called ‘dark money’ network that invests billions in politically liberal causes.

In a lawsuit this week, attorneys for FTX accused Bankman-Fried’s parents, Allan Joseph Bankman and Barbara Fried, of siphoning millions from the company, which is trying to recover the money.

A footnote to the filing states that Bankman “served on the advisory board of Arabella Advisors,” a leading for-profit consulting firm that manages a network of closely related nonprofits that support liberal causes.

Arabella spokesperson Steve Samson told DailyMail.com that the claim is false and that Bankman “never had any role at Arabella Advisors.”

Bankman-Fried has pleaded not guilty to charges that he siphoned corporate funds to make lavish real estate purchases, political donations and to prop up his hedge fund.

Arabella was founded by former Clinton administration appointee Eric Kessler (above), and its network of associated nonprofits spent more than $1.2 billion in 2020, taking advantage of tax rules that often obscure the identity of conceal the donors.

However, he added that the New Venture Fund, one of five nonprofits closely associated with Arabella, “has publicly noted that it has briefly worked with the FTX Foundation to provide administrative services for some of its grantmaking .’

“NVF also noted that Mr Bankman served in an advisory role on the project at NVF which was affiliated with the FTX Foundation,” he added.

The New Venture Fund did not immediately respond to a request for comment, but a spokesperson told Fox News, which first reported Bankman’s ties to the group, that it had worked with Bankman before FTX’s collapse last November.

“In early 2022, the NVF made grants from a project advised by Mr Bankman and affiliated with the FTX Foundation, all of which went to carefully vetted charities addressing environmental challenges and hunger,” the fund’s spokesperson told Fox.

“This is a pending legal matter and any remaining funds will be returned based on the resolution of that lawsuit.”

Arabella was founded by former Clinton administration appointee Eric Kessler, and its network of associated nonprofits spent more than $1.2 billion in 2020, taking advantage of tax rules that often obscure the identities of donors.

Bankman-Fried has pleaded not guilty to charges that he siphoned corporate funds to make lavish real estate purchases, political donations and finance risky trades at Alameda Research, his cryptocurrency hedge fund.

His federal fraud trial is scheduled to begin Oct. 3 in Manhattan.

Several other former FTX executives have pleaded guilty to fraud and conspiracy charges and are cooperating with investigators.

The lawsuit alleges that Bankman, a Stanford University law professor and tax law expert, and Fried, a retired Stanford law professor, participated in the misconduct that led to FTX’s collapse and resulted in both criminal and civil investigations.