Demand for mortgages dropped 75% at end of 2022, Bank of England says

>

Demand for new mortgages is down 75% by the end of 2022, according to BoE, as homeowners hit by higher interest rates and rising cost of living

- Mortgage rates peaked in October last year, but interest rates are slowly falling

- Home purchase mortgages fell dramatically in the last three months of 2022

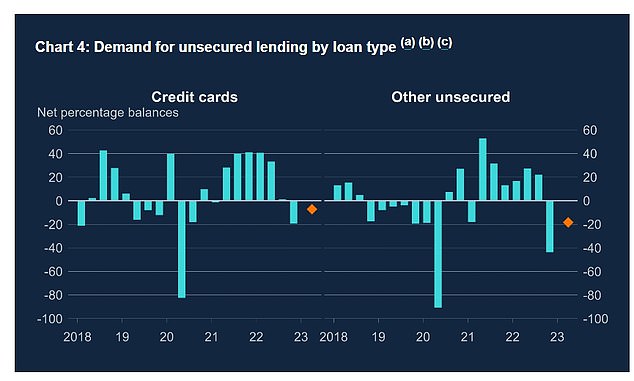

- There is also an increase in demand for credit cards and loans

Demand for mortgages to buy a house fell sharply in the last three months of last year, as rising mortgage rates and the crisis in the cost of living affected the market.

New mortgages for the purchase of real estate fell by 75 percent compared to the previous three months, according to data from the Bank of England.

Lenders expect the decline in demand to continue into the first quarter of this year, though the landing will be softer than at the end of 2022, the BoE said.

Bank of England data shows a significant drop in demand for mortgages to buy a home

Although demand for remortgages also fell, the 17 percent drop was much less pronounced.

Simon Gammon, managing partner, Knight Frank Finance, said: ‘Mortgage rates may be improving, but lenders clearly expect housing market activity to ease in the coming weeks.

While rates are falling, they are unlikely to fall much further and now is a good time to act

Demand for home purchase mortgages has fallen dramatically over the last three months of the year and is expected to decline further in the first three months of 2022, although lenders expect the pullback to moderate.

“The data shows the extent to which the market has stabilized in the wake of the mini-Budget, but headwinds will continue throughout the year and depress mortgage demand.

“Borrowers can clearly see that conditions are better than they were a few weeks ago and that rates, while falling, are unlikely to fall much further and that now is a good time to act.”

“We are now entering a ‘new normal’ for mortgage rates, with the best products with a fixed term of five years just under 4.5 percent.”

Mortgage rates rose rapidly at the end of last year, thanks to the uncertain economic conditions in the UK and the consequences of the disastrous mini-budget in September, but are now falling slowly.

The interest rate on the average five-year mortgage has fallen well below 6 percent to 5.42 percent as more lenders lower their rates.

Two-year fixed-rate deals now average 5.6 percent, according to Moneyfacts.

But the best deals available right now are heading towards 4 percent, with rates as low as 4.04 percent on a 10-year fix for those with large deposits.

Demand for credit cards increased towards the end of the year as the housing crisis intensified

Credit card applications are on the rise as budgets tighten

While demand for mortgages fell, credit card loan applications rose 17 percent from October to December last year, highlighting households’ increasing reliance on credit as rising prices continue to weigh on finances.

And credit availability also declined, falling by 36 percent at the end of 2022 and expected to fall by another 50 percent in the first quarter of 2023.

This is partly due to the uncertain economic conditions and the reduced risk appetite of lenders.

Sarah Coles, senior personal finance analyst at Hargreaves Lansdown said: ‘We’re already struggling with debt like credit cards and loans, and defaults have been on the rise over the last three months of the year.

“Unfortunately, if we make it through the rest of the winter, chances are this will get even worse.

“Rising rates play a role, but the sheer volume of people’s debt also poses enormous challenges. Those who have borrowed to make ends meet while prices have risen are running out of options.

“As time passes, those debts mount up and people struggle to borrow extra money, they will become more and more vulnerable. And while debt may seem like the short-term answer to our problems, it itself creates huge problems.”