December jobs report: US breathes a sigh of relief as economy adds 216,000 new workers and extends longest spell of unemployment below 4% since the 1960s

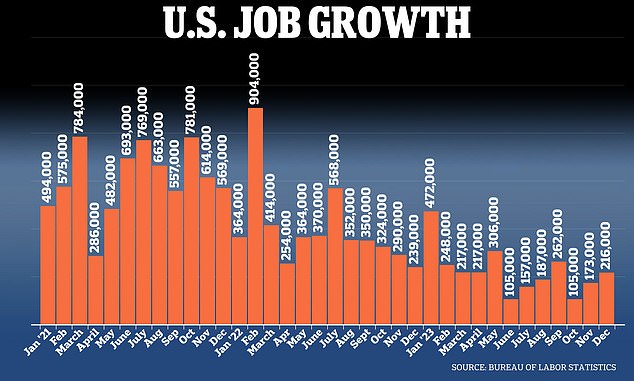

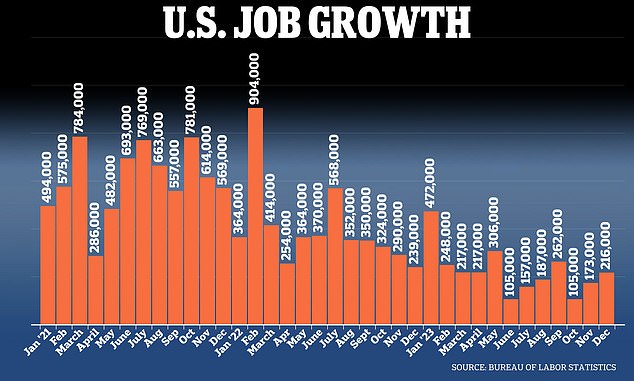

U.S. employment continued at a rapid pace in December, with the economy adding more than 216,000 new jobs, capping a year of robust employment growth.

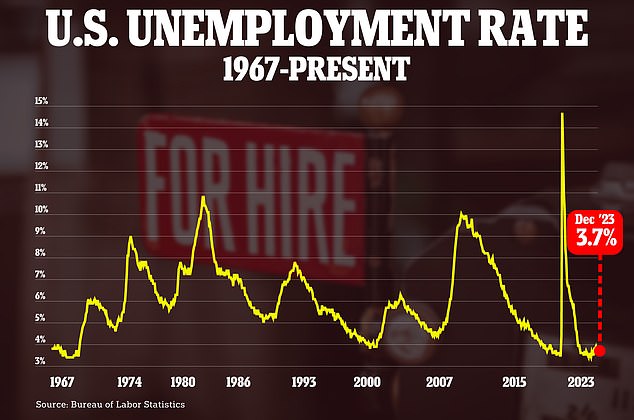

Unemployment held steady at 3.7 percent, making December the 23rd consecutive month with an unemployment rate below 4 percent, the country's longest stretch since the 1960s.

Job growth in December exceeded the 170,000 economists had forecast and was the largest monthly employment gain since September.

But despite low unemployment and inflation continuing to cool, polls show many Americans are dissatisfied with the economy. This gap, which will likely be an issue in the 2024 elections, has puzzled economists and political analysts.

A key factor, however, is the public's annoyance at higher prices. Although inflation has been falling more or less steadily for a year and a half, prices are still 17 percent higher than before the start of the inflation wave.

Unemployment remained stable at 3.7 percent, making December the 23rd month in a row with an unemployment rate below 4 percent

Major U.S. stock indexes were little changed after the new report, with the Dow Jones Industrial Average up less than 0.1 percent at the opening bell.

Friday's new jobs report from the Department of Labor included downward revisions to October and November job growth, which were revised down along with 71,000 new jobs.

Still, according to the latest figures, the economy has created nearly 2.7 million jobs in 2023, or 225,000 jobs per month, defying widespread predictions that higher interest rates would trigger a recession.

“The unemployment rate hasn't changed much in December, and it's the 23rd month in which unemployment has been below 4 percent – something that hasn't happened since 1969,” Elizabeth Renter, a data analyst at NerdWallet, told DailyMail.com.

'If you had told most experts a few years ago that this would happen at the same time as eleven interest rate increases by the Fed, they would not have believed it. But here we are,” she added.

Renter noted that workers are more likely to keep their jobs than a year ago, when layoff rates were high as job hoppers looked for better opportunities.

'Those looking for change will find it harder to end up in a better position than this time last year, so many are staying put where it is safe. This is what a 'cooler' labor market looks like,” she added.

Last month, employment grew mainly in government, healthcare, social security and construction, while the transport and warehousing sectors lost jobs.

In December, the average hourly wage for all workers on private nonfarm payrolls rose 15 cents, or 0.4 percent, to $34.27, according to the new report.

In December, wages rose 4.1 percent from a year ago, surpassing inflation, which last stood at 3.1 percent in November.

US employment continued at a rapid pace in December, with the economy creating a larger-than-expected 216,000 new jobs

The economy added nearly 2.7 million jobs in 2023, or 225,000 jobs per month, defying widespread predictions that higher interest rates would trigger a recession (file photo)

Hourly wages rose by 4.3 percent for all of 2023 compared to the previous year, lower than the modern record of 5.3 percent wage growth in 2022.

Rapidly rising wages were a key driver of inflation as companies passed on higher labor costs to consumers, making slowing wage growth a welcome sign for policymakers at the Federal Reserve.

Fed Chairman Jerome Powell had previously warned of tough times ahead after the central bank began raising rates in the spring of 2022 to tackle high inflation, but the latest employment data calls for a so-called soft landing '.

Economists had predicted that much higher borrowing costs for households and businesses would trigger a recession in 2023, with widespread layoffs and rising unemployment.

Yet a recession has never occurred, and one does not appear to be in sight. The country's labor market, while cooler than in the sweltering years of 2022 and 2023, is still generating enough jobs to keep the unemployment rate at historically low levels.

The resilience of the labor market goes hand in hand with the sustainability of the economy as a whole.

Rather than slipping into recession, U.S. gross domestic product (the total production of goods and services) grew at a strong annual pace of 4.9 percent from July through September.

Strong consumer spending and business investment were responsible for much of the expansion.