Considering spending your later years in the Sunshine State? Here’s why you should NOT retire in Florida

Florida is considered by many to be the ultimate retirement state, but experts suggest it may not be the best place to build your later years.

While the weather and coastal access are desirable, it is particularly vulnerable to natural disasters such as hurricanes, meaning home insurance premiums are more expensive than anywhere else in the country.

Homeowners paid an average annual premium of $7,788 in 2022 insurance company Insurify – nearly five times the national average of $1,636.

And while the Sunshine State doesn’t have an income tax, citizens can tax themselves in other ways that are even less friendly to retirees — including on purchases and on their homes.

With good weather for much of the year and access to the coast, Florida has become known as the ultimate retirement state

Florida homeowners paid an average annual premium of $7,788 in 2022, making it the most expensive state in the country for home insurance. Pictured: the aftermath of Hurricane Michael in 2018

“Florida is prone to natural disasters, especially hurricanes,” said John Grace, president and founder of Investor’s Advantage Corp. GoBanking Rates.

“While homeowners insurance is essential, premiums in Florida can be significantly higher due to the increased risk of hurricane damage. Retirees should carefully consider these insurance costs in their financial planning,” he added.

“Additionally, climate change could exacerbate these risks in the future, potentially leading to even higher insurance costs and concerns about property damage.”

In July, former President Donald Trump called out Florida Governor Ron DeSantis, his rival for the next Republican presidential nominee, for failing to take action to ease the cost of expensive home insurance in his state.

“We want him to go home and get the insurance, because you have the highest insurance in the country,” Trump said at the time.

Days earlier, national insurer Farmers Insurance said this will be the case no longer offer insurance plans in Florida.

Not only are Florida homes more expensive to insure, their values are notoriously volatile. That could cause problems for retirees who have more wealth in real estate.

“The Florida real estate market can be volatile, with property values fluctuating dramatically,” financial expert Mark Smith told GoBankingRates.

“This volatility can impact your long-term financial stability, especially if you rely on real estate investments as part of your retirement strategy,” he added.

Although Florida has no income tax, the country relies heavily on sales and property taxes to generate revenue. Pictured is a vacation home in Florida

Damaged property following the arrival of Hurricane Idalia in Horseshoe Beach, Florida, in August

Part of Florida’s appeal for many lies in its relaxed approach to taxation.

But while there is no state income tax, Grace suggested it may not be cheaper overall.

“Some Florida counties have high property tax rates, especially in desirable retirement communities,” he said.

With an effective property tax rate of 0.91 percent, the country has the 26th largest property tax as a percentage of home value of any state, according to Tax Foundation.

“Retirees should research the property tax rates and sales tax implications in their desired retirement location in Florida to ensure it fits their budget,” he added.

Florida has an average combined state and local sales tax rate of about 7 percent, which complements its large tourism industry.

Pension experts therefore suggest that some other states may have more desirable retirement destinations.

Grace suggested retirees should consider states like Colorado, Texas or Nevada.

“Colorado offers a wide variety of outdoor activities,” he said. ‘It also has a relatively low property tax rate and many cities offer a mix of cultural facilities and recreational opportunities.’

Like Florida, Texas has no income tax.

“Cities like Austin, Houston and Dallas offer diverse cultural scenes, and the cost of living can be relatively lower compared to other major metropolitan areas,” he said.

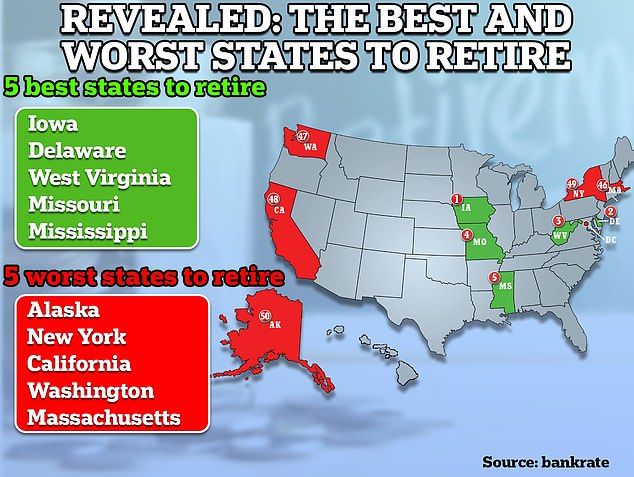

It comes as one Research from Bankrate this year found that Florida is no longer the best state to spend your senior years, with Iowa taking over the top spot.

It marked a significant change from the 2022 rankings. This year, Florida fell from first place to eighth among the top retirement hotspots.

Bankrate ranked all 50 states based on affordability, overall well-being, quality and cost of health care, weather and crime

Iowa was ranked as the best state to retire in due to its reasonable cost of living, affordable yet quality health care, and low crime levels

The annual pension survey looked at affordability, overall well-being, health care quality and costs, weather and crime.

Although the weather in Iowa is colder than in Florida, the Hawkeye State is the sixth cheapest place to live, according to the American newspaper Hawkeye. Council for Community and Economic Researchmaking it an attractive home for retirees looking to increase their steady income in today’s economy.

Lower housing costs also helped the state in affordability, Bankrate said, and the price of homeowners insurance is below the national average.

This is evident from data from a real estate company Redfinthe median home price in Iowa is $239,000 – well below the national typical home price of $388,800.

Although the state ranks near the middle in taxes, it ranks near the top when it comes to quality health care services and low health care costs.

Additionally, according to Census data, nearly 20 percent of Iowa’s population is 65 or older, making it easier for retirees to meet others of the same age.