Commonwealth Bank slugs customers with ridiculous new fee to withdraw their money in shock announcement

- The bank sent an email announcement to customers on Monday

Australia’s largest bank is now charging customers a fee if they want to withdraw their own money from one of its branches.

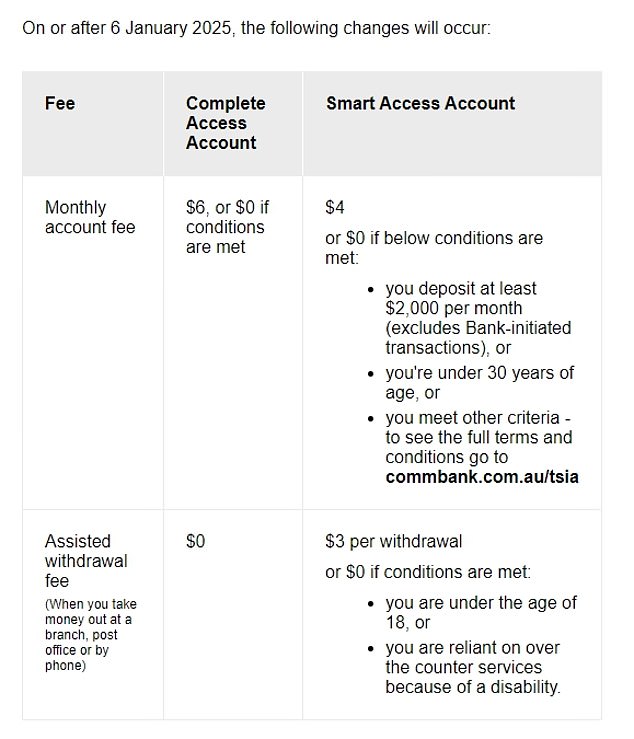

Commonwealth Bank Australia (CBA) said in an email to customers on Monday that it would close its ‘Complete Access Account’ and migrate customers to its ‘Smart Access Account’.

The new bill from January 6 includes a $3 fee for each withdrawal at a branch, post office or by telephone.

The bank has been tight-lipped in recent years on whether it will transition its entire branch network to ‘cashless’, following the opening of a number of ‘Specialist Centres’, which do not have ATMs that handle physical cash.

These specialized centers focus on business and home loan products, credit facilities and merchant services, while customers looking to deposit or withdraw money are directed to digital banking or ATMs.

In August this year, the Commonwealth Bank said it cost about $350 million a year to keep physical money in its network and that it was a “challenging commercial model”.

When the Specialist Centers first appeared, this masthead asked in July last year whether the bank would be phasing out physical cash, and received an answer that seemed to sidestep the question.

“Commonwealth Bank has established a very small number of specialist centers in major metropolitan areas, which are designed to support personal and business customers with more complex banking needs,” a spokesperson said at the time.

Commonwealth Bank has told customers they will have to pay a fee to withdraw money from a branch

An email sent to customers on Monday detailing the new charges for the Smart Access Account, Complete Access Account type will be closed

‘These Specialist Centers provide customers with face-to-face access to specialist private and business lenders as well as offering the latest self-service technologies. All of our specialty centers are located in major urban locations and close to full-service facilities.

“We continue to maintain Australia’s largest branch network for clients.”

Daily Mail Australia has contacted CBA for further comment.

More to follow.