Commonwealth Bank told to end new cash fee by Anthony Albanese’s government

Anthony Albanese’s government has urged the Commonwealth Bank to reconsider charging customers a fee to withdraw their own money from branches.

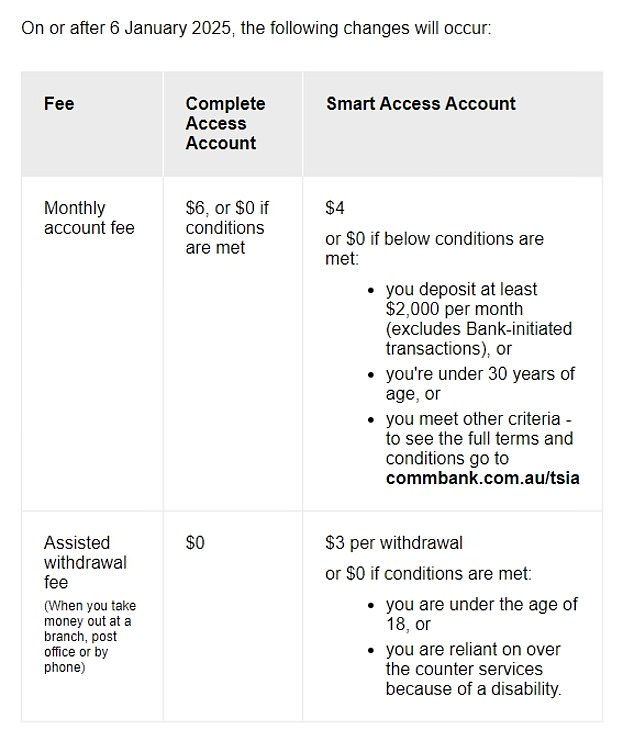

Customers of the bank got a big shock on Monday when the bank announced it was closing its ‘Complete Access Account’ and changing it to ‘Smart Access Accounts’.

But the new bill will charge a $3 fee for each withdrawal from a branch, post office or phone starting Jan. 6.

Housing Minister Clare O’Neil announced the decision and called on the bank to reconsider.

“It doesn’t seem fair or appropriate and this is a huge bank making huge profits. Come on, guys. It’s Christmas. We don’t need this right now,” O’Neil told Nat Barr’s Sunrise show.

“This is not something the bank should be doing and we ask them to reconsider.

CommBank told Daily Mail Australia it “continues to offer customers free withdrawals from our national ATM network”.

“The monthly account fee for the Smart Access account is currently $2 less than the Complete Access account and both accounts offer similar features,” the spokesperson said.

Commonwealth Bank has told customers they will have to pay a fee to withdraw money from a branch

An email sent to customers on Monday detailing the new charges for the Smart Access Account, Complete Access Account type will be closed

“Our Smart Access account has a $3 withdrawal fee. This is our main transaction account and the assisted withdrawal fees on that account have not changed.

‘We continue to offer waivers on assisted withdrawal fees for customers who meet certain criteria, including certain types of pension recipients, those who contribute $2,000 per month and those under the age of 18.

‘Our Streamline Basic account has no monthly account fees or assisted withdrawal fees and is available to customers who hold an eligible concession card.’

The bank has been tight-lipped in recent years on whether it will transition its branch network as a whole to ‘cashless’, with CommBank opening a number of ‘Specialist Centres’, which do not have ATMs to handle physical cash.

The Specialist Centers focus on commercial and home loan products, credit facilities and merchant services. Meanwhile, customers who want to deposit or withdraw money are directed to online banking or ATMs.

When the Specialist Centers first appeared in July last year, this masthead asked whether the bank was planning to phase out physical cash and received an answer that seemed to sidestep the question.

“Commonwealth Bank has established a very small number of specialist centers in major metropolitan areas, which are designed to support personal and business customers with more complex banking needs,” a spokesperson said at the time.

‘These Specialist Centers provide customers with face-to-face access to specialist private and business lenders as well as offering the latest self-service technologies. All of our specialty centers are located in major urban locations and close to full-service facilities.

“We continue to maintain Australia’s largest branch network for clients.”

In August this year, CommBank said it cost around $350 million a year just to keep physical cash in its network, describing it as a “challenging commercial model.”

However, that had little impact on CBA’s bottom line as it made post-tax profits of $9.5 billion in the 2023/2024 financial year.

CBA subsidiary Bankwest announced earlier this year that it would scrap physical money services and move to a digital-only bank.

Bankwest said it would close 45 of its branches and convert a further 15 regional branches into CBA locations.

Of the other Big Four banks, ANZ and NAB have also opened branches that do not offer OTC services.

Australia’s fifth largest, Macquarie Bank, has closed its personal services and transitioned to a digital-only bank from November 1 this year.

In all cases, banks have said physical cash transactions represent a small portion of their revenue, but concerns have been raised about the move to digital-only currencies.

These include privacy, the costs associated with tap-and-go payments and the increased risk of hacks, cyber attacks and online scams, in addition to the dependence on digital infrastructure that can lead to power outages.

Vulnerable people such as people with disabilities, undocumented workers, refugees, victims of abuse and those living in remote and regional areas are also likely to be disproportionately affected by the loss of cash.

The photo shows workers at a Commonwealth Bank cashless branch in Penrith. Deposits and withdrawals can still be made via on-site ATMs

CBA has also removed more than 800 ATMs from its network.

‘Five years ago, 43 percent of all cash register transactions took place in cash. Today this figure is around 15 percent,” CEO Matt Comyn explained last year.

“And yet, customers transact more than $18 billion through the CommBank app every week, a 64 percent increase in just two years.”

He said CommBank’s 10 million customers each paid about $40 to finance the $400 million cost of keeping physical cash in circulation at its branches.

“Many of our customers do not use cash and these customers cross-subsidize those who do,” he said.

Earlier this year, Australia’s largest money distribution service, Armaguard, was on the brink of collapse until it received a $50 million bailout package from major banks and major retailers in late June.

Despite fewer people using cash, the right to do so must be defended, Reserve Bank Governor Michele Bullock said.

In testimony to the Federal Parliament’s economics committee, Ms Bullock said access to cash was “a sensitive issue” as pressure grew in the banking sector and government to get rid of it.

“There is a minority, but a significant minority, of people who still rely heavily on cash and want to use cash,” she said.

“The government is committed, and so are we, to trying to maintain access to cash for people who want to use it,” she said.

“This isn’t just a problem in Australia, it’s a problem around the world as the use of cash for transactions declines,” Ms Bullock said.

“You have all these fixed costs of maintaining a cash distribution system, and with fewer cash transactions it means the cost per transaction just keeps going up – it becomes uneconomical.”