Commonwealth Bank stuff-up: Brisbane academic faces possible eviction as nightmare continues

An epidemiology academic embroiled in a bitter legal nightmare over the purchase of her “dream home” because her bank was 13 minutes late in finalizing the settlement has been dealt another crushing blow.

Dr. Loretta McKinnon fears she will soon be evicted from her central Brisbane rental home, which she made a winning bid of $580,000 for at auction in 2021.

She was delighted with the bargain, especially after a similar property next door sold for $200,000 more just a fortnight later.

But Dr McKinnon’s dreams came crashing down weeks later after her lender, the Commonwealth Bank, accidentally checked a wrong box on official documents and missed the payment deadline to complete the 90-day settlement.

The seller ended the deal due to the late settlement and pocketed her $29,000 down payment, leaving the would-be homeowner to pay both the rent and the loans she took out to purchase the property.

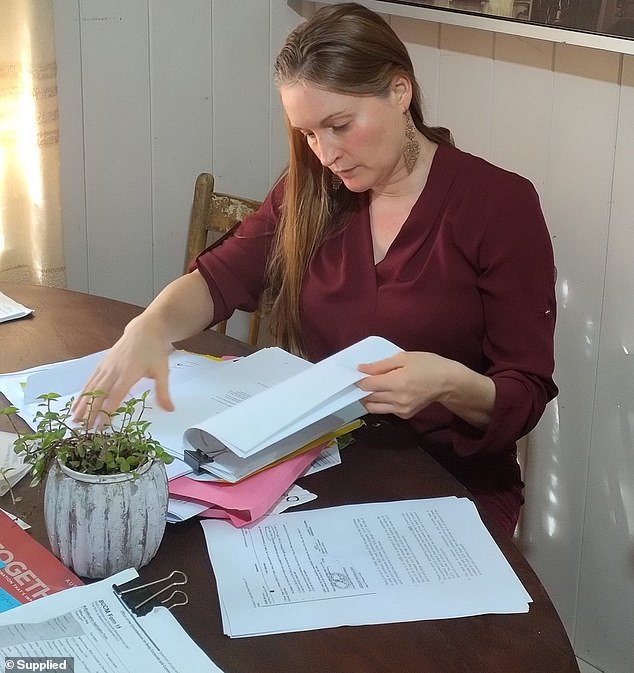

Loretta McKinnon (above right) thought she bought her dream home two years ago, only for the sale to fall through weeks later

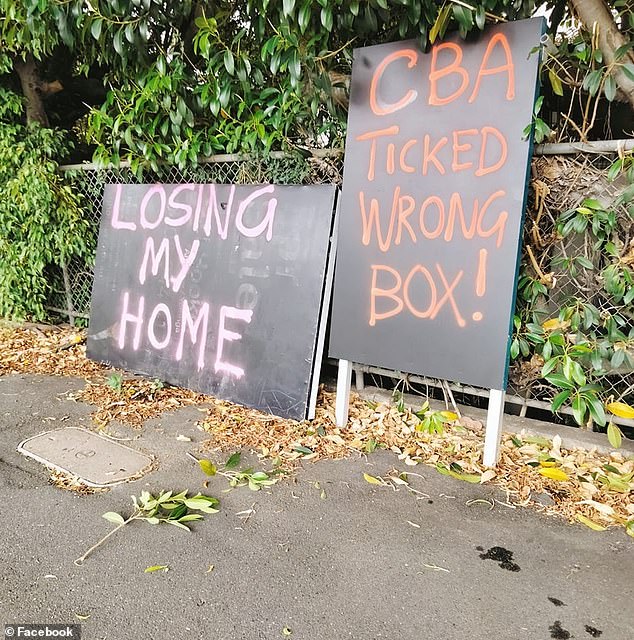

The Commonwealth Bank accidentally checked a wrong box on the documents and missed the payment deadline to finalize Loretta’s settlement

Dr. McKinnon has been embroiled in a complicated legal battle for two years to acquire the three-bedroom Windsor property she has been hawking for almost three years.

It included placing a caveat on the property to prevent the seller, who is also her landlord, from selling to anyone else.

Dr. McKinnon now faces a hefty legal bill and the threat of homelessness after losing her case to purchase the house in the Brisbane Supreme Court this month.

Judge Peter Applegarth ruled that Dr. McKinnon had to withdraw the caveat and pay the seller’s legal costs.

“I’m devastated,” she told Ny Breaking Australia.

‘The past two years have been very difficult.

‘I didn’t do anything wrong, but I’m the one being punished.

‘I don’t know what’s going to happen next. I feel like I’ve been beaten to a pulp.’

A court has ordered Dr McKinnon to remove the caveat she placed on the property to prevent the seller, who is also her landlord, from selling it to anyone else.

Dr. McKinnon has spent the past two years warning others of her ongoing plight. Pictured is signage outside her home in Brisbane

Dr. McKinnon plans to appeal the court’s recent ruling and continue her long fight for justice.

She was unable to move or change banks due to the rental shortage in Brisbane.

The tripling of interest rates in the past two years has also put a huge dent in her homeownership aspirations.

“I sold two properties so I could buy this house, which was a really good deal,” she said.

“I couldn’t get an apartment right now with that $580,000.”

“I can’t move either because there are no rental properties in Brisbane.

‘The bank must be held accountable.’

The Real Estate Institute of Queensland has since amended its contractual requirements guidelines to include a grace period if the property settlement deadline cannot be met in time to be in line with other states.

She claims it took a long time for the Commonwealth Bank to admit the mistake and feels she has been held captive by the bank.

“The bank must help me acquire this house or find a suitable replacement,” she said.

Loretta’s settlement fell through after Commonwealth Bank missed its payment deadline by 13 minutes. The seller kept her deposit and the house in Windsor (pictured above) where she still lives as a tenant

‘I have the feeling that the bank did everything it could to ensure that the settlement could not go ahead.’

“I was a valued Premier customer, but they took away my banking privileges and treated me like the enemy. I would cut all ties if I could.”

‘I wouldn’t mind moving to a new house as I have been completely traumatized and trapped here for over two years now.

‘The fear has always been that I would have to stay here because CBA would not compensate me properly if I left.’

“I just hope it doesn’t destroy me in the meantime.”

A Commonwealth Bank spokeswoman told Ny Breaking Australia it was not involved in any legal proceedings regarding the removal of Dr McKinnon’s caveat between Dr McKinnon and the property owner.

Loretta McKinnon (pictured) plans to appeal the recent court decision

Loretta still lives in the Brisbane home she bid for $580,000 at auction as a tenant in 2021

The bank added that it had worked with Dr McKinnon over the past seven months to resolve the situation and ensure she would not be worse off as a result of the outcome.

“CBA has been actively negotiating with Dr. McKinnon and the owner of the home, where she currently lives, to facilitate the purchase of the home,” the spokeswoman said.

‘Dr. McKinnon has not accepted CBA’s offers to resolve the dispute and completion of the purchase has not been possible.

‘CBA has informed both Dr. McKinnon, as the owner of the property, confirms that it intends to continue working with both of them and has invited the parties to participate in a mediation to resolve the outstanding disputes.”

Loretta McKinnon (pictured) just wants the long-running legal saga to be over

Dr. McKinnon has not given up her legal battle despite the threat of possible eviction (photo: a sign outside her ‘dream home’)