Commonwealth Bank mystery $90k: How young couple’s campaign for answers about what happened badly backfired – as loved ones share their theory about what happened

A couple who say they lost their life savings in a botched Commonwealth Bank transfer are in hiding after their emotional plea for help turned sour.

Ellie Houston, 21, and her partner Trae Murphy, 23, say they transferred $90,000 from their account to a bank Melbourne account on June 30 before disappearing into thin air.

Ms Houston claimed in an interview with Radio 3AW on Monday that the money initially returned to their original account – before eventually disappearing altogether.

They then appeared on television in another attempt to recover the missing money.

Sources have told Daily Mail Australia the media blitz was recommended by the couple’s lawyer after they exhausted all efforts to get answers about the mysterious transaction from the banks.

Ellie Houston, 21, and her husband Trae Murphy, 23, say they transferred $90,000 from their account to a Bank of Melbourne account

The fallout from these media appearances became clear on Thursday when Daily Mail Australia attempted to speak to a shocked Mr Murphy.

The tradie’s parents said their son was so ill from the stress and anxiety of his ordeal that he could not get out of bed.

‘To have money and then suddenly it’s gone. It seems he has been scammed somehow,” said his concerned mother.

‘And to think that people now think he’s the one lying. It’s devastating.’

The couple had saved a significant amount of money for a settlement in Yarrawonga, a town near the NSW-Victoria border.

Ms Houston claimed she has screenshots and receipts showing the money was moved between the two accounts, but the Commonwealth Bank is refusing to refund the lost money.

The couple’s public campaign for answers quickly turned pear-shaped, with sympathy turning to suspicion.

Armchair detectives went into overdrive online as people openly speculated about what they thought went wrong.

Sources close to the couple say that while the public campaign has forced the Commonwealth Bank to re-engage with them, they still have no answers about where the money went or how to get it back.

“The Commonwealth has said that once it got into the account he wanted it in, it was transferred to someone else’s account with a name he doesn’t even know,” the source said.

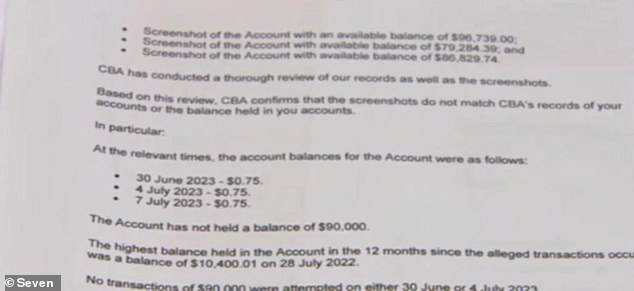

A spokesperson for the Commonwealth Bank (CBA) said it had investigated the claims and had since told Mr Murphy that the receipt numbers he provided ‘do not appear in the CBA data’.

The couple were on a long-planned trip to Bali when their transfer from a CBA account came back from the Bank of Melbourne “because both their names had not yet been approved”, Mrs Houston told 3AW radio on Monday.

A Commonwealth Bank spokesman said it had investigated the couple’s claims and had since told Mr Murphy that the receipt numbers he provided “do not appear in the CBA records”.

“Upon examination of the images of the receipts issued, the documents appear to differ from genuine CBA receipts and the receipt numbers do not appear in the CBA’s records,” the spokesperson said.

The statement added: ‘Mr Murphy claims the balance in his account should be $96,000. Following an investigation by CBA, we informed Mr Murphy:

‘The account in question (or any other account held by Mr Murphy) did not have a balance of $96,000 (or an amount close to it) at the time of the relevant transfers or in the twelve months prior.

‘The account from which the transfers are alleged to have taken place is a NetBank Saver which only allows transfers to another CBA account and is unable to process transfers to any other financial institution.

“Subject to additional information from Mr. Murphy, CBA is prepared to investigate further.”

Friends of Mr. Murphy have backed his story, focusing on vicious speculation suggesting he may be covering up some secret gambling habit.

“Who in their right mind would drop $96,000 on a horse? It’s ridiculous,” said a friend.

The couple claims the Commonwealth Bank sent a link to Beyond Blue, a suicide prevention hotline, after she described the toll the missing money had on her and her partner.

The friend said the couple only went public in an attempt to get the bank back up and running in the hope of getting their savings back.

The couple was on a long-planned trip to Bali when their transfer from a CBA account was returned by the Bank of Melbourne because “both of their names had not yet been approved”, Ms Houston told 3AW radio on Monday.

The couple tried to transfer the $90,000 to the Bank of Melbourne account again on July 4, but the money was returned to their account a few days later.

Because they were on vacation in Bali at the time, the couple were unable to transfer the money internationally and were charged a $2,500 late settlement fine.

‘They did not flee to Bali because of this. They were going there for a wedding, so they had to go there,” their friend said.

“They had it booked before all this happened. A long time ago, so it’s just a coincidence.’

Ellie Houston, 21, and her husband Trae Murphy, 23, are desperate for their missing money

The friend said the couple’s public plea was born out of sheer desperation.

“They wanted help and answers because they weren’t getting it,” the friend said.

Those who know the hard-working couple claim they are victims of a terrible crime.

“He was hacked or the bank account was hacked,” the friend said.

Daily Mail Australia has been told Murphy has been working long hours to save up for the couple’s dream home in Yarrawonga.

The money was all kept in a closed savings account that Mr Murphy is said to have opened at a real bank.

“These two have worked hard. “Something happened and on the advice of a lawyer they started talking to Neil Mitchell to get things moving,” a source said.

“They wanted to get things going and they did that. And they’ve gotten more information this week than in the last two months. And it helped them understand that they were scammed.”

The case will be taken before the Australian Financial Complaints Authority in the hope of finally resolving the matter.

Concerned friends say Mr. Murphy is so distraught over the missing money that he has cut himself off from loved ones.

“He’s not in a good place… and now it’s turned negative,” a friend said.