David Koch’s urgent warning to Australian homebuyers considering a fixed rate mortgage instead of a variable rate home loan, as ME Bank cuts their rates to beat Commonwealth Bank

Financial expert David Koch is urging Australian borrowers to be wary of switching to a fixed-rate loan – even if they now offer much lower interest rates.

The former Sunrise host warned that interest rates could soon fall dramatically, leaving anyone locked into a fixed rate.

It comes after ME Bank cut its two-year fixed rate to 5.79 percent. significantly lower than the typical standard variable interest rate of 6.5 percent at the major banks.

None of the Big Four banks offer a fixed rate as low as ME Bank, with Commonwealth Bank, Australia’s largest home lender, offering a fixed rate of 6.59 percent.

But Koch, who is now the economics director of Compare the Market, said borrowers who locked in lower fixed rates now would miss out if the Reserve Bank were to cut rates later this year.

Financial expert David Koch urges Australian borrowers to be wary of switching to a fixed rate loan – even if they have much lower interest rates (he is pictured right with his wife Libby)

“While these fixed interest rates south of 6 percent may seem tempting, it may be better to wait for a rate cut,” Koch said.

‘Fixed home loans protect you well against interest rate increases, but they prevent you from getting an interest rate reduction.’

The Reserve Bank raised rates in November for the thirteenth time in eighteen months, but analysts now expect the RBA to start cutting rates from late 2024 until next year, leading to lower variable mortgage rates.

If the Commonwealth Bank variable rate were to fall from 6.49 per cent to 4.99 per cent, the average borrower would see monthly repayments fall from $3,780 now to $3,210 by mid-2025.

For a borrower with an average mortgage of $598,624, monthly repayments would have fallen by $570, or $6,840 a year, by June next year, based on the latest official lending figures.

Hopes for a rate cut have been fueled after monthly inflation of 3.4 percent in February was only marginally above the Reserve Bank’s target of 2 to 3 percent.

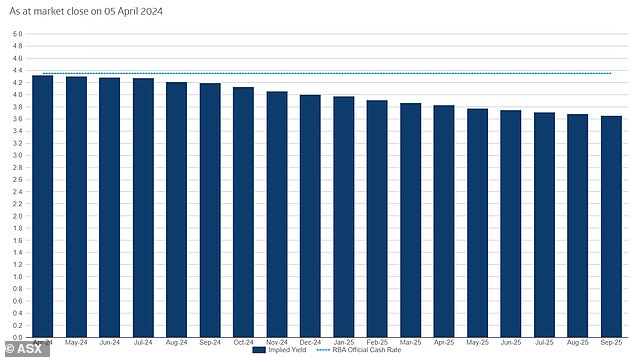

On the 30-day interbank forward market, the RBA will cut rates by 25 basis points from October, with further cuts expected in 2024 and 2025.

The Commonwealth Bank expects six cuts by the middle of next year will be the most generous concessions to mortgage holders since the global financial crisis of 2008 and 2009, and the first relief since the Covid pandemic in 2020.

Three rate cuts in September, November and December would see the RBA cash rate fall for the first time since May 2023 from the existing 12-year high of 4.35 per cent to 3.6 per cent in December.

This would be followed by three more rate cuts in the first half of 2025, taking the RBA cash rate to 2.85 percent for the first time since December 2022.

But that could leave even those with a fixed-rate mortgage of just 5.79 percent from ME Bank paying much more over two years than those with variable-rate loans, even though it is now cheaper in the short term.

This product is available to people with a mortgage deposit of at least 20 percent.

Should these predictions of a rate cut come true, borrowers who fixed a mortgage rate now would be in a similar position as borrowers in early 2008 who fixed their mortgage rate after two rate increases early that year.

Interest rates had reached a 12-year high of 7.25 percent in March 2008, but as the global financial crisis worsened later that year, the RBA cut rates to a then-record low of 3 percent from October 2008 to March 2009.

The warning came after ME Bank cut its fixed rate by 60 basis points on Friday, dropping the lowest rate for owner-occupiers to just 5.79 percent (pictured are homes in Ipswich, southwest of Brisbane).

On the 30-day interbank forward market, the RBA will cut rates by 25 basis points from October, with more cuts also expected in late 2024 and 2025

Koch said this history shows the wisdom of shopping around for a more competitive variable rate rather than taking out a mortgage.

“History tells us that it is usually better to remain a little flexible and consider staying on a variable rate when we are at the peak of the cycle and interest rates are going to fall on a large scale,” he said .

‘It just depends on whether you want to take a gamble on a higher variable, or whether you prefer to set a stable rate that you think you can pay.’

Fixed rate mortgages were cleared during the Covid pandemic almost 40 per cent of home loans at the start of 2022, when RBA interest rates were still at a record low of just 0.1 per cent and banks were offering fixed interest rates starting with a ‘two’.

But as of February 2024, they made up just 1.4 per cent of all mortgages, according to new Australian Bureau of Statistics lending data released on Monday.