Coles and Woolworths refuse to answer questions about why Tim Tams are cheaper to buy overseas

Supermarket bosses have dodged the question of why a pack of Tim Tams is more expensive in an Australian supermarket than in London.

Liberal Senator Jane Hume on Friday questioned senior managers at Coles and Woolworths about why a pack of chocolate biscuits cost $6 Down Under and about $4.86 at Tescos, a popular British supermarket chain.

Senator Hume commented that it was ‘strange’ that a ‘product manufactured in western Sydney would cost more in a supermarket in the Australian city than in a store in London, despite the ‘rigmarole’ over freight charges and import taxes.

Woolworths Chief Commercial Officer Paul Harker told a Senate inquiry into the cost of living that this was ‘probably a big ask for Arnott’.

He said Woolworths had adopted Arnott’s “recommended retail price” and could not discuss the biscuit giant’s negotiations with other markets.

“I don’t know what agreements they have or don’t have with the sale of that product in the British market and what margins they expect to make with that product in that market,” Mr Harker said on Friday.

“In this market, we negotiated the best standard costs with Arnott’s every day… and then we put all our efforts into negotiating promotions on those products for consumers.”

Coles head of public affairs Adam Fitzgibbons said it should not be assumed that Arnott’s sold their products to Australian retailers at the same cost as to international grocers.

A pack of Arnott’s Original Tim Tam will cost Aussies $6 if purchased from Coles or Woolworths (pictured in the Woolworths online store)

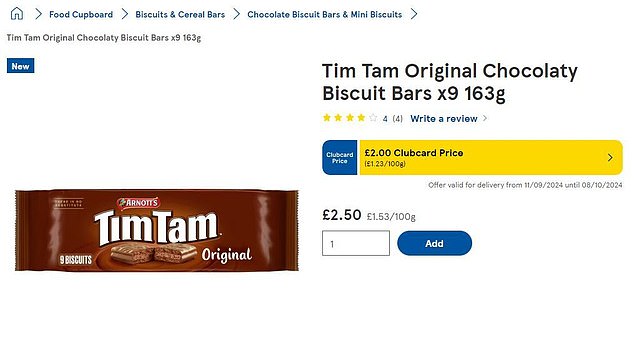

However, overseas, customers can purchase the same product at leading supermarket chain Tesco for £2.50 ($4.83 AUD) (shown on Tesco’s online store)

“That’s not something that Coles would have any insight into at all, but I think that’s certainly a question best addressed to Arnott’s,” he said.

‘We don’t have visibility into, as we said, their commercials, what they sold at Tescos or their promotional agreements with them, but those are the sort of factors that would influence that sales price.’

Addressing Coles, Senator Hume also noted that the chain had offered Tim Tams a promotional price of $4.50 and asked Mr Fitzgibbons whether the biscuits were being sold as a loss leader, where an item is sold at a lower price to attract customers encourage to buy. other products.

Mr Fitzgibbons said while promotional prices were being negotiated with suppliers, he declined to add further details due to legal action at the Australian Competition & Consumer Commission (ACCC).

The watchdog is taking both Woolworths and Coles to court for allegedly misleading consumers by temporarily raising prices by at least 15 per cent before supplying them with promotional discount stickers at prices higher than before the increase.

The ACCC claims Woolworths did this for 266 products in its Price Dropped promotion over 20 months, while Coles did this for 245 products in its Down Down promotion over 15 months.

Supermarket bosses have dodged questions about why a pack of Tim Tams is more expensive in an Australian supermarket than in London (stock image)

In September, Arnott’s defended the price of its 200g pack of Tim Tams after consumers complained about the high price tag.

The company said it was facing significant input costs, including “rising cocoa prices.”

During the investigation, the supermarket giants also gave evidence that the food industry was ‘highly competitive’, despite the ACCC saying the Australian market was an ‘oligopoly’, with dominant players Coles and Woolworth controlling prices.

Greens Senator Nick McKim questioned why the positions between the ACCC and the supermarkets were so “diametrically opposed”.

Mr Fitzgibbons said that while there were a ‘limited number of supermarket chains’, ‘a high level of concentration does not equate to a low level of competition’.

Mr Harker said the report notes that consumers are cross-shopping “more than ever”.

“I accept the fact that we are a concentrated supermarket sector and that does not determine a lack of competition,” he said.