CITY OF LONDON INVESTMENT TRUST: Dividend record is music to the ears of investors

CITY OF LONDON INVESTMENT TRUST: Dividend record is music to investors’ ears

The UK economy has been anything but stable and predictable over the past seven decades. Since 1966, there have been numerous recessions, effects of global financial crisis, pandemic, Brexit and others.

Yet through it all, year after year, City of London Investment Trust increased the annual dividend it pays to its shareholders.

Over the decades, the trust has invested in largely UK-listed companies that tend to pay good returns to shareholders. It then passes this income on to its own investors in the form of dividends.

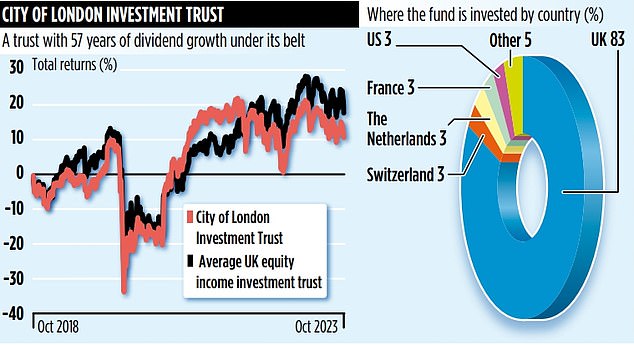

This means the trust has an unbroken streak of 57 consecutive dividend increases – the longest record for any investment trust. Stable and predictable amid turbulence. And will he manage 58 years of consecutive promotions?

Manager Job Curtis has been in charge for 32 of those years. He says: “We can never promise that we will increase the dividend again, but we have every intention of doing so.”

Curtis explains that the fund’s structure is key to its success. The City of London is an investment trust, which means it can set aside up to 15 percent of its income each year.

In this way, the trust can invest its savings to maintain its dividend-paying record even in the more difficult years. “We also invest in companies that are profitable and we are confident that we can continue to pay shareholders,” he adds.

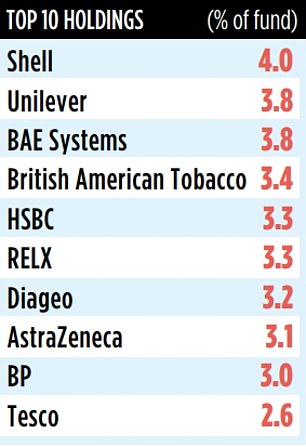

The majority of the trust’s shares are UK companies – currently around 83 per cent. FTSE 100 values stand out strongly; such as Diageo, Unilever and Shell.

So you might expect the trust’s fortunes to be closely linked to the UK economy. However, Curtis explains that 69% of the revenue from the companies it invests in comes from outside the UK.

The obvious benefit of this is that the trust is diversified and not overly dependent on the state of the UK economy. But another advantage has emerged in recent months as UK companies struggle against persistently high inflation.

“Because the companies we invest in have a global perspective, many of them have been operating for years in countries that tend to experience high inflation and are used to dealing with it,” says Curtis.

“Unilever has a large market in India, while British American Tobacco has a large operation in Brazil. Both countries have not experienced the long phase of low inflation enjoyed until recently by the UK, US and Europe.”

Once Curtis and his team buy a new stock, they typically hold it for the long term—and often for more than a decade. However, they are not shy about making a change – even if it goes against the grain. “We sold Microsoft in June after holding it since 2011,” says Curtis.

“I know there is interest in him now because of the growth of AI, as he is seen as one of the main players. But it has grown more than tenfold since we bought it and has a market capitalization almost equal to the entire FTSE 100. I was happy to take the profit and move on.’

Curtis works in a team of 15 people, all looking for new investment opportunities. Sometimes, though, the best ideas just land in his lap. In June, Curtis and the team bought Round Hill Royalties, which bought the rights to the songs. At the time, it was trading at a 40% discount to its asset value.

“I really like Spotify,” says Curtis. “I like to listen to music on the train. I especially like music from the late 70s – like Saturday Night Fever. And I thought that even though a lot of young people are already streaming, there are a lot of older fans like me who are still discovering it.

“Round Hill receives royalties from a huge portfolio of pre-2000 music and so is expected to benefit.”

The value of the trust’s holding in Round Hill has already risen by 65 per cent since it bought it because of the takeover approach.

The City of London has a fixed annual charge of 0.37 per cent. Its stock identification code is CTY.