City bosses paid the average annual salary in the first THREE DAYS of 2025

- The typical FTSE 100 CEO earned £4.7m in 2023

Bosses at Britain’s biggest companies earned more in the first three days of 2025 than the average worker takes home in the entire year.

The news will reignite the row over fat cat pay, at a time when there are calls to give top executives even more money to attract the best to run the biggest companies listed on the London stock market .

The typical FTSE 100 CEO earned £4.7m in 2023, the last year for which full figures are available, according to The Mail on Sunday’s Fat Cat Files.

That amount is 125 times greater than the average worker’s annual income of £37,430.

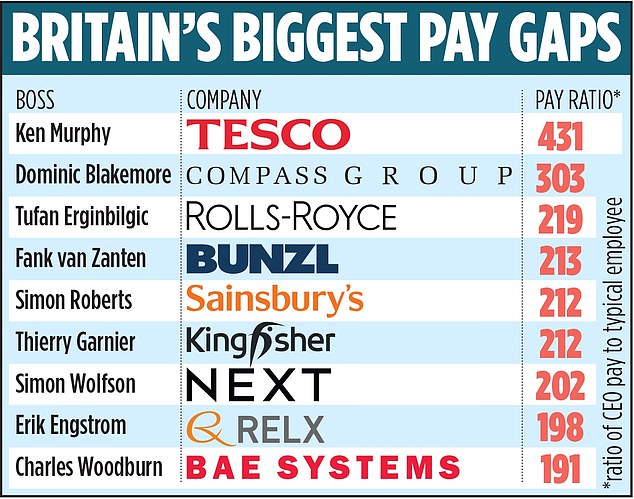

But the headline figure masks some even larger pay gaps.

The biggest gap among blue chip companies is at Tescowhere CEO Ken Murphy was paid almost £10 million – 431 times the salary of the average supermarket worker (£23,010 per year).

Break it down: A typical Tesco worker earns £23,010 a year, but in 2023 CEO Ken Murphy was paid £10 million, or 431 times that amount

It means Murphy earned more on New Year’s Day – when most Tesco stores were open – than his staff did in the rest of 2025.

Other retailers such as Sainsbury’s, Next and B&Q owner Kingfisher are also on the list, where the pay gap is widest.

However, some say the bosses’ pay is not high enough. Companies such as plumbing giant Ferguson and Tarmac owner CRH have already moved their main listings from London to Wall Street, where sky-high boardroom pay is more widely tolerated.

Cambridge-based chipmaker Arm Holdings primarily chose to go public in New York.

That has led to warnings of a brain drain from business leaders such as Julia Hoggett, CEO of the London Stock Exchange, who has said that “a lack of a level playing field” was causing an exodus of companies from the city to New York and beyond.

Billionaire financier Lord Michael Spencer recently joined in, arguing that the best bosses should be paid like ‘top footballers’ without facing backlash.

Tesco, which has increased its dominance of the supermarket market under Murphy’s leadership, defended its award.

Alison Platt, chair of the remuneration committee, which sets executive pay, said at the time that she recognized “the strong performance of the business” and “the fact that Tesco has delivered for all its stakeholders over the past year”, including “record investment” . in colleague salary’.

As Prime Minister, Theresa May tried to tame ‘fat cat’ wages by forcing companies to reveal more information about their pay ratios.

In 2017, she described the behavior of some corporate bosses as “the unacceptable face of capitalism” in an article for The Mail on Sunday.

She launched a public register naming and shaming companies where a significant number of shareholders believed boardroom salaries were too high.

However, greater disclosure has failed to curb growing wage disparities.

Critics say this reinforces workplace inequality, especially as real wages have stagnated since the 2008-2009 financial crisis and average incomes struggle to keep pace with rising prices.

DIY INVESTMENT PLATFORMS

A. J. Bell

A. J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

Sax

Sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.