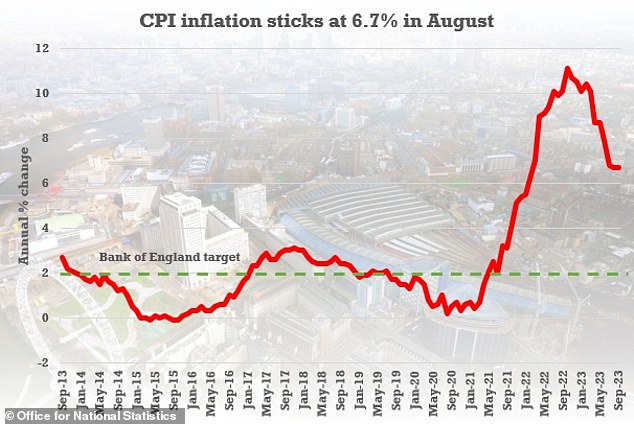

City bets Bank of England will pause interest rates again as inflation stays flat

- The CPI remained at 6.7% in September thanks to higher services inflation

- Sterling rises, but futures markets point to a year-end yield spike of 5.25%

- However, the Bank of England could consider more rate hikes next year

Inflation did not fall again in September, but analysts do not think that persistent cost pressures will force the Bank of England to raise rates again next month.

Consumer price inflation was flat from the previous month at 6.7 percent, higher than forecasts of 6.6 percent, as easing pressure on food and goods prices was offset by higher energy costs, data from the Office for National Statistics.

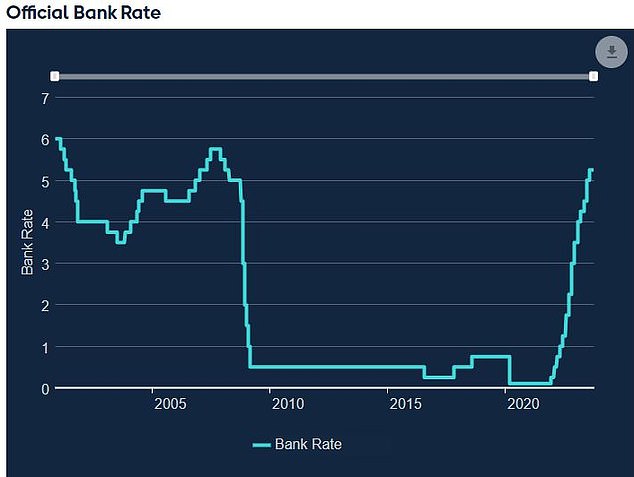

It follows the decision taken by the BoE at the last meeting of the Monetary Policy Committee in September, when the bank ended 14 consecutive rate hikes with a pause of 5.25 percent.

Food for thought: Inflation remains more persistent than expected, keeping BoE Governor Andrew Bailey guessing

Rate hikes have made the cost of borrowing much higher, impacting economic growth and putting pressure on consumers, businesses and governments, but they have not yet been able to bring inflation back to the target BoE of 2 percent.

In response to warmer-than-expected inflation, the pound rose this morning, reversing losses from yesterday’s wage growth figures – suggesting currency markets are becoming more cautious ahead of another BoE rate hike.

Rob Morgan, chief investment analyst at Charles Stanley, said: ‘There will be two more rate announcements this year, on November 2 and December 14.

‘While wage growth remains robust and fuel prices rise, on balance it seems likely that the BoE will continue to suspend interest rates for the time being to take into account more economic and inflation data.

“Today’s inflation numbers will cause some discomfort that a further turn of the interest rate screw will be necessary.”

Flat: Inflation remained at 6.7% in both August and September

But developed markets economist at ING James Smith said there is “not much” in the current inflation data that is likely to “put pressure on the Bank of England to resume its rate hike cycle.”

The BoE has focused on UK services inflation – a key driver of overall inflation pressures this year – and will have been disappointed to see it rise from 6.8 per cent to 6.9 per cent in September.

But Smith said the “volatile package holiday prices included in the services data appear to have done a lot of the work for that”, and services inflation remains below the BoE’s projection of 7 percent in August.

He added: “We still think that inflation in the services sector should turn lower for the rest of the year, perhaps ending at 6 percent in 2023. While that’s not a huge improvement, it would reflect survey data showing that fewer companies are raising prices and that those that do are raising prices less aggressively.

‘In terms of headline inflation, October will obviously be another step lower as last year’s sharp increase in household energy bills disappears from the annual equation.

“As neither yesterday’s wages data nor today’s inflation data contained any earth-shattering surprises, we think the Bank will be content to keep rates unchanged again in November.”

As of this morning, prices on the futures market indicate that Britain will end 2023 with a yield peak around ten basis points higher – pointing to another break in November at 5.25 percent.

Janet Mui, head of market analysis at RBC Brewin Dolphin, said: ‘The fact that wage growth is slowing and more concrete signs that the labor market is loosening should give the Bank of England comfort that underlying inflationary pressures are on their way to Reduce.

‘The report slightly increases the likelihood that the Bank of England will raise rates again by the end of the year, but markets generally think the Bank is done with rate hikes.’

However, senior personal finance analyst at Interactive Investor Myron Jobson warned that while rates “may not need to rise further for now,” this does not necessarily mean the end of the rate hike cycle.

He said: ‘Bank of England policymakers are likely to keep the door open to further rate hikes until they can feel more confident they can keep rising prices under control.’

The Bank of England halted its rate hike cycle in September at 5.25%