Citigroup’s top US economist gives grim warning about cracks in the economy – saying problems could ‘snowball’

Citigroup’s top economist Andrew Hollenhorst has warned about how a deteriorating labor market is exposing cracks in the US economy.

This was said by the chief economist of the bank, the fourth largest in the US CNBC in an interview this week how this could mean the economy ‘snowballing’ into a ‘hard landing’.

A ‘hard landing’ occurs when there is a clear economic slowdown after a period of rapid growth.

While many argue that the labor market data in recent months does not necessarily indicate that the economy is souring, Hollenhorst says it may be less positive than people realize.

It comes as Jamie Dimon – head of the world’s largest bank, JPMorgan Chase – also said he cannot rule out the possibility of a hard landing for the US economy.

Citigroup’s top economist Andrew Hollenhorst has warned of how a deteriorating labor market is showing cracks in the US economy

Hollenhorst pointed out the areas in the labor market where he sees cracks emerging.

Citing data from the National Federation of Independent Business, he told CNBC: “Small businesses are telling us their hiring intentions are at the lowest levels we’ve seen since 2016.”

‘And when I look at the economy, the workforce percentage is currently at the lowest level since 2014.

‘We have the lowest staff percentage in ten years.’

He noted that while unemployment has been below 4 percent for almost two years, the current rate of 3.9 percent is up from a low of 3.5 percent earlier this year.

“That shows us that companies may not be laying people off yet,” he said.

‘We don’t think so. There is labor hoarding. But companies hire staff at a lower rate. Companies allow employees to work fewer hours.

‘So this gradual softening has already started. That tends to snowball and end up in something more like a hard landing.”

Hollenhorst predicted that if unemployment rose above 4 percent, it could mean the Federal Reserve would cut interest rates as early as July.

The recently released minutes of the Federal Reserve’s latest meeting show that policymakers are becoming increasingly concerned about inflation. Some members indicated that there was a lack of confidence in lowering interest rates and easing monetary policy.

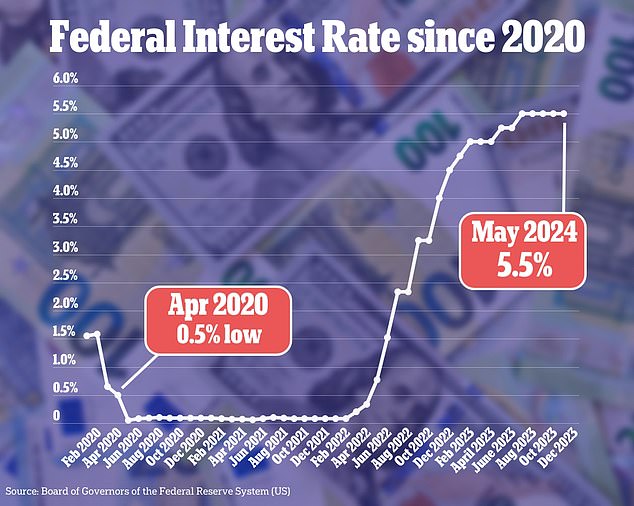

The central bank voted earlier this month to keep interest rates stable at a 23-year high of between 5.25 and 5.5 percent.

Hollenhorst said there has been an extended period of high interest rates that is finally having an effect on businesses – in addition to rising prices and savings.

“I think we’re seeing that in a lot of corporate earnings, with retailers talking about the need to maybe cut prices now. So this really strong driver of consumption, consumer spending and demand finally seems to be slowing down.”

JPMorgan CEO Jamie Dimon also warned about the US economy earlier this week.

When asked about the prospect of a hard landing during a CNBC interview on Thursday, he said: “Could we actually see one?” Of course, how can anyone who reads history say there is no chance?’

America’s most influential banker also said the worst outcome for the US economy would be “stagflation” – which is when inflation continues to rise but unemployment is high and growth is slowing.

Economists consider stagflation, last seen in the US in the 1970s, in some ways more worrying than a recession. It would drive down stock prices, hitting 401(K)s and other retirement savings.

The billionaire banker chimed in another interview Last month, he worried that the U.S. economy “looks more like the 1970s than we’ve ever seen before.”

The Federal Reserve voted to keep interest rates steady at their current 23-year high at its last meeting earlier this month

JPMorgan Chase CEO Jamie Dimon has said he cannot rule out a ‘hard landing’ for the US

Speaking at the JPMorgan Global China Summit in Shanghai, Dimon said: “I look at the varied outcomes and again, the worst outcome for all of us is what you call stagflation, higher interest rates and recession.

“That means corporate profits will fall and we’ll get through that. I mean, the world survived that, but I think the odds have been greater than other people think.”

Despite this, he says consumers are in “pretty good shape” at the moment and will continue to be so if the economy enters a recession.

While many Wall Street analysts remain optimistic about the economy, JPMorgan’s chief market strategist Marko Kolanovic also published a note on Monday predicting that the S&P 500 could fall 20 percent to 4,200 points by the end of the year.