Citigroup’s new hire Raghavan – a no-nonsense, decisive dealmaker | World News – Business standard

Viswas Raghavan | Photo: Bloomberg

While Citigroup Inc. CEO Jane Fraser is shrinking Wall Street’s underdog into a leaner competitor, its latest big hire is a dealmaker known for sloppy behavior — and little tolerance for laggards.

In one of his less conventional performances in nearly 24 years at JPMorgan Chase & Co. Viswas Raghavan helped the bank take Deutsche Bank AG’s sponsorship of the prestigious Lord’s cricket ground to the next level, a chapter in his friendly rivalry with the German lender’s once co-star Anshu Jain. -director.

Inside JPMorgan, Raghavan made clear to senior dealmakers that he was obsessed with climbing the rankings and eclipsing longtime investment banking rival Goldman Sachs Group Inc., according to people familiar with the executive who spoke on condition of spoke with anonymity. He was known to publicly reprimand senior investment bankers when they lost an advisory mandate and placed high demands on their junior staff. His pursuit of dealmakers left some under pressure.

But after four years co-leading JPMorgan’s global investment banking franchise, Raghavan, 57, is now set to take over Citigroup’s entire Wall Street business as part of Fraser’s company-wide overhaul aimed at tightening of profitability. The style of the tough, bespectacled recruit offers a first impression of how corporate culture may shape up in the coming years.

His interest in taking control of a wider division also underlines his ambitions.

“Sometimes you want to run the show instead of being part of a team,” says Wells Fargo & Co. analyst Mike Mayo. The veteran banker’s bet on Citigroup’s prospects is notable, Mayo said. “An executive’s willingness to go from the best to the worst company in his class makes us wonder whether our numbers are too conservative.”

‘Center moment’

Fraser — who is in the process of cutting about 20,000 jobs at Citigroup — announced Raghavan’s appointment Monday in a memo to staff, calling him “the right person to take over at this crucial time.”

When he formally joins Citigroup this summer, as expected, he will succeed Peter Babej, who took over the division on an interim basis when Fraser divided the bank into five “core businesses” during its restructuring in September. Babej is retiring.

It is not yet clear whether Raghavan – a fan of British football team Arsenal and Mayfair eatery Scott’s – will formally move from London to the bank’s New York branch, said a company spokesman, who declined to comment further the appointment. But either way, he will regularly travel to his outposts around the world and meet with customers.

Before finally choosing the director, the bank polled several senior women from across the industry, according to some people.

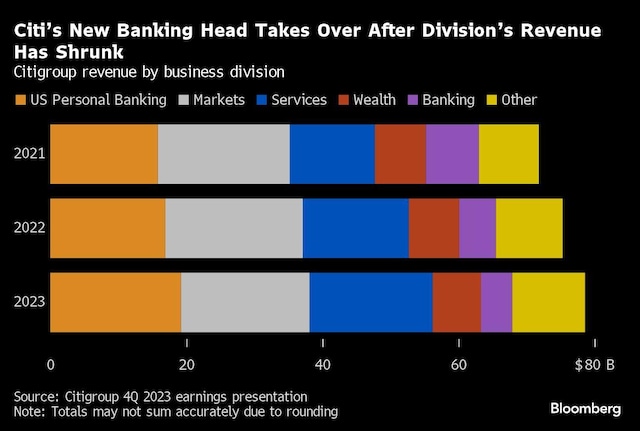

Raghavan takes over the reins of a company that has suffered in recent years as revenues remained subdued amid a global slump in dealmaking and capital markets activity. The division – which includes advisory, capital markets and corporate banking – is Citigroup’s smallest pillar. It reported a 15 percent drop in revenue last year to $4.6 billion, which was less than 6 percent of Citigroup’s total. Including costs, the unit lost money.

At Citigroup’s 2022 Investor Day, executives laid out goals for growing market share in investment banking’s three major divisions: advisory, equities and debt. Two years later, Citigroup has effectively lost market share in the advisory and equity markets, while the company’s share of debt underwriting deals has barely budged.

Fraser has vowed that its moves will help boost a key measure of profitability known as the return on tangible common stock to at least 11 percent by 2027. On that front, Raghavan’s banking division has the furthest to go.

Raghavan’s hiring is not the first time Fraser has shown she is willing to look beyond Citigroup’s ranks to bring in top talent. Last year she added Andy Sieg from Bank of America Corp. to lead her growing wealth business. These moves also helped Citigroup create a deeper pool of executive talent that could one day succeed Fraser.

If Raghavan can narrow the gap with rival banks and Citigroup’s other divisions – such as services and US retail banking, where revenues rose – it could make him a contender to one day take over Fraser’s position in the top spot to take. People who know him said they wouldn’t be surprised if he also persuaded some of his closest colleagues from his former employer to help with the task at hand.

In 2014, Raghavan’s boss, Daniel Pinto, put it this way in an interview with Financial News: “Fish has incredible energy and encourages everyone to never be complacent.”

‘Federation King’

Raghavan was not a rainmaker in the traditional sense of that word. Instead of a vast Rolodex of CEOs to tap for advisory mandates, he spent much of his career helping clients raise money in the capital markets. He first made his name by advising on what was then the world’s largest sale of convertible bonds, and in 2003 helped the German government sell bonds that could be converted into shares of Deutsche Telekom, Europe’s largest telecommunications provider.

These steps earned him the nickname ‘the convertible bond king’ in the European press. In a later deal, he advised Indian billionaire Anil Agarwal when he took a stake in mining company Anglo American Plc in 2017 through a complex, structured bet. JPMorgan made several million dollars on that transaction alone. And more broadly, he has built a strong customer base in India, according to one of the people.

Even as he rose through the ranks of JPMorgan, Raghavan never forgot his roots in capital markets. When he was appointed CEO of the company’s operations in Europe, the Middle East and Africa in 2017, Raghavan told a reporter from the International Financing Review that he was “still a modest CB banker.”

Raised in India and based in London, Raghavan entered the financial world with a bachelor’s degree in physics from the University of Bombay and a second bachelor’s degree in electronic engineering and computer science from Britain’s Aston University in Birmingham in 1989, which later earned him a degree . honorary doctorate.

Fraser, who started as a consultant at McKinsey & Co. and told other banks how to improve their operations, rose to the top of Citigroup in 2021. To gain an edge in recruiting, she embarked on a more aggressive overhaul in 2023, as the stock headed for a fourth straight annual decline.

In September, she announced a major overhaul of the company’s divisions, and soon after warned employees to join her reorganization or leave. She followed up in January with the announcement of workforce reduction targets.

“I am encouraged by the fact that Jane is willing to make bold changes to the bank’s trajectory,” said Daniel Babkes, portfolio manager at Pzena Investment Management, which holds shares in the bank. “Citigroup is going for a cultural transformation, and that is difficult if you keep the same team.”

First print: February 28, 2024 | 3:09 PM IST