Chipotle admits charging MORE for burritos helped boost profits 37% to $1.1 TRILLON last year – with chain also helped by lower costs for avocados

Chipotle easily beat market estimates for profit and revenue – boosted by price increases last October.

Despite menu items becoming more expensive, more Americans visited the Mexican restaurant chain in the last three months of 2023.

That created a double whammy: more burritos were sold, each at a higher price. In some cases they are a dollar more – rising prices up to $12.

While most U.S. restaurant and fast-food chains have seen customer numbers — and spending — weaken in recent months, Chipotle is bucking the trend.

This is partly due to customers who are wealthier than those of competitors such as McDonald’s. This means they are less affected by higher prices.

Despite menu items becoming more expensive, more Americans visited the Mexican restaurant chain in the last three months of 2023

Chipotle announced its quarterly and annual results tonight, reporting income of $282.1 million from October to December, compared to $223.7 million a year earlier.

Revenue in the quarter, meanwhile, rose 15.4 percent to $2.52 billion, crushing market forecasts of $2.49 billion.

Chipotle said the number of customers at its restaurants increased 7.4 percent between October and December — compared to the same period in 2022.

For all of 2023, revenues were $1.23 billion – up from $899.1 million for 2022.

The California-based company increased the price of its burritos and rice bowls by 3 percent last October – the fourth time the chain has raised prices in the past two years.

Lower costs for one key ingredient also helped.

Chipotle told investors that the company has “benefited from menu price increases and, to a lesser extent, lower avocado costs.”

Chipotle has raised prices four times in two years, most recently in October. According to Business insiderBefore that change, a chicken burrito bowl cost $10.95 at a location in Brooklyn, New York City.

After the walk, the same bowl cost $11.35 without extra guacamole or queso, according to Chipotle’s website. These can add $2.95 and $1.80 respectively.

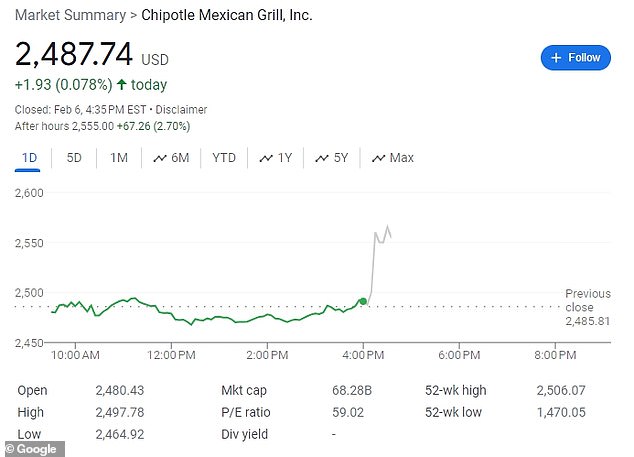

Following the earnings results, shares in the company rose in extended trading.

Following the earnings results, shares in the company rose 2 percent in extended trading

While price increases helped boost sales by increasing average order value, improvements in store efficiency further helped attract more customers, the company said.

Chipotle noted that customer transactions in the quarter 31 were up 7.4 percent from a year earlier, while the average amount spent per order increased 1 percent.

While Chipotle has seen higher costs for some ingredients, such as beef and queso, the cost of other raw materials, such as paper and some vegetables, have fallen in recent months, boosting margins at the company.

The Mexican Grill said it had opened 121 locations in the final quarter of last year and plans to open between 285 and 315 new restaurants by 2024.

While Chipotle has seen an increase in footfall, fellow food companies McDonald’s and Starbucks have both reported a drop in footfall during the final three months of last year.

Traffic at McDonald’s U.S. stores fell 13 percent last October, according to Placer.ai data cited by Wells Fargo.

In November and December the economy fell by 4.4 percent and 4.9 percent respectively.

Despite this, the fast food giant still managed to increase profits by 7 percent by charging customers more for McMuffins, Big Macs, McNuggests and fries.

Photos of eye-watering prices at some Golden Arches stores have gone viral, including a single Egg McMuffin for $7.29 and a Big Mac for $8.39. These higher prices are usually found in restaurants with higher rental prices, such as rest areas.