Cash Isas have become hugely popular, with £73.5 billion being deposited into them in just 18 months

Savers have continued their search for cash, with £4.2 billion being deposited into tax-free accounts in May, new data from the Bank of England shows.

It comes after savers put aside a record £12.3 billion in April and HMRC last week estimated that savers could face a collective tax bill of more than £10 billion this tax year after exceeding the personal savings allowance.

The amount in May is a record for any month since ISAs in their current form were launched 25 years ago. In total, early birds have amassed £16.5bn in cash ISAs in just two months.

Every April, savers receive a new annual allowance of £20,000 for the financial year – and it seems Isas are proving more popular than ever.

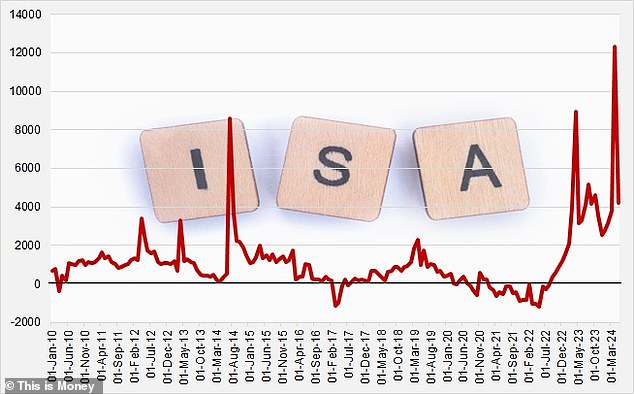

Flying high: The amount of money flowing into tax-free accounts has exploded in recent years

This cash analysis of Bank of England data shows that £3.1bn was deposited into cash Isas in May 2023. In May 2022, that figure was -£1.1 billion, as more savers withdrew money from tax-free accounts than put into them.

Cash Isa money was also more withdrawn than deposited in May 2021, showing how far the shift has gone.

Between January 2023 and May 2024, £73.5 billion entered cash Isas.

By comparison, between January 2021 and May 2022, £8.8 billion of money was withdrawn from tax-free accounts. This means that more savers withdrew money than put it in. This shows how far the tide has gone.

According to Laith Khalaf of AJ Bell, the new wave of appeal of Isa packs is partly because savers know taxes will go up no matter who wins the election, and are therefore taking evasive action.

He added: ‘While Labor largely denied raising taxes during the election campaign and the Conservatives promised to cut them, one message has come through loud and clear: frozen tax thresholds mean we will all be paying more and more income tax in the future. next four years.

‘OBR estimates show that collectively we will pay around £20-£25 billion more a year as a result of the freeze on personal allowances and the higher rate threshold.

‘The budget watchdog also believes the freeze will result in 3.2 million people paying tax, while creating 2.1 million additional higher-rate taxpayers and 350,000 additional additional-rate taxpayers.

‘We can therefore assume that Isas will play a leading role in the financial plans of anyone who wants to save for the future.’

Resurgence: While there were net outflows for cash ISAs in 2021 and 2022, they have become hugely popular since January 2023

Figures from the Tax Authorities last week showed that taxpayers who pay an extra rate make up the majority of people who pay tax on savings interest.

While basic rate taxpayers get a £1,000 buffer and higher rate taxpayers get £500 on what they can earn in interest before the PSA kicks in, additional rate taxpayers do not have a PSA.

The taxman says that of the £10.4 billion he expects to receive in savings interest tax, £1.14 billion will come from basic rate taxpayers, £2.4 billion will come from higher rate taxpayers and £6.8 billion will come from taxpayers with an additional rate.

As more and more people move into higher tax brackets, the PSA shrinks along with it.

There are also plenty of savings accounts currently paying more than 5 percent, meaning that violating the PSA has become much easier than in previous years.

For example, at a rate of 0.75 per cent, a basic rate taxpayer would need a deposit of £133,000 to breach the £1,000 PSA.

At a rate of 5.2 per cent, £19,231 would be in breach of the allowance. For higher rate taxpayers, around £10,000 would be over the limit at a rate of 5.2 per cent.

The This is Money savings calculator can help you work out how much would push you over the edge.

Cash Isas were also in the Resolution Foundation’s sights. Earlier this year it advocated a lifetime limit of £100,000.

But This is Money editor Lee Boyce argues that Isas are a simple, well-understood and successful way to save.