Cash buyers pay THOUSANDS less for a home than buyers with a mortgage

Cash buyers get big discounts when they buy a home, new figures show.

Those who do not need to borrow to buy a home pay 13 percent less than those who take out a mortgage, an analysis of MPowered Mortgages of Land Registry data shows.

The analysis of completed sales in September found that cash buyers in the UK typically paid £28,189 less per property.

This amounts to an average discount of 9.3 percent on the asking price.

This ‘cash buyer’s discount’ has increased by 12.4 percent compared to September 2022, when Liz Truss’s mini-Budget hit the brakes on the property market.

Cash is king: Cash buyers get discounts of 13% compared to the average buyer with a mortgage, according to analysis of land registry data

Why do cash buyers pay less for homes?

Buyers with cash are more attractive than buyers with a mortgage because the mortgage is one aspect of the real estate purchase that can go wrong.

They are therefore seen by sellers and real estate agents as more security – and a greater chance of a successful sale.

The mortgage can also be a lengthy process, which can delay home sales. So a cash buyer can also offer buyers a faster move.

This puts cash buyers in a strong bargaining position, allowing them to ask the seller for a discount.

Their numbers are also declining, which only increases their bargaining power. MPowered’s analysis shows that cash buyers now account for just a fifth of house purchases in Britain.

According to Land Registry figures, cash buyers made up 22.4 percent of transactions in September, compared to 28.6 percent two years ago.

Stuart Cheetham, CEO of MPowered Mortgages, believes this combination of scarcity and speed allows cash buyers to pay less for the home they want.

“As the property market heats up and interest rates fall, the number of house hunters using a mortgage to finance their purchase is increasing, and cash buyers are becoming relatively rarer,” says Cheetham.

Stuart Cheetham, CEO of MPowered Mortgages

“Then there’s the trump card that cash buyers can play: speed. Rising demand is making a slow process take even longer, with the average seller in England and Wales now having to wait 152 days between accepting an offer and completing the sale.

‘That’s why buyers who have their finances in full order when they make an offer are much more attractive to sellers than those who don’t.

‘Sellers will often accept a lower offer in exchange for the extra security that these buyers offer.

“If you’re not fortunate enough to have the money to buy the house you want, you can give yourself almost the same leverage by having a fully underwritten mortgage offer.”

Where cash buyers get the biggest discounts

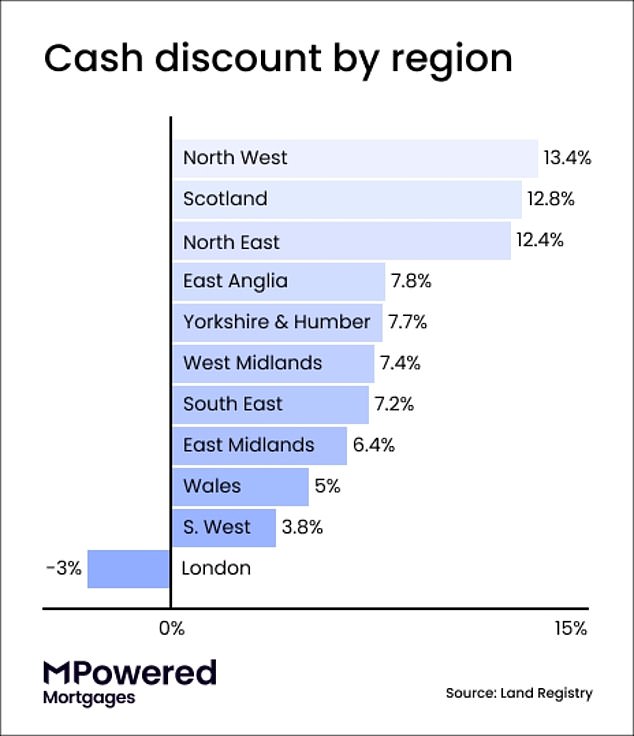

According to MPowered’s analysis, discounts are significantly higher in the northern parts of Britain.

It found that cash buyers enjoy the biggest discounts in North West England, where they typically pay £31,827 (13.4 per cent) less than buyers with a mortgage.

In Scotland the average ‘cash rebate’ is £26,476 (12.8 per cent), and in North East England £22,122 (12.4 per cent).

Discounts decrease further south. In the South East, buyers with a mortgage paid an average of £392,021 in September, compared to £364,232 among cash buyers – a discount of 7.4 per cent.

In the South West, the average buyer with a mortgage paid 3.7 per cent more than their counterparts who bought with cash – a cash discount of less than £12,000.

Cash Out Deal: Cash buyers get discounts of 13.4% in North West England and 12.8% in Scotland

The only place where cash buyers can’t enjoy lower prices is London.

In September 2024, cash buyers in the capital paid £15,344 more per property than those using a mortgage, reflecting the large number of foreign property investors – who invariably pay in cash – buying homes there.

The discrepancy in London is also likely to be accentuated by the high concentration of cash buyers active in central London, where property prices are highest.

In inner London, cash buyers paid an average of £644,481 per home, compared to £586,593 among buyers with a mortgage in September.

However, it is worth pointing out that the overall 3 percent ‘cash premium’ in London has almost halved since September 2022.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.