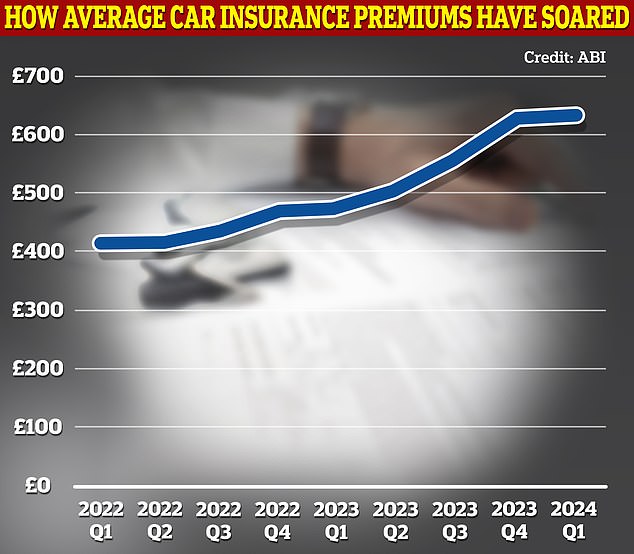

Car insurance costs hit a new average record of £635, but increases may be starting to slow

- It’s even more bad news for motorists as premiums rise to a new record level

- But there may be light on the horizon as motorists paid just 1% extra in the first quarter of 2024

Long-term drivers have been hit with another car insurance premium increase this year, with the average driver now paying a record £635 for cover.

This is another record high and up from £627 in the last three months of 2023, according to the Association of British Insurers (ABI).

The high cost of car cover has led to charities warning MPs that some drivers are being forced into it choosing between buying food or insurance.

However, the 1 percent increase in the first quarter of 2024 gives motorists some hope that the worst is behind them when it comes to premium increases.

Insurers said damage costs, thefts and repair prices were behind the high car insurance premiums.

At stake: Motorists are being squeezed by car insurance increases they can’t avoid

ABI director of general insurance Mervyn Skeet said: ‘We understand that the cost of car insurance is putting pressure on household finances. These figures show how competitive the car market is, with insurers absorbing significant cost increases but keeping prices relatively stable.

“Even though these numbers show a slowdown in price increases, we won’t take our foot off the gas when it comes to our work to address the cost of coverage.”

The ABI also said that car insurers paid out £1.14 in claims and costs for every £1 collected in premiums, according to EY analysts.

However, these figures do not take into account the money insurers make from investments, a crucial income stream.

What now with car insurance premiums?

Premium increases for auto insurance may be slowing, but insurers are divided over whether prices will fall.

The ABI hinted that premiums could continue to rise, saying: ‘The latest quarter indicates that claims inflation has yet to stabilise, with the costs of repairs, replacement vehicles and theft all rising.’

But Britain’s largest insurance company, Admiral, said last month that premium prices may have peaked.

Admiral Chief Executive Milena Mondini de Focatiis said it has stopped increasing the cost of car coverage – and has even started cutting back on some costs.

Focatiis added: “There was a lot to recover from, but I think we are in a very different situation now.

“We remain vigilant… but we are not raising prices and are doing everything we can to be competitive.”

The ABI recommends that anyone struggling with the cost of their cover should contact their insurer.