Capita sells stake Defra joint venture Fera Science for £60m

- Bridgepoint Group will acquire Capita's 75% stake in Fera Science for £60 million

- Fera Science started in 2015 as a joint venture between Capita and DEFRA

- The divestment program is part of a turnaround led by CEO Jon Lewis

Capita has completed the strategic sale of all non-core assets by agreeing to divest its majority stake in Fera Science.

The outsourcing giant announced that private equity firm Bridgepoint Group will acquire its 75 percent stake in the research organization for £60 million.

Fera was established in 2015 as a joint venture between Capita and the Department of Environment, Food and Rural Affairs, which owns the remaining 25 percent stake in the company.

Takeover: Capita revealed that private equity firm Bridgepoint Group will acquire its 75 percent stake in research organization Fera Science for £60 million

It provides testing, research, advisory and assurance services to companies and government agencies involved in agricultural and environmental sciences.

The Yorkshire-based company, previously called the Food and Environment Research Agency, posted a turnover of £45 million and pre-tax profits of £3 million last year.

Capita plans to use the money from the sale of its stake in Fera to improve its balance sheet and investment plans.

Having just sold its travel and events businesses, Agiito and Evolvi, to Clarity Travel for £37m, Capita said the sale of Fera marks the completion of its 'non-core divestiture programme'.

The program is part of a turnaround plan led by CEO Jon Lewis to strengthen the company's balance sheet and reduce its high debt levels.

Lewis said: “We had previously announced our intention to sell our stake in Fera as part of our ongoing strategy to simplify and strengthen Capita.

“It was the right time to find a new partner who could build on the strong, successful foundations now in place at Fera, and take the company to the next phase of its development.”

Lewis will step down as boss later this year after six years in charge, having helped reduce the company's net debt from more than £1.1 billion to £166.2 million at the end of June during his tenure.

Capita has also repositioned itself towards providing services traditionally offered by the public sector and has become a more high-tech company.

In recent years the company has won contracts to provide training services to the Royal Navy, manage the Civil Service Pension Scheme and assist fraud victims on behalf of the City of London Police.

The company also won contract extensions to manage the London Congestion Charge and the ULEZ Low Emission Zone, manage the BBC licensing fees and provide primary care support services to NHS England.

Adolfo Hernandez, the vice president of global telecommunications for cloud computing platform Amazon Web Services, replaces Lewis as CEO.

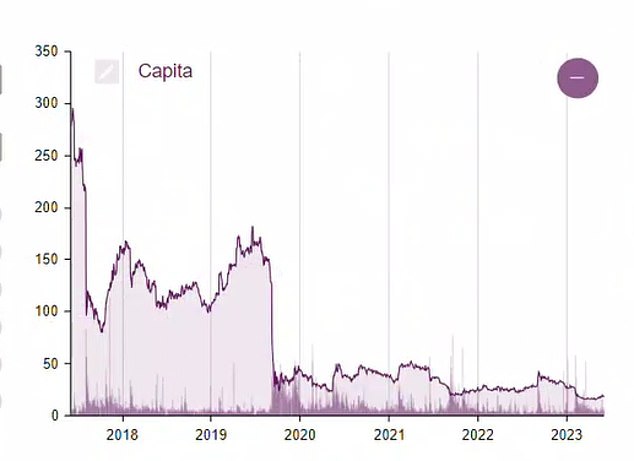

Capital shares were 3.9 percent higher at 20.8 pence on Monday morning, putting them among the top five gainers on the FTSE 250 Index, but are down around 17 percent since the start of the year.

Capita's share price remains well below pre-pandemic highs