California woman stunned to learn 35 strangers had been added to her Chase credit card

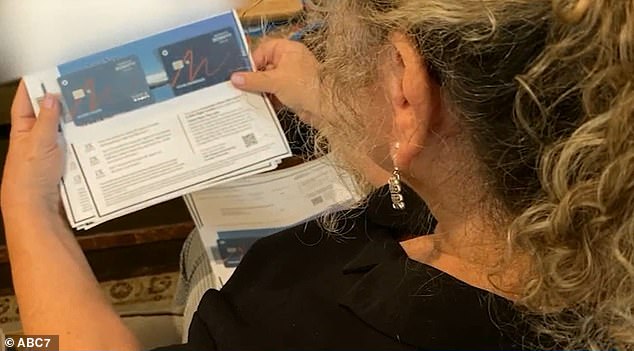

A California woman was shocked to discover that Chase Bank had allowed dozens of strangers to use her credit card without her knowledge.

Jodi Hayes of Walnut Creek was vacationing on a cruise ship when she and her husband received an “informed delivery” email from the U.S. Postal Service.

But the birth went differently than she expected.

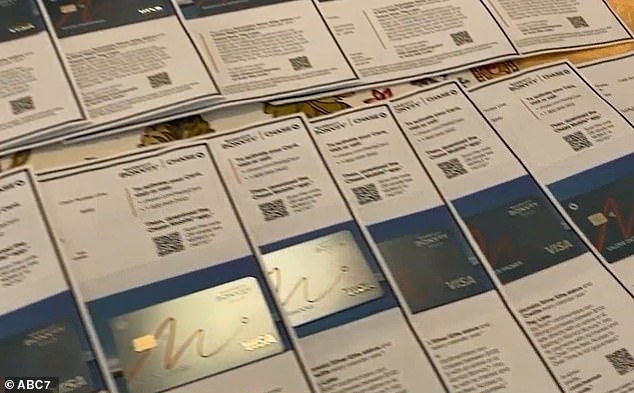

Thirty-five credit cards, all in other people’s names, were found in her mail, ABC 7 reported.

Worse, none of them were friends or family. They were names she had never heard before. These 35 authorized users had the power to load up to $19,000 onto her card.

Jodi Hayes of Walnut Creek, California, was shocked to discover that 35 people had been added as authorized users to her credit card while on vacation

Hayes called Chase Bank while still on a cruise ship to ask what had happened, but they seemed unconcerned about the incident and attributed the confusion to a glitch in their systems.

They could also use the card and get up to $950 in cash back.

“This fiasco ruined the end of our vacation,” Hayes told ABC 7.

Hayes and her husband were on vacation in August when they received the suspicious email. Hayes then decided to contact Chase Bank while still on the boat.

But she said Chase didn’t seem too concerned about the ordeal. In fact, she said they acted completely normal about the whole situation, attributing the confusion to their systems.

“They were just very basic – oh okay yeah. Maybe it’s a computer glitch. We’re going to stop,” she added.

Chase also put her in touch with the fraud department, who eventually called her when she returned from vacation.

Hayes assumed the department would ask her more questions about the people now authorized under her own credit card, and even hoped they would launch an investigation into what exactly had happened.

The authorized users under Hayes’ credit card had the authority to load $19,000 onto the card and use the card to obtain up to $950 in cash back

Hayes eventually received applications from a number of other banks, including Capital One, Discover and Citi Bank

But like Chase, she was also unhappy with the way the fraud department responded to the seriousness of the situation.

They didn’t give her any explanation and said, ‘We’ll sort it out, we’ll send you a new card and a new number,'” Hayes added.

Frustrated by the company’s responses, she called 7 On Your Side, an investigative division of ABC News.

Hayes then came into contact with the United States Postal Inspection Service.

“My initial reaction is that this looks like identity fraud,” U.S. Postal Inspector Matthew Norfleet told ABC 7.

“Search warrants, surveillance, grand jury subpoenas, these are all tools we use to investigate fraud schemes large and small,” he added.

As recently as April of this year, National Public Data, which collects data to conduct background checks, confirmed it had suffered a massive data breach that compromised Social Security numbers and a host of other personal information for millions of Americans, according to Today in the US.

The incident was first disclosed through a class action lawsuit filed in the U.S. District Court in Fort Lauderdale, Florida.

Then it was discovered that 2.9 billion records had been stolen from the National Public Data — records containing names, addresses, social security numbers and even relatives going back at least three decades.

But the plan was even bigger than it seemed. It didn’t just end with Chase.

Hayes received applications from nearly every bank, including Capital One, Discover and Citi Bank, ABC 7 reported.

Fortunately, all cards were declined due to insufficient credit history.

“All of these names are the same as some of the people on the credit cards that they sent. A lot of repeated names. Brittany Jackson, about four times,” Hayes added.

Chase put Hayes in touch with their fraud department, but their response did not satisfy her either. She hoped for an investigation, but instead they said they would send out a new card.

When she read out the names of the authorized users on her own credit card, none of the names sounded familiar until more and more requests started appearing and names started repeating themselves

Fortunately, Hayes had a safe on her mailbox, which made her mail and personal documents less vulnerable to crime and much safer than if they were left unlocked. Plus, they were delivered well-informed.

In a statement emailed to 7 On Your Side Investigates, a Chase spokesperson wrote, “We monitor customer accounts for suspicious activity and contact them immediately if anything unusual is detected.”

“In this case, our vigilant customer alerted us first. We closed the unauthorized cards, issued a new account and card, and apologized for the inconvenience she had experienced while on vacation.”

Hayes has blocked her credit card.

But the worst part is that the perpetrators can be anywhere: abroad or even nearby.

U.S. Postal Inspector Matthew Norfleet said the incident sounded like identity theft as soon as he heard about it. Pictured: JPMorganChase world headquarters

Luckily, Hayes has ‘informed delivery notifications’ – which let you know when mail is coming your way – and a safe on her mailbox, but the plan still ruined her holiday

“Once someone discovers a fraud scheme, they will repeat it as often as possible,” Norfleet adds.

He noted that using the mail to commit fraud is a criminal offense, punishable by up to 20 years.

If Hayes had never had a locker and ‘informed delivery’ – an alert that tells you when mail is coming your way – the situation could have been very different.

The U.S. Postal Service recommends both safety precautions and states that when traveling, it is always safer to have your mail held at the post office until you return home.

Ultimately, no mailbox is safe from attempted fraud.

“I have good credit, but I’ve never seen anything like this,” Hayes added.