Build more homes to lower rent, says Rightmove, as average renter pays £91 more per month than last year

According to property website Rightmove, rental prices have reached record highs again.

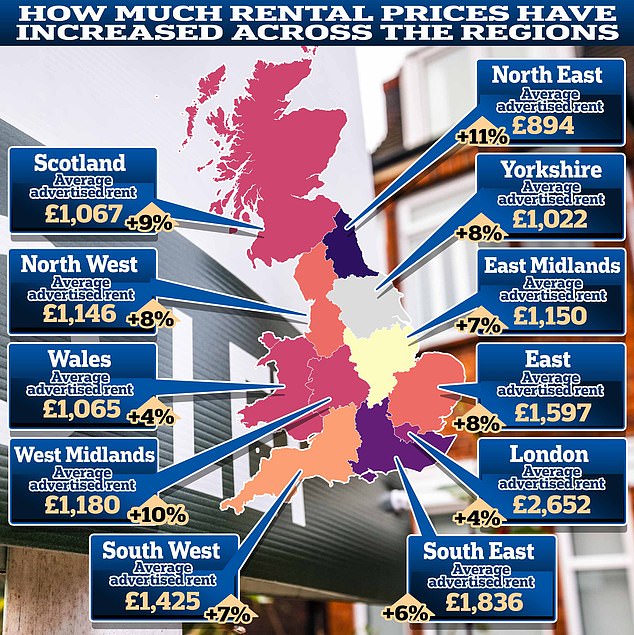

Outside London, the average advertised rent is £1,316 per calendar month. That’s £91 or 7 per cent more than a year ago, when the average rent was £1,225.

In the capital, average rents are now £2,652 per month, up £92 or 4 per cent from £2,560 a year ago. In percentage terms, it was the region with the smallest increase, along with Wales.

Rightmove is therefore calling on the next government to build more homes so that rent increases become ‘more sustainable’.

Supply and demand: Rightmove says an additional 120,000 rental properties are needed on the market to return rental growth to a more normal level of around 2% per year

Rents continue to rise, but the increase is slower as more homes become available, meaning landlords may be able to set rents more competitively.

Rents are rising less rapidly now than they were two years ago, when they were just 12 percent, but they are still higher than the normal level of around 2 percent per year before the pandemic.

According to Rightmove, there are still not enough homes to satisfy the number of tenants who want to move.

The analysis shows that 120,000 additional rental properties are needed to reduce rental growth to 2 percent per year, based on current demand.

Rents are rising the most in North East England

In some parts of the country, rents are rising faster, even by double digits in some regions.

In the North East of England, for example, the average rent has risen by 11 per cent compared to last year, from £808 a month to £894.

In the West Midlands, where the average rent is now £1,180 a month, rent has risen by 10 per cent compared to the same period last year, equating to a monthly increase of £109.

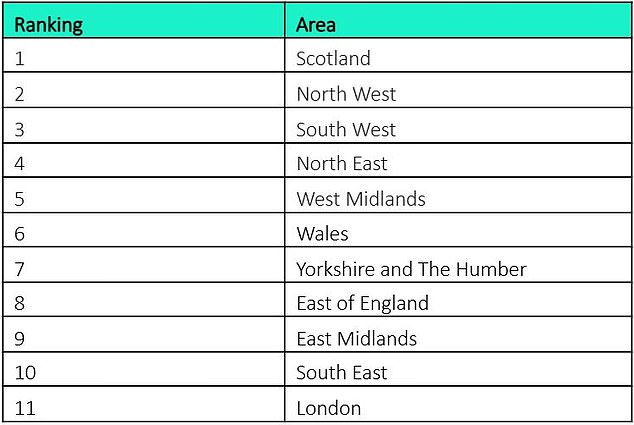

According to Rightmove, Scotland is currently hardest hit by the supply and demand imbalance, with renters competing fiercely for the limited supply.

Until recently, Scottish landlords were only allowed to increase rents on existing leases by up to 3 percent unless they obtained special permission.

However, as of March 31, the cap has been lifted and rental costs are back in the hands of landlords, 18 months after the first price freeze was introduced.

Despite the imposed rent controls, average advertised rents in Scotland have risen by 9 per cent compared to a year earlier.

Meanwhile, rents in London are now 4 percent higher than last year. This is also the case in Wales.

In London, rents rose in 2022 and 2023, but prices now appear to be cooling in most areas, thanks to a better balance between supply and demand in the capital.

Change of pace: London rents are now 4% above last year’s levels, now the joint smallest increase of all regions, after the biggest rise in the past two years

Next government ‘must build houses to lower rents’

Tim Bannister, property expert at Rightmove, believes the next government should streamline the planning process, speed up housebuilding and incentivise landlords to invest in more homes.

According to him, this would improve the balance between supply and demand on the rental market and ensure that rents no longer rise so sharply.

“We’ve been talking about the supply-demand imbalance in the rental market for a long time,” Bannister said. “It’s easy to forget that there was a time before the pandemic when rental growth was more stable.

‘The annual double-digit rent increases were not sustainable. While there has been some improvement in the supply-demand ratio, the 7 percent price growth indicates that we are still out of balance.

‘Our analysis shows that we need an additional 120,000 rental homes to achieve a more sustainable level of rental growth of around 2 percent per year.

‘The next government should prioritize improving the planning process, accelerating housing construction and stimulating more supply on the rental market.’

Biggest supply-demand imbalances

Nathan Emerson, chief executive of Propertymark, the estate agent membership organisation, agrees with Bannister.

He said: ‘Propertymark has long argued that the private rental sector needs more homes to stabilise rents, but there are numerous other factors that can help make the market more attractive to both investors and tenants.

‘With a general election coming up this week, we want the next government to reform the tax system so that more investors can be persuaded to invest in the private rental sector and rents for tenants can be reduced in the long term.

‘While we want a greater supply of housing, there must also be a sensible, feasible programme in which we protect the green belt where possible.

‘It would also be wise if they avoided rent controls, which have had a devastating effect on the private rented sector in Scotland’

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free. We do not write articles to promote products. We do not allow commercial relationships to influence our editorial independence.