Budget at a glance: 2p NI cut confirmed as Chancellor tackles child benefit tax trap

Chancellor Jeremy Hunt today presented a long-awaited Spring Budget, facing pressure to cut taxes and boost faltering public services.

The chancellor confirmed expectations of a 2p cut in national insurance and an extension of the fuel duty freeze, while also announcing plans to tackle the ‘unfairness’ of the so-called child benefit tax trap.

Hunt boasted of a ‘budget for growth’, which unveiled a new ‘public service productivity plan’, an additional boost in funding for several parts of the country and a shake-up of the Isa regime to encourage investment in UK assets .

He also introduced an excise duty on vaping products from 2026 and abolished the tax regime for holiday rentals and the exemption for multiple homes.

How the Budget Will Affect You – Essential Reading

> How much the 2p discount on National Insurance will save you

> The UK Isa is offering investors an extra £5k tax-free to boost the UK stock market

> How much does the fuel duty freeze save you – and how much petrol is taxed?

> No help to stimulate stagnant EV sales within the budget

> Budget increases high-income child benefit threshold to £60,000

> The annual stamp duty bill will rise by 74 per cent to £22.1 billion by 2029

> NS&I will launch British savings bonds in April

> Council tax will soon rise by £13 billion a year

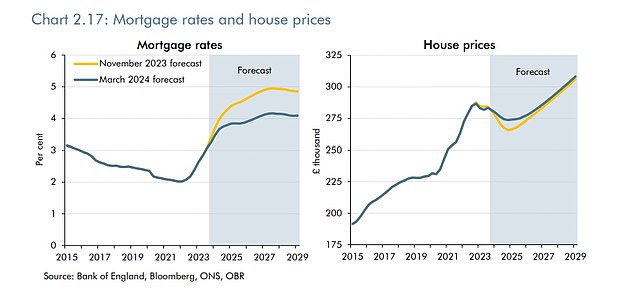

> Mortgage rates will peak at 4.2% – much lower than previously predicted

> Chancellor hands capital gains tax relief to landlords

> VAT threshold increased to £90,000, but small businesses are calling for more support

> Ten OBR forecasts to watch: from energy price jitters to inheritance tax gains

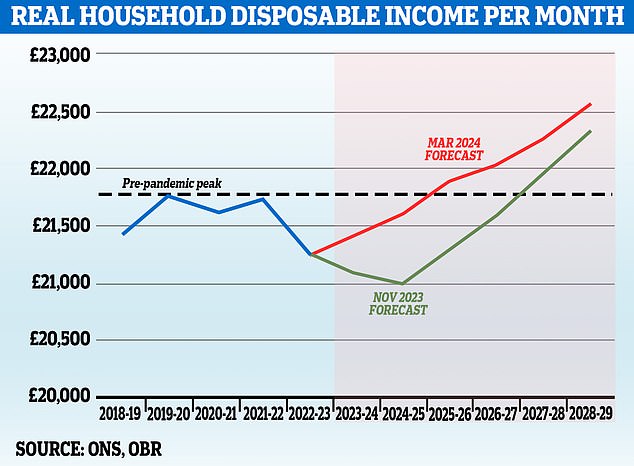

Pressure on incomes continues due to frozen tax thresholds, which have barely risen in the past five years. Meanwhile, inflation in the period since 2019 has been 22%

Personal tax

The Chancellor rejected calls for changes to inheritance tax and instead made widely expected changes to national insurance.

The NI rate for employees was reduced from 10 to 8 percent, while the NI rate for the self-employed was reduced from 8 to 6 percent.

The freeze on fuel duties was extended for 12 months, while a freeze on alcohol duties has been introduced until February 2025. From 2026, excise duties on vaping products must be paid.

The Chancellor has taken steps to “end the unfairness” over the child benefit tax trap, which will move to a household-based system. The threshold will move from £50,000 to £60,000, with the top band increasing to £80,000. Hunt said this will benefit 0.5 million families, saving an average of £1,300 from next year.

House prices are expected to tread water before rising sharply from 2025 onwards

Real estate tax

Both the holiday rental tax regime and the multi-occupancy exemption were abolished, but the higher capital gains tax rate for residential properties was reduced from 28 to 24 percent.

The so-called ‘non-dom’ tax system was replaced by a ‘modern, fairer and simpler’ residency-based system. If you’re still living in Britain after four years tax-free, you’ll pay tax at the same rate as British citizens – raising £2.7 billion by the end of the forecast period

Isas, dividend tax and capital gains tax

As part of efforts to boost investment in Britain, the Chancellor confirmed the launch of the ‘British Isa’. Brits will be able to invest £5,000 a year tax-free in UK assets

There were also some details of a shake-up for the pensions regulator and FCA, with a new requirement to disclose pension funds’ exposure to UK assets.

The government will also launch a new UK savings bond, with a fixed interest rate for three years

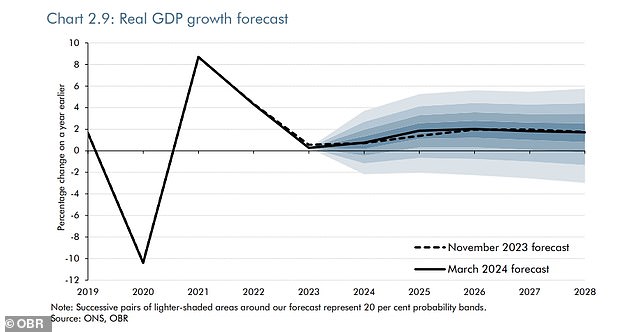

The OBR marginally raised its growth outlook for next year

Go for growth

The chancellor unveiled plans to help boost the economy, particularly his ‘public service productivity plan’, which includes a £4.3 billion NHS Workforce Plan.

He also outlined plans to decentralize spending to allow more budgetary power for local leaders, and an additional £100 million to increase funding for some areas.

Hunt highlighted new investment for the creative industries, with £26 million earmarked for the National Theatre, as well as measures to support the childcare sector, with rates increased for children over 9 months.

He pledged up to £120 million more for the Green Industries Growth Accelerator fund, and £270 million more for advanced manufacturing industries.

The chancellor also confirmed that the government’s remaining NatWest shares will be sold this summer

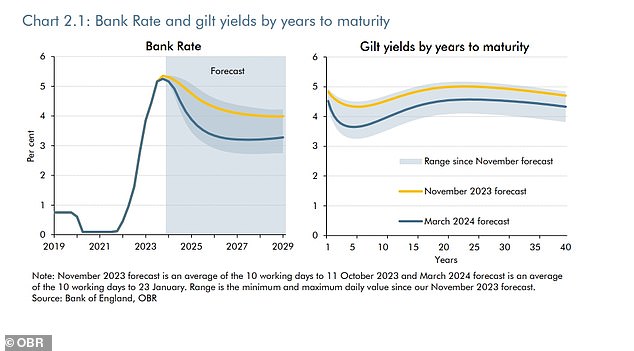

The Bank of England will cut interest rates this year

OBR predictions

Household real disposable income is likely to rise by 0.8 percent this year.

Borrowing will fall from 4.2 percent of GDP this year, to 3.1, 2.7, 2.3, 1.6 and 1.2 percent in the next five years.

GDP will grow by 0.8 percent this year and 0.9 percent next year, 0.5 percent higher than the autumn forecast

Company

There was good news for small business owners: the VAT registration threshold was increased from £85,000 to £90,000 from April 1. Hunt also unveiled a £200 million expansion to the recovery loan scheme, giving 11,000 SMEs access to finance

There was bad news for the energy companies, it was thought, when the energy profit tax expired until 2029.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.