Bonus time for the city! Bankers will receive a £2 billion commission bonanza after a big year of British takeovers

Bankers are set to see a £2 billion bonanza after a year of frenzied takeover activity.

According to data from Dealogic, the value of mergers and acquisitions involving UK companies has increased by 36 percent this year to £250 billion.

And the fees earned by the investment bankers working on the deals rose 19 per cent to £2.1 billion – the highest level since 2021.

Accountants, lawyers and other advisers are also expected to have received huge payouts after a wave of takeovers.

Some of the biggest deals this year include the £5.4 billion purchase of Hargreaves Lansdown by private equity giant CVC, the sale of Britvic to Carlsberg for £3.3 billion, and the £2.9 billion buyout of Virgin Money by Nationwide.

Others include Aviva’s £3.7 billion takeover of Direct Line, although mining giant BHP failed in its £39 billion bid for Anglo American.

Takeover bonanza: A wave of buyouts and mergers has hit the city this year

Advisors typically share fees between 1 and 5 percent of the acquisition value, with bankers taking the lion’s share.

Dan Coatsworth, investment analyst at AJ Bell, said a banner year would be “music to the ears of investment bankers” and other advisers.

Among those hitting the jackpot are advisers working on billionaire tycoon Daniel Kretinsky’s £3.6 billion takeover of Royal Mail owner International Distribution Services (IDS).

Deal documents show bankers, lawyers and others will share £146 million – 4 percent of the price. Among those making money is former Labor frontman Chuka Umunna, who now works for JP Morgan and advises Kretinsky.

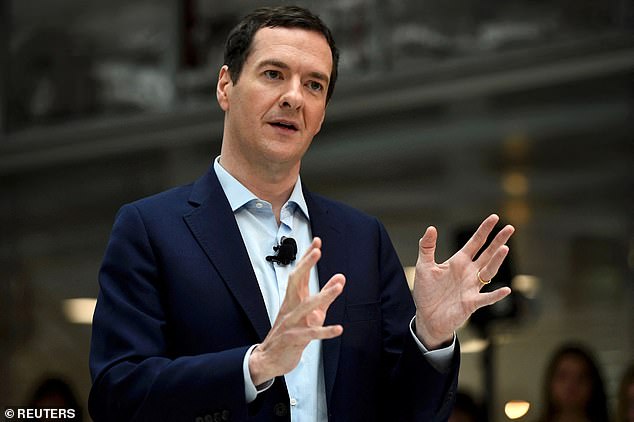

From chancellor to banker: George Osborne now works for Robey Warshaw

George Osborne is another former politician who has benefited from the takeover frenzy.

The former chancellor now works for boutique investment bank Robey Warshaw and was one of four partners to share a £70m payday this year.

Robey is advising Direct Line on the deal with Aviva, after defending the company against a takeover by Belgian Ageas earlier this year.

The investment bank, where Osborne has worked since 2021, also advised video games company Keyword Studios when it was bought by private equity group EQT for £2 billion.

Bankers are also in the money at Goldman Sachs, which, according to LSEG, advised on more takeovers involving British companies than any other bank in the first nine months of the year.

Lucille Jones, senior manager at LSEG, said the increase in activity was “driven by mega deals as foreign buyers and private equity made moves.”

Coatsworth said: ‘There has been a lot of action in the large and mid-cap sector – it’s music to the ears of bankers and legal advisers when they collect a fee based on the size of the deal. Britain is on sale.”

DIY INVESTMENT PLATFORMS

A. J. Bell

A. J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

Sax

Sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.