BlackRock says Labour will boost UK stocks – and these funds could benefit

Analysts at US investment giant BlackRock expect British shares to outperform as foreign investors are attracted by “relative political stability”.

The BlackRock Investment Institute has taken an “overweight” position in London-listed stocks this week, arguing that a new government with a significant majority will encourage investors to see “attractive valuations”.

But BII expects a busy election year to not produce a groundswell of excitement worldwide. Troubled waters are forecast for fish stocks in the US and France.

A boost for the City as BII predicts London-listed stocks will outperform

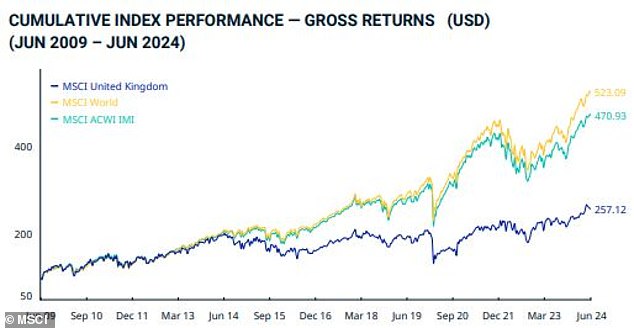

UK stocks have increasingly been seen as cheap in recent years as they continue to underperform their peers. Many international investors are deterred by uncertainty over the future direction of policy following the Brexit referendum and various changes in the role of Prime Minister.

The MSCI UK index, which measures the performance of the large and mid-sized segments of the British market, has risen by 6.94, 5.74 and 2.7 percent over three, five and 10 years respectively.

The MSCI World rose by 7.38, 12.32 and 9.73 percent respectively over the same period.

London-listed stocks lag their international peers

Data shows the gap between the performance of smaller UK companies and that of their international competitors is even wider.

The MSCI UK Small Cap index has fallen by 2.67 percent over three years, while it has risen by only 1.97 and 5.03 percent over three and ten years respectively.

International small-cap competitors saw their returns increase by 2.15, 7.5 and 10.04 percent respectively over a period of three, five and ten years.

However, BlackRock II believes the outcome of last week’s general election could mark a turning point in perceptions of London-listed stocks.

It said: ‘Political stability and improving growth could improve investor sentiment, raising the UK’s low valuation relative to other (developed market) stock markets.’

BII has previously said UK markets could benefit from a Labour leadership willing to “promote a more cooperative relationship with the EU, including closer defence cooperation, given the war in Ukraine”.

“And targeted trade agreements can benefit key sectors such as energy and chemicals,” it added.

‘Improved EU relations could reduce market uncertainty, boost foreign investment and improve the UK’s growth prospects.’

BII compared this to election years in the US, where “no candidate or major party… has made debt and deficits a major campaign issue, nor has France.”

Chairman Tom Donilon said: ‘We believe the unprecedented political stalemate in France following the parliamentary elections and the weak financial outlook will lead to increased investor attention.

‘Global elections are adding to the geopolitical volatility we are seeing. This is a challenging time for incumbent politicians.’

Liontrust boss John Ions expects greater political stability to be good for UK stocks. The market has been loath to embrace this stability, which has taken a toll on the UK asset management industry.

However, Goldman Sachs Asset Management said on Wednesday that the new administration is unlikely to be the main driver of stock price movements in the near future.

It said: ‘Labour’s manifesto policies imply relatively limited changes to fiscal policy.

‘The new government is expected to announce more details of its policy agenda, including on spending and taxes, in the coming weeks and months.

‘We expect investors to remain focused on the progress of disinflation and the possibility of rate cuts by the BoE.’

Funds to support UK stock recovery

Darius McDermott, Managing Director of FundCalibre, said: ‘While we still have a long way to go, business and market leaders have largely accepted the new Labour government as a welcome change, bringing a more stable political environment (particularly compared to other parts of the developed world).

‘This renewed stability, combined with attractive valuations, easing macro headwinds and falling interest rates, positions the UK for a potential recovery.

‘Investors looking to capitalise on this upturn may find value in UK-focused investment funds.’

Two funds that McDermott believes can make a profit are:

Schroder British Opportunities Trust (SBO)

After a long period in the eye of the storm, small caps are starting to recover somewhat. Combined with increased M&A activity and attractive valuations, they could now present an incredibly attractive opportunity.

SBO provides exposure to resilient small and medium-sized enterprises in the UK, with a focus on undervalued companies with growth potential.

Schroders’ research expertise enables them to identify the very best opportunities across both public and private markets, making it a truly unique offering.

Fidelity Special Values (FSV)

Another interesting option is FSV, a trust managed by Alex Wright, who has a proven track record in identifying undervalued UK mid-sized and large companies.

While generating revenue is not a priority for the foundation, the dividend has steadily increased since Wright took over in 2012.

This trust is aimed at investors looking for a value investment in the UK market with a medium to long term investment horizon.

Tom Stevenson, investment director at Fidelity International, said: ‘The outlook for the UK stock market is better than it has been for a long time. A focus on investment, economic growth and improving productivity would provide a solid backdrop for a market that is cheap by historical standards and offers investors a good combination of growth and income.

‘A government with a ten-year programme for change is unlikely to take stupid risks in the short term.’

He says Fidelity’s Select 50 contains different funds that focus on the UK, including:

FTF Martin Currie UK Equity Income Fund

Stevenson says: ‘FTF Martin Currie UK Equity Income Fund is an actively managed fund, which aims to provide an income in excess of the FTSE All-Share Index. Its main holdings are dividend-paying stocks such as Shell, BP, Unilever, AstraZeneca and GSK, Rio Tinto, British American Tobacco and National Grid.’

Stevenson says: Liontrust UK Growth Fund is an actively managed fund that aims to identify companies with intangible assets or other sustainable competitive advantages. It invests at least 90% in companies that are founded, based or do significant business in the UK. Top holdings include Shell, AstraZeneca, BP, Unilever, GSK, Diageo, RELX and Compass Group. The fund’s approach has a ‘quality’ bias, meaning it buys companies that are typically more expensive than others but have excellent characteristics, such as the returns they squeeze out of capital.

Stevenson says: ‘Vanguard FTSE 250 ETF is a passively managed fund that tracks the performance of the FTSE 250 Index and invests in mid-sized UK companies. The top 10 holdings include easyJet, British Land, Greencoat UK Wind and Bellway. This could be a suitable addition for those who want exposure to mid-sized UK companies, have a long-term horizon and are cost-conscious.’

DIY INVESTMENT PLATFORMS

AJ-Bel

AJ-Bel

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive investor

interactive investor

Fixed investment costs from £4.99 per month

eToro

eToro

Stock Investing: 30+ Million Community

Trading 212

Trading 212

Free stock trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals are chosen by our editorial team because we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free. We do not write articles to promote products. We do not allow commercial relationships to influence our editorial independence.