Bitcoin spikes to $48k on back of FAKE tweet from SEC stating the crypto ETFs had been approved – but drops to low of day after hack emerges

Bitcoin rose to nearly $48,000 on Tuesday after a fake tweet from the U.S. Securities and Exchange Commission said it had approved spot Bitcoin exchange-traded funds.

The fake tweet, published on

Fifteen minutes later, Gary Gensler, head of the SEC, tweeted from his own account: “The SECGov account was compromised and an unauthorized tweet was posted. The SEC has not approved the listing and trading of spot-traded bitcoin products.”

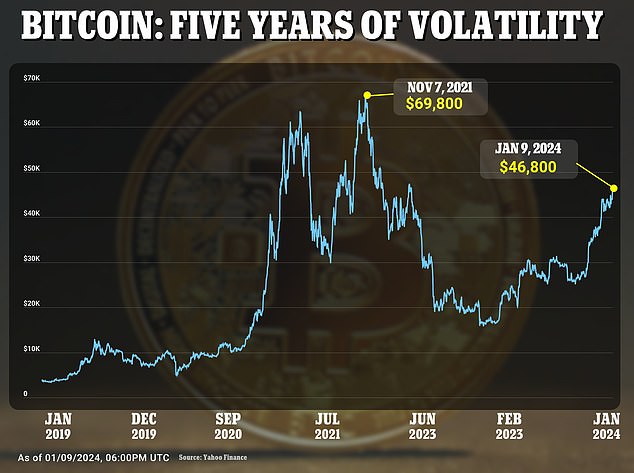

The token temporarily jumped to its highest level since March 2022. Its all-time high, just below $70,000, was in November 2021. Soon after, it retreated to below $46,000 – below the level where it had been for much of the day had rocked.

The tweet, published at 4:11 p.m., came from the SEC’s official account

At 4:26 p.m., SEC Chairman Gary Gensler posted his own tweet suggesting that the official SEC account had been “compromised.”

The token had retreated to just over $46,500 by Tuesday afternoon, but this week is at its highest level since March 2022. The all-time high of just under $70,000 was in November 2021.

Questions immediately arose about who was behind such a ‘compromise’ and who would benefit from it.

Gensler’s tweet was flooded with comments from users about how the US financial regulator couldn’t have better security on his social media channels since his tweets can move the markets dramatically.

It is possible that the account was hacked in an attempt to drive up the price. Experts have suggested that if coins were sold at the peak, significant profits could be made.

Accounts for

But experts point out that hackers can get around this – by gaining access to the phone or email, or by blackmailing someone who has access.

Bitcoin was up nearly 10 percent on Monday to above $47,000, as investors grow increasingly optimistic that the U.S. Securities and Exchange Commission (SEC) will approve a spot Bitcoin ETF.

It comes as regulators face a deadline on Wednesday to approve one of about a dozen pending applications from asset managers for a Bitcoin ETF – a fund that would behave like a stock and roughly track the value of the cryptocurrency.

Standard Chartered Bank’s head of financial research Geoffrey Kendrick told investors in a note this week that approval was imminent and “most likely” on January 10.

About 10 asset managers are processing applications for a Bitcoin ETF. The SEC must make a decision on at least one decision by Wednesday. Pictured is the SEC headquarters in Washington, DC

Major investment firms, including BlackRock and Fidelity, have applied to operate Bitcoin ETFs, but the US Securities and Exchange Commission (SEC) has yet to allow them

Should approval occur, he predicted Bitcoin could reach $200,000 by the end of 2025.

“We see this as an inflection point for normalizing participation in bitcoin by institutional money, and we expect approval to drive significant inflows and price appreciation for BTC,” Kendrick wrote.

Standard Chartered also predicts that between $50 billion and $100 billion will be invested in US spot bitcoin ETFs by the end of this year.

To justify the position that ETF approval will result in significant cash inflows into bitcoin, Kendrick referenced investing in golf following the approval of a gold ETF in 2004.

Within a decade, the price of gold rose by more than four, he pointed out in the note.

‘We use this 4.3x price increase as our base case for bitcoin, but we expect BTC’s gains to occur over a shorter period of one to two years as we expect the BTC ETF market to mature more quickly .’

But Gilles Ubaghs, strategic advisor in commercial banking and payments at Datos Insights, told DailyMail.com last year that investors should be cautious.

Ubaghs noted that bitcoin was not particularly valuable as an actual currency and questioned its ability to hold value in the long term.

“It’s complicated, difficult to issue and pay out, it has a bad reputation, and most importantly, it’s so volatile,” he said.

Nevertheless, he acknowledged that while it has limited practical use for making payments, it does function as a “digital asset” that can have a value comparable to that of gold or fine wines.

“While Bitcoin is a fairly weak means of payment, it is ultimately unlikely to disappear anytime soon,” Ubagh wrote.