Bitcoin falls 4.7% as tensions in West Asia lead to caution in markets

A 50-day correlation coefficient for a measure of the top 100 digital tokens and the MSCI Inc. global stock index. amounts to 0.65. | Photo: Shutterstock

Bitcoin speculators banking on a seasonal melt-up in October faced an early reality check as rising tension in the Middle East led to caution in global markets.

The digital asset fell 4.7 percent on Tuesday, the most in almost a month, after Iran fired about 200 ballistic missiles at Israel in a sharp but brief escalation of hostilities between the two adversaries. The token pared some of the decline on Wednesday, changing hands around $61,260 as of 7:43 a.m. in New York.

Click here to contact us via WhatsApp

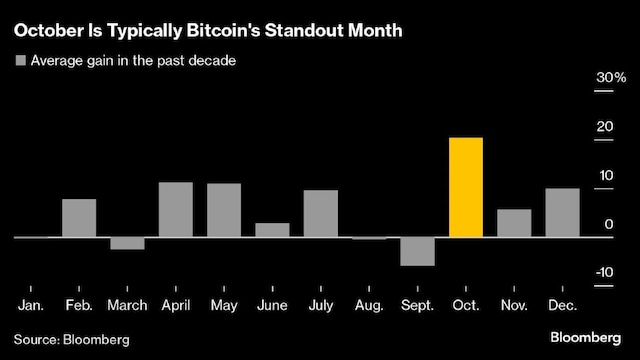

Bitcoin fell about 4 percent in the first two days of October, a contrast with the average gain of 20 percent for the month as a whole over the past decade, according to data compiled by Bloomberg. That historic pattern raised hopes of a rise past March’s record high of $73,798, until perhaps the biggest geopolitical rift in global markets poured some cold water on the optimists.

Sean McNulty, trading director at liquidity provider Arbelos Markets, argued that the sell-off is a “temporary setback” as the Federal Reserve has started cutting interest rates. The administration that emerges after the US presidential election in November will also likely be friendlier to crypto, he said.

“The seasonal trend of October being the best month for Bitcoin is alive and well,” McNulty added.

For now, markets are on alert for an intensification of the conflict as they rebuff Israeli Prime Minister Benjamin Netanyahu’s promise to retaliate against Iran’s attacks. U.S. stock futures fell on Wednesday, while oil prices rose on supply fears.

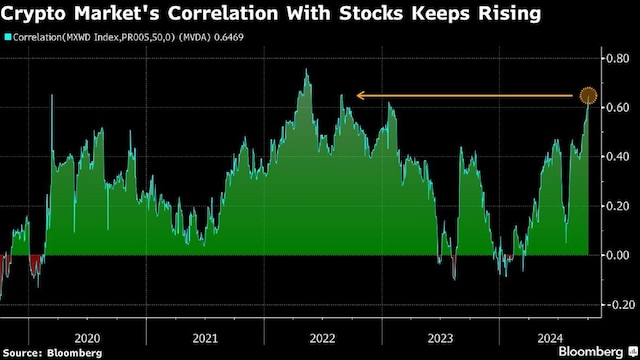

Digital assets have been moving more in tandem with stocks lately, suggesting that macroeconomic factors such as monetary policy are critical to Bitcoin right now.

A 50-day correlation coefficient for a measure of the top 100 digital tokens and the MSCI Inc. global stock index. is 0.65, the highest since 2022, according to data compiled by Bloomberg. A value of 1 indicates that the assets are moving in the same direction, while minus 1 indicates reverse equality.

“The geopolitical environment does not seem conducive to risky assets,” said Caroline Mauron, co-founder of Orbit Markets, a liquidity provider for digital asset derivatives trading.

First publication: Oct 02, 2024 | 11:43 PM IST