Billionaire CEO Larry Fink says retirement age of 65 is too low amid growing fears longer life expectancies could lead to collapse of Social Security

Americans should continue working past age 65 – to prevent the Social Security system from collapsing.

That’s one of two options to avoid a “pension crisis” in the US, according to billionaire Larry Fink – the boss of the world’s largest fund manager Blackrock.

‘No one should have to work longer than they want. But I find it a bit strange that our anchor idea for the correct retirement age – 65 years – dates back to the time of the Ottoman Empire,” Fink wrote in his 2024 letter to shareholders.

He points out that in the 1950s, very few workers could actually retire at age 65 and claim a pension – because they had already died. Life expectancy was much lower.

“Today, these demographics have been completely unraveled, and this unraveling is obviously a wonderful thing,” Fink added. ‘We would like more people to live longer. But we cannot overlook the enormous impact on the country’s pension system.”

Larry Fink, boss of the world’s largest money manager Blackrock, thinks Americans may have to work when they’re over 65

Nearly half of Americans aged 55 to 65 reported not having a single dollar saved in their personal retirement account

He added: ‘As a society we spend a huge amount of energy helping people live longer.

“But not even a fraction of that effort is spent helping people afford those extra years.”

He cited figures showing that one in six people will be over 65 by mid-century, compared to one in 11 in 2019.

Fink said U.S. Census Bureau data on consumer finances in 2022 showed that nearly half of Americans ages 55 to 65 reported not having a single dollar saved in personal retirement accounts.

Social security already constitutes the largest share of government expenditure.

The future of social security is already under discussion. Within a decade, it will face a funding shortfall as the increase in the number of retiring boomers is not offset by new, younger workers paying into the system.

Fink’s second solution to averting the pension crisis is for Americans to invest more in their personal retirement plans – by strengthening their 401(k)s and IRAs – to reduce their dependence on federal funds.

A third option is one proposed not by Fink, but by someone on the other end of the polite spectrum: Senator Bernie Saunders. The far-left Democrat wants to eliminate the income tax for social security.

For 2024, income above $168,600 is exempt from the 12.4 percent Social Security tax.

It means those who receive $1 million a year will essentially stop paying on March 2, CBS Money Watch reports. Fink takes home about $25 million annually in salary, benefits and bonuses.

The Old Age and Survivors Insurance Trust Fund, one of the funds that pays Social Security, won’t be able to make full payments until 2033.

A pension expert says that Fink is right when he says that there are problems with the pension system in America, but that working longer misses the point.

Teresa Ghilarducci told CBS MoneyWatch: “After a forty-year experiment with a voluntary, do-it-yourself retirement system, half of workers have no easy way to save for retirement.

“And why is the age of 65 in rich countries not a good target for most workers to stop working for someone else?”

She added: ‘Working longer won’t get us out of this. Most people don’t retire when they want to anyway.’

Fink and Blackrock have a financial interest in raising the issue. The asset manager will launch a product next month to tackle this problem.

The ‘LifePath Paycheck’ will go live in April and 14 pension plan sponsors aim to make it available to 500,000 employees in the form of defined contribution plans.

BlackRock, which had more than $10 trillion in assets under management at the end of last year, oversees the largest pension funds in the US.

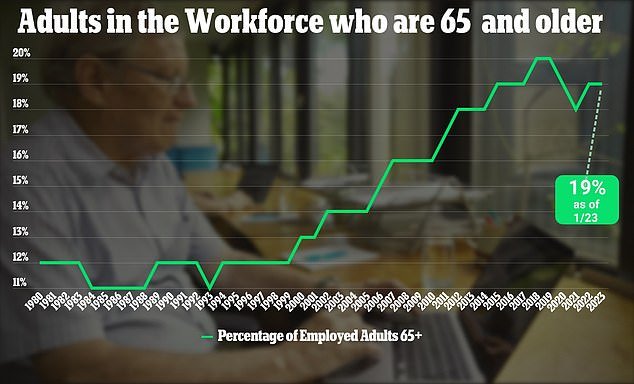

The number of Americans who have worked in recent years has doubled in the past thirty years

Joyce Fleming (pictured, right) had to return to work after her retirement due to the rising cost of living

Fink said U.S. Census Bureau data on consumer finances in 2022 showed that nearly half of Americans ages 55 to 65 reported not having a single dollar saved in personal retirement accounts.

Millions of older Americans are already going back to work to pay the bills after rising prices ate away at retirement savings.

When Joyce Fleming retired in 2019, she thought she was done working.

But just a few years later, the rising cost of living has sent the 70-year-old nurse back to work to make ends meet.

The price of daily necessities, car ownership, insurance and housing have soared in recent years, driven by rampant inflation.