Big business backs Britain… but global recession now looms

>

Bosses back Britain: UK voted 3rd most attractive place in the world to grow a business… but global recession now looms

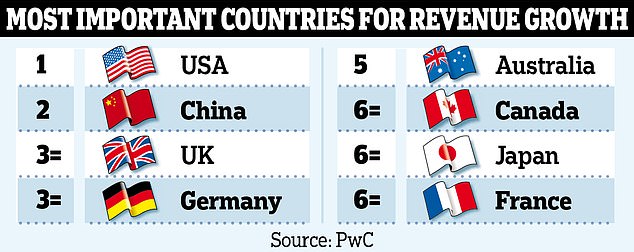

Britain has overtaken Germany to be named the third most attractive place in the world to grow a business.

In a global survey of chief executives on top countries for revenue growth, the United Kingdom tied with its European ally for the first time in the report’s 26 years.

Only the US and China scored higher in the poll polling giant PwC, which was released at the start of the World Economic Forum’s (WEF) annual meeting of global business and political leaders in Davos, Switzerland.

The UK tied Germany in a global survey of chief executives on top countries for revenue growth, published at the start of the World Economic Forum in Davos

But in a sign of the ongoing economic crisis, 40 per cent of UK bosses said they have already started cutting jobs or will consider doing so in the next 12 months.

And a separate WEF survey found that nearly two-thirds of chief economists at large organizations predict a global recession this year.

However, most also expected the cost of living of abusive businesses and households to become less severe by the end of 2023.

The findings come as economies worldwide are suffering the fallout from the war in Ukraine, which has driven up energy and food prices, prompting central banks to hike interest rates sharply.

Amid the turmoil, the PwC survey suggests that the UK’s relative attractiveness has improved. It was fourth last year behind Germany in third.

Kevin Ellis, chairman and senior partner at PwC UK, said: ‘Chief executives don’t expand and invest on a whim – they choose the UK because that’s where they expect returns.

That choice will be based on the industry’s strengths in areas such as AI [artificial intelligence] and biotech, in addition to our people-oriented, business-friendly environment.’

The boost for the UK defies fears that the political unrest culminating in September’s disastrous mini-budget has damaged investor confidence.

Bank of England Governor Andrew Bailey has said the event damaged Britain’s reputation abroad. Still, the pound’s weakness makes British assets look cheap to foreign investors.

At the same time, Germany’s industry-heavy economy is being ravaged by Russia cutting off its gas supply. But there is more work to be done to strengthen Britain’s position, Ellis said.

“To keep the UK attractive, we need a renewed focus on skills and regional growth – both of which will help unlock productivity,” he said.

The survey of 4,410 CEOs in 105 countries also found that many are concerned that they need radical changes to survive.

It found that 39 percent believed their business will not be economically viable within a decade unless they change course.

British bosses are slightly less concerned, but 22 percent still share that feeling. Ellis said: “Companies have already undergone massive changes this decade, with hybrid working and cloud computing being one of the big shifts.

“But this is the tip of the iceberg. Many CEOs believe that their current business models are unsustainable and that this means more change lies ahead.

This is not about tinkering, but about fundamental changes that require major investments in people, skills and technology.’

The PwC survey also found that 73 percent of bosses believe world economic growth will slow over the next 12 months, the most pessimistic since the survey began 12 years ago.

It is a significant departure from 2021 and 2022, when about three-quarters thought growth would improve.

The WEF’s separate global poll of chief economists found that 63 percent believe a global recession is likely, but 68 percent expect the cost of living to peak.

Saadia Zahidi, managing director of the WEF, said: “With two-thirds of chief economists expecting a global recession in 2023, the global economy is in a precarious position.”