Big banks predict junk food giants to lose BILLIONS over next decade as Wegovy and Ozempic sap nation’s sweet tooth

The rise of weight-loss drugs is not only shrinking America’s waistline, but it could also shrink food companies’ profits.

Some experts predict that junk food companies — already grappling with a rise in health-conscious customers — could face a tobacco downfall due to drugs like Ozempic and Wegovy, which reduce cravings and help people feel full longer.

Major banks, such as Morgan Stanley, predict that by 2035, 24 million people, or seven percent of the US population, will use weight-loss drugs.

An analysis by the bank also predicts that patients prescribed the drugs will consume a quarter of the sweets, confectionery and other junk food they used to eat – saving billions of dollars in annual revenue.

And companies are already afraid. A recent analysis shows that executives at junk food companies are increasingly talking to investors about the drugs.

A Morgan Stanley survey found that 73 percent of people ate fewer confectionery products, including sugary sweets, chocolate and some pastries

Like snack makers, major players in the fast-food industry such as McDonald’s, Burger King and Yum Brands, owner of KFC and Taco Bell, could also see declining demand.

Morgan Stanley’s food analyst Pamela Kaufman said in a report: “The food, beverage and restaurant industries could see weaker demand, especially for unhealthier foods and high-fat, sweet and salty options.”

The new class of drugs could lead to a 20 to 30 percent reduction in daily calories, and people tend to eat fewer foods high in sugar and fat, meaning the makers of chips, cookies and pastries could take a hit , where the banks A decline in consumption is predicted by as much as three percent until 2035.

Although any negative consequences are likely to occur gradually, investors and top executives are already starting to worry.

Reuters Breakingviews searched the transcripts of company presentations, events and earnings calls, a conference between a company’s management, financial analysts, media and investors.

In 2022, 18 mentions of Wegovy, Ozempic and Mounjaro were found. So far in 2023, at least one of these drugs has been mentioned 71 times in calls.

Research from Morgan Stanley found that 73 percent of people taking the weight-loss drugs ate fewer sweets, including sugary sweets, chocolate and some pastries.

Seventy percent of people consumed fewer sugary drinks; 69 percent ate fewer cookies; and 67 percent reached for less salty snacks.

These drastic cuts could spell trouble for the mega-producers of these foods, including Cadbury and Oreo maker Mondelez International, Nestle, which makes Hot Pockets and Häagen-Dazs, and Kraft Heinz, which makes products like Jell-O and Kraft Mac. and cheese.

These companies dominate the global snack food market, currently valued at half a trillion dollars, and they must brace for declining demand.

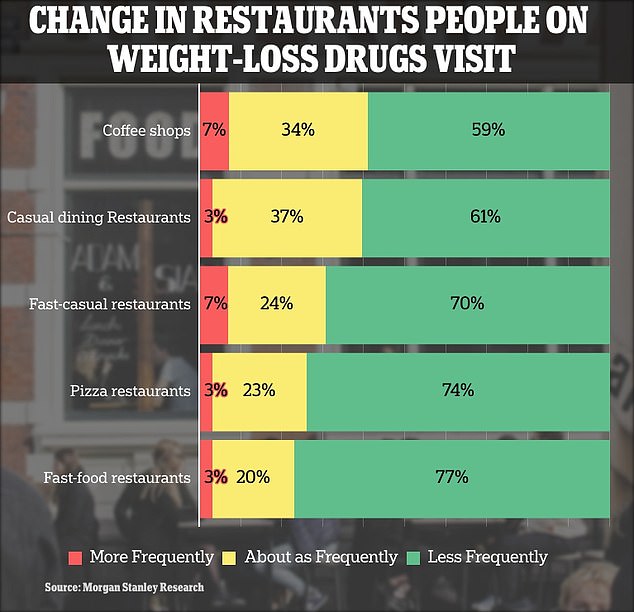

The catering industry is also taking a hit. The same study found that 77 percent of people taking weight-loss drugs went to fast-food restaurants less often and 74 percent ate less at pizzerias.

Like snack makers, major players in the fast-food industry such as McDonald’s, Burger King and Yum Brands, owner of KFC and Taco Bell, could see declining demand, with analysts predicting a one to two percent drop in sales by 2035.

While two percent may not seem like much, it amounts to almost $7 billion.

Alcohol will also take a hit from the rise in weight loss prescriptions. Two-thirds of Americans taking these medications report consuming less alcohol and nearly a quarter have stopped drinking alcohol altogether.

Banking analysts predicted that US-focused alcohol companies are most at risk and can expect a two percent decline in consumption by 2035.

The implications of the approval and popularity of weight-loss drugs extend beyond the food and beverage industry.

Financial analysts also predict that companies that make products to treat conditions resulting from obesity could also take a hit.

Companies that make products for sleep apnea, a condition in which patients occasionally stop breathing during sleep, will likely see a decline in value because about 70 percent of patients are obese.

Additionally, companies that sell joint replacements can also expect their valuations to decline.

And rival weight-loss companies, such as WW International, formerly known as Weight Watchers, have seen their shares plummet by about 70 percent since Wegovy was approved in June 2021. Jenny Craig, a similar company, closed in May after more than 40 years. years due to increasing competition from weight loss drugs.