Biden will urge Congress to give $10,000 to first-time homebuyers and $25,000 to help with down payments

- President Joe Biden will urge Congress to provide relief by injecting the housing market with more first-time homebuyers

- He will ask Congress to encourage young families to leave their starter homes by offering a one-year credit of up to $10,000.

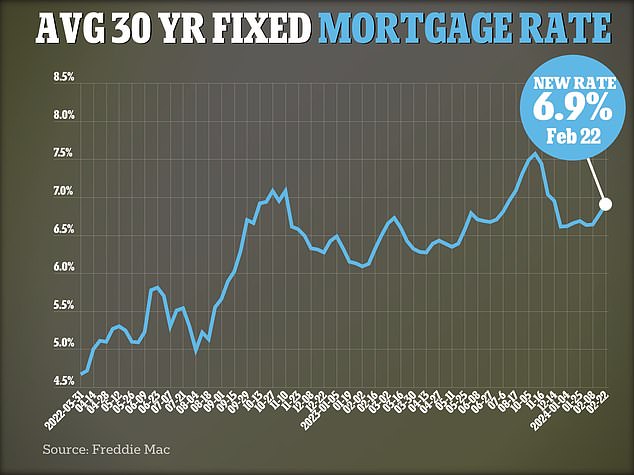

- Come amid rising mortgage rates and high home prices in the US

President Joe Biden is preparing for a massive housing initiative as more young adults say they can’t afford to buy their first home.

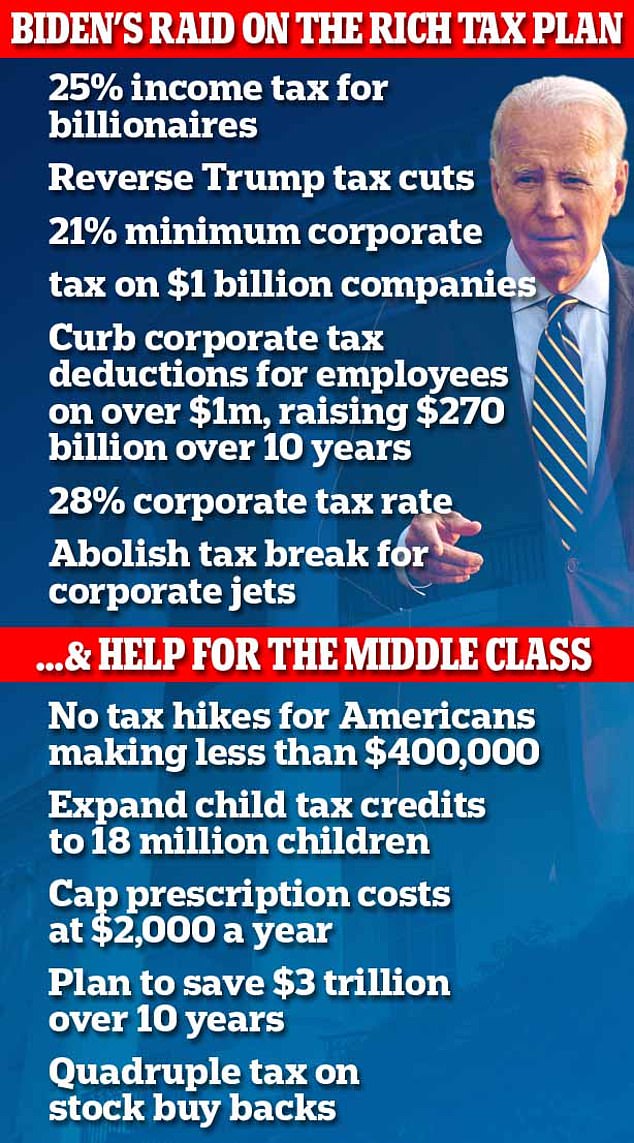

Amid record high inflation and rising mortgage rates, Biden will push Congress to lower mortgage rates by offering first-time homebuyers a $5,000 credit each year for the first two years of home ownership, amounting to a total of $10,000.

The White House says this amounts to essentially cutting 1.5 percent of homeowners’ interest rates on the average U.S. home.

In a series of proposals in his State of the Union address on Thursday evening, Biden will urge Congress to help free up some of the housing market by offering a one-year credit of up to $10,000 to families selling their starter homes .

The average mortgage rate for a $300,000 loan is 7.9 percent for a 30-year fixed term. Meanwhile, the average cost of a home in the US is more than $400,000.

President Joe Biden will push Congress to pass massive stimulus measures to try to provide relief by injecting the housing market with more first-time homebuyers and encouraging families to move out of their starter homes.

Inflation saw huge spikes after the pandemic. Last month it approached 7 percent and as of March 7 it is 7.9 percent for a 30-year fixed mortgage for a $300,000 loan. The average cost of a house is more than € 400,000

A fact sheet from the White House about the proposals reads: “President Biden believes that housing costs are too high and that significant investments are needed to address the large affordable housing shortage that he inherited from his predecessor and that has been growing for more than a decade. ‘

“During his State of the Union address, President Biden will call on Republicans in Congress to end years of inaction and pass legislation to lower costs by providing a $10,000 tax credit to first-time homebuyers and people who are selling their starter home; build and renovate more than 2 million homes; and lower rental costs,” the release adds.

Due to rising housing costs and higher interest rates in recent years, first-time buyers and young families are finding it more difficult than ever to purchase their first or second home.

Biden has previously called on Congress to provide $25,000 down payment assistance to first-generation homebuyers. He will repeat this push during his State of the Union address to a joint session of Congress.

In addition, Biden wants relief for renters and will ask Congress to look at expanding the tax credit for low incomes. The president plans to unveil a $20 billion grant fund in his budget released later this month to support the construction of affordable multifamily housing.

While Congress may not act on this, Biden can take some unilateral actions to address housing problems.

Biden wants to encourage starters on the housing market, families with starter homes and first-generation home buyers to move into a (new) home with rising costs and interest rates. Pictured: A home for sale in Austin, Texas on February 21, 2024

However, the White House has faced criticism for not being aggressive enough on housing and rental issues — especially after the pandemic, when all other costs are also rising.

The housing market has been under pressure from several facets for several years.

There is a shortage of millions of homes in the US and the Federal Reserve’s struggle to curb inflation has led to a rapid rise in mortgage rates, from below 3 percent a few years ago to 8 percent.

The interest rates combined with the high costs of a home are pushing many potential buyers out of the market.

Rental costs also soared during the pandemic and were one of the main drivers of rising inflation.