Biden completely botches name of website as he reveals yet another new student loan forgiveness plan

Biden completely botches the website’s name as he unveils yet another new student loan forgiveness plan

- Biden repeatedly stumbled over reciting a website URL on how to apply for an income-driven repayment plan as student loan payments resume this month

- “Student aid dash gov slash – student aid dash, student aid dot gov slash save,” said the president – finally getting the URL right at the end

- The future of student loans remained in limbo for more than three years when proposals to extend the pause and initiate widespread forgiveness were ultimately rejected.

President Joe Biden became tongue-tied when he tried to name a student loan forgiveness website that provides information about a new plan to help borrowers save money as payments resume this month.

During an announcement Wednesday about a new Department of Education initiative to lower monthly costs for student loan borrowers, Biden appeared unable to recite the website URL from the teleprompter.

“No one with student loans today or in the future, whether it’s a community college or a four-year university, will have to pay more than 5 percent of their discretionary income to repay these loans,” Biden said during the unveiling of the new plan. .

He explained: “That is the income after you pay for necessities such as housing, food and other necessities. You can sign up for the SAVE plan at studentaid.gov/save.”

But after Biden correctly read the website’s URL, he had trouble repeating it.

“Student aid dash gov slash – student aid dash, student aid dot gov slash save,” he said – finally getting it right at the end, after fumbling the order of the dots and slashes.

President Joe Biden repeatedly managed to cancel the URL of a web page with information on how to apply for an income-driven repayment plan as student loan payments resume this month after more than three and a half years of delay

“And remember, if you keep up your payments after 20 years, anything left in the loans will be forgiven,” the president added.

Biden, 80, is known for his frequent gaffes and word salad moments. He often mumbles or stumbles over his words when reading from a teleprompter.

The increasing number of these blunders has raised concerns about Biden’s age, as well as his mental and physical fitness for office. Strikingly, a poll last month showed that 77 percent of voters are concerned about Biden’s age and think he is too old to stay in power for another four years.

But that’s exactly what he does. Biden and Vice President Kamala Harris are running for 2024 reelection virtually unopposed.

Longshot Marianne Williamson is running in the Democratic primary – as is Robert F Kennedy Jr., who is expected to announce last week that he is now running as an independent.

After years of payment deferrals and interest accrual caused in March 2020 by the global COVID-19 pandemic, student loan payments will finally resume this month.

For the first time in three years and seven months, most Americans with outstanding student loans will have to make their payments. Interest accrual resumed last month.

This has increased concerns about how the average American will pay their higher daily costs due to record inflation and a recession, along with the resumption of payments that sometimes reach the high end of hundreds to nearly a thousand dollars.

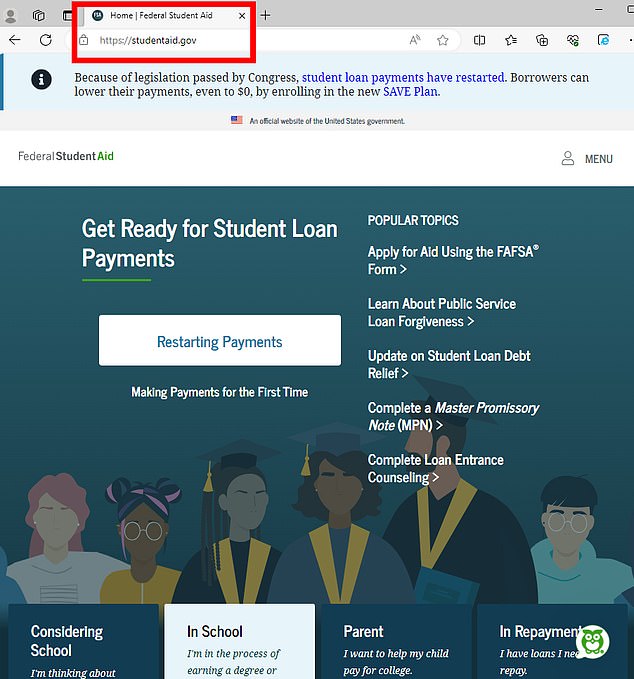

Typing “studentaid.gov/save” will direct users to a page with details on how SAVE income-driven repayment could help lower their monthly student loan payments

Biden’s efforts to cancel student debt and lower monthly payments come after his widespread plan to eliminate up to $20,000 for most borrowers was shot down by the Supreme Court this year.

Earlier this year, the Biden administration unveiled a repayment plan called the SAVE plan that sets borrowers’ monthly payments based on what they earn in monthly income. It is also intended to prevent balances from increasing exponentially due to unpaid interest.

Biden has repeatedly added new programs over the past two years to the growing list of initiatives to reduce or cancel student loan debt.

It comes after the Supreme Court rejected his sweeping plan to forgive $10,000 in student loans for most borrowers earning below a certain threshold of annual salary — and up to $20,000 for Pell Grant recipients.

Another plan protects borrowers who engaged in deceptive practices and those who attended career programs that resulted in unaffordable debt based on what they could earn after graduation.

The White House touted Biden’s approval of $127 billion in student debt forgiveness for nearly 3.6 million borrowers.

The new income-based repayment plan would apply to about 885,000 borrowers and could save nearly $42 billion in total. They claim the new program will help correct inaccuracies to reduce monthly costs.

In addition, through government loan forgiveness programs, $715,000 people who work for the government should receive a total of $51 billion in debt forgiveness that was previously unhonored.