Because EU law requires ‘speed limiters’ to be fitted to new cars, they can increase the cost of your vehicle… but save you a lot of money on your insurance

Are the fun days of driving over? First automatic cars destroyed the art of gear shifting, then silent electric vehicles destroyed the satisfying va-va-voom of engines.

A new speed limit technology goes into effect this week that will bombard drivers with beeps, vibrations or other warnings when they exceed the speed limit.

The technology has been made mandatory for all new EU cars and is likely to be fitted to most cars sold in the UK.

Campaigners hope it will put an end to the reduction in collisions on British roads. But will the system benefit both your wallet and the road? Or will the high repair costs for the complicated software ultimately break the bank?

Regulations that came into effect on Sunday will require manufacturers to install Intelligent Speed Assistance (ISA) in all new EU cars

How does a ‘speed limiter’ work?

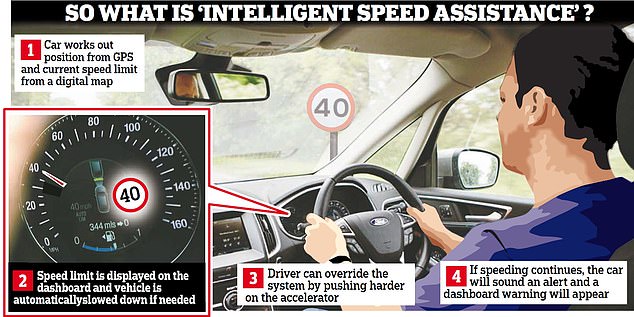

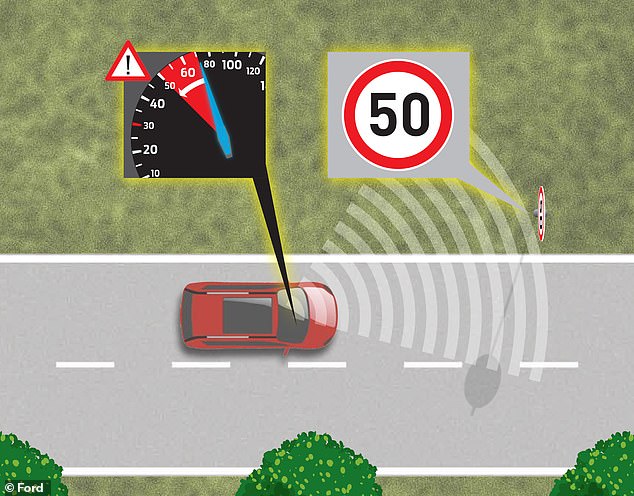

Intelligent Speed Assistance (ISA) is a speed limiting technology that uses GPS data and cameras to look for road signs to determine the speed limit. It then warns drivers when they reach it.

The system warns drivers in one or more of these ways: by making a sound, vibrating the steering wheel, and applying pressure through the accelerator pedal or cruise control, which may reduce engine power to bring the car to the legal speed limit. However, the driver can override this by pressing the accelerator pedal.

Manufacturers only need to include one of these options for the regulation to pass. So in theory, cars could have just an audio signal.

According to a spokesperson for the Society of Motor Manufacturers and Traders (SMMT), drivers still have control of the vehicle, but the system is designed to prompt and encourage drivers to slow down if they exceed the speed limit.

The technology can be overridden by the driver. Drivers can also switch off the assistance, but this must be done every time the engine is started.

Stuart Masson, editor of The Car Expert, said: ‘I don’t believe it will make the roads safer. The system will bombard you if you’re going one mile an hour over the speed limit. That’s something no police officer will pull you over for. But speed limits are important.’

ISA uses GPS data and cameras to look for road signs to determine the speed limit. It then warns drivers when they reach it, and if they don’t reduce their speed, the system can actively reduce engine power to bring the car back to the legal speed limit.

The regulations, which came into force on Sunday, will require manufacturers to install this “speed limiting technology” in all new EU cars.

The UK government has not mandated that the system be installed on all new British cars, but road safety groups are pushing the new government to introduce similar legislation.

Jack Cousens, head of roads policy at the AA, added: “Although ISA is not mandatory in the UK, many new cars will still be sold with the technology.” The RAC said it would add unnecessary production costs if manufacturers deliberately excluded the feature from UK models.

BMW, Citroën and Ford are among the companies that have committed to implementing the systems across all UK models from this month.

Some British cars are already equipped with the system. Analysis of manufacturers by This is Money shows that most manufacturers of British car models have ISA, are introducing it in new models or plan to implement it in the future.

The European Transport Safety Council has recommended the technology to achieve the goal of zero road fatalities by 2050.

There is no need for existing cars to be equipped with the technology or for drivers to use the technology. All that is needed is for new cars to be equipped with it.

Will ISA drive up car prices?

The new technology will likely lead to higher costs, but it is up to individual manufacturers to decide whether to pass these costs on to buyers.

Simon Williams, head of policy at the RAC, said: ‘It will clearly have an impact on the cost of a vehicle, but probably not a huge one.’ A study completed more than five years ago initially estimated the system cost at around £2,000. But hardware such as cameras are already fitted to cars, so the cost to manufacturers is thought to be negligible.

It is not mandatory to install the system in existing cars and it is usually only available in new cars.

It is possible to adjust ISA, but according to Williams the costs of doing so are likely to be high.

Will insurance and repair costs increase?

Motorists have been struggling with a rising cost crisis in traffic in recent years, with insurance premiums rising by 34 percent between the end of 2022 and 2023. ISA technology can help reduce premiums in the long term.

“If there are no more accidents, insurance premiums will also go down,” Williams said.

If ISA technology prevents speeding tickets, it could theoretically save a driver hundreds of pounds in annual insurance premiums.

The minimum penalty for speeding is three penalty points on a driving licence, plus a £100 fine. Premiums will increase by 40 per cent for a driver with three penalty points for speeding, according to 2022 data from insurer Admiral.

The average annual comprehensive car insurance premium is £635, according to data from the Association of British Insurers. Annual payments can rise to £889 for someone with three points on their licence.

However, Mr Cousens does not believe the technology will have a significant impact on insurance premiums, although he says ISA technology will mean drivers will have to spend more on repair costs.

The average cost of repairing a car after a collision is expected to rise due to more complex driver assistance technology.

“Even a minor impact can affect the sensors in the front bonnet. They need to be checked and recalibrated. It gets cheaper the more cars you protect,” Mr Cousens said.

Nicholas Lyes of road safety organisation IAM Roadsmart says the days when you could get a bonnet repaired for £30 to £40 are over, because there are so many systems behind the bodywork of a car.

But Lyes says the safer systems will hopefully lead to fewer collisions in the long run, resulting in lower repair costs.

It will take some time before the added benefits of safer roads trickle down to insurance premiums, he says.

“Even if you have the technology, other drivers on the road may not, so those who do may not see the full benefit. It has to be spread across multiple vehicles. Over time, the repair costs should come down.”

Mr Williams added: ‘The more complex the cars become, the more expensive it becomes to repair them.

“It will take a number of years before the benefits of the technology outweigh the costs. It will make our roads safer in the long run.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free. We do not write articles to promote products. We do not allow commercial relationships to influence our editorial independence.