Banks are offering Americans up to $900 to switch accounts – here’s how to get the cash

Banks are offering Americans up to $900 in bribes to transfer their accounts to them.

Chase, America’s largest bank, offers the largest amount of bribes: $900, but you have to open both a checking and savings account to get the full amount – and pay a certain amount.

Citi, First Horizon and Wells Fargo all offer hundreds of dollars in incentives as well.

Banks would like to entice as many Americans as possible to park their money with them and are willing to offer cash bribes to lure potential new customers.

Chase is currently offering up to $900 total for opening new services with the bank

Chase’s offer may be generous, but it’s worth checking the details in case you later find yourself with lower savings rates or higher fees than your current bank.

The nation’s largest bank is currently offering customers $300 to open a new checking account and $200 for a new savings account.

Additionally, you can earn another $400 if you open both.

While such offers look attractive, customers need to “understand exactly what you have to do to get the bonus,” Adam Rust, director of financial services at the Consumer Federation of America, told the New York Times.

For example, to receive the checking account bonus with Chase, customers must deposit a minimum of $500 within three months of account opening.

If you don’t do this, you will be charged a $12 monthly maintenance fee for the new account.

For the savings offer, you must deposit at least €15,000 within 30 days and maintain that balance for three months.

Meanwhile, Citi Bank is offering a generous $400 bonus to new customers who open a checking account.

Citi also applies a promotional rate of 5 percent on new savings accounts during the first 90 days.

Some regional banks are also offering cash bribes, including Memphis-based First Horizon, which is offering $450 for opening a new checking account.

Cash bonuses are increasing. The average for opening a new checking account rose to $400 earlier this year, up from $130 in 2016, according to Curinos data.

“Years ago $100 was common, but now $100 doesn’t really matter,” Adam Stockton, head of retail deposits and lending at Curinos, told the Times.

Another factor to consider is that any cash bonuses earned by switching accounts will be reported to the IRS and taxed as interest.

It’s also important to consider any benefits you can gain from your current bank account, such as mortgage savings or useful travel tools abroad.

And if your checking account offers a decent interest rate, switching to a cash offer may not be beneficial in the long run.

But “if you could get $300 in your pocket tomorrow, that’s more attractive to some people than the delayed gratification of a 4 percent interest rate,” Stockton told the Wall Street Journal.

The cash bribes come at a time when banks are in the news for a completely different reason: mass branch closures.

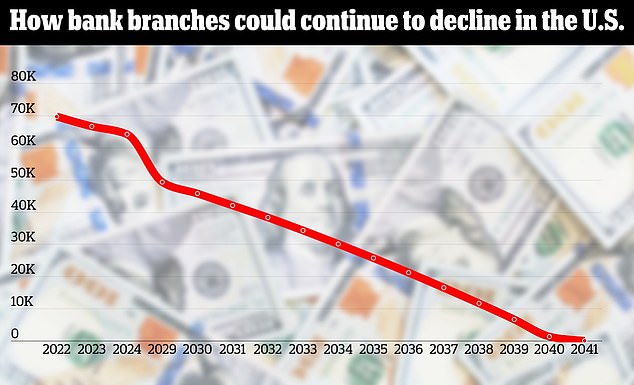

Physical bank branches in the US could be extinct by 2041, according to a new report

US banks closed 539 branches in the first half of the year, according to research by DailyMail.com.

The hardest hit state was California, which saw 72 closures. New York came in second with 51 closures, followed by Pennsylvania at 40.

The closures continued at a rapid pace last summer.

Chase abruptly closed seven branches in just one week earlier this month.

The bank, the largest in the US, was not alone. A total of 14 branches were closed between September 8 and 14.

Wells Fargo, Capitol, Fifth Third Bank, Bank First and Citizens Bank also closed locations between September 8 and 14.

If the trend of closures continues, the last physical bank branch will disappear could close as early as 2041, according to a new report from Self Financial.

This date was arrived at by studying the number of net closures across the country, which has averaged 1,646 per year since 2018.

Dailymail.com has reported on the alarming number of closures and revealed the locations of weekly closures reported to the Office of the Comptroller of the Coin.

In the first half of 2024 alone, major banks closed 539 local branches, leaving more and more Americans without access to basic financial services.