Bank of England eyes the biggest financial stability risks of 2024

The Bank of England has warned that the outlook for financial risks remains 'challenging', citing weak economic growth, geopolitical tensions and the potential for an inflationary revival.

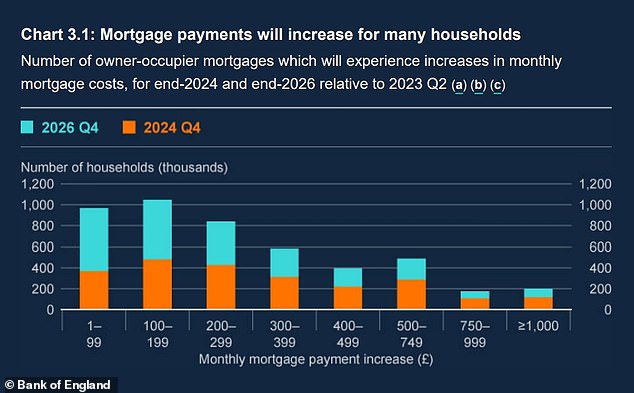

The bank reiterated its message that interest rates will have to remain higher for some time and warned that the potentially damaging consequences of previous rate hikes will not yet be fully absorbed by households and businesses.

The Financial Stability Report published today highlighted the key risks the BoE is monitoring for the year ahead, but struck a more positive tone on the outlook for UK consumers and the strength of the country's banking system.

Sarah Breeden, BoE Deputy Governor for Financial Stability

Sarah Breeden, the bank's deputy governor for financial stability, said: 'Conditions remain challenging and reflect uncertainty about the outlook for growth, inflation, higher interest rates and increased geopolitical tensions.

'Many households and businesses remain under pressure as they face higher borrowing costs

'But inflation is falling, incomes are now rising and interest rates on new mortgages and loans have fallen slightly.

'UK banks are in a strong position to support households and businesses, even if the economy turns out to be significantly weaker than expected.'

Interest rates

The BoE has raised its base rate 14 times since December 2021, before pausing amid signs of softer inflation, a loosening labor market and weaker economic output.

Markets are now convinced that interest rates in Britain and many other major economies have peaked and that the BoE is likely to cut key rates next year.

But the BoE and Governor Andrew Bailey have been at pains to reiterate that market expectations of impending rate cuts are too optimistic.

The BoE's Financial Stability Report states that regardless of the timing of a potential rate cut, it is cautious about the delayed impact of previous rate hikes.

It said: 'Long-term interest rates in Britain and the US are now around pre-2008 levels. The full impact of higher interest rates has yet to materialise, presenting ongoing challenges for households, businesses and governments, which are yet to can be amplified by vulnerabilities in the system of market-based financing.'

However, it added that while it continues to monitor developments, “UK borrowers and the financial system have broadly been resilient to the impact of higher and more volatile interest rates.”

According to the BoE, households are managing higher interest rates well, but mortgage costs will continue to rise

Debts of households and companies

The BoE said there are so far 'few signs of stress' when it comes to the ability of UK households and businesses to service their debts.

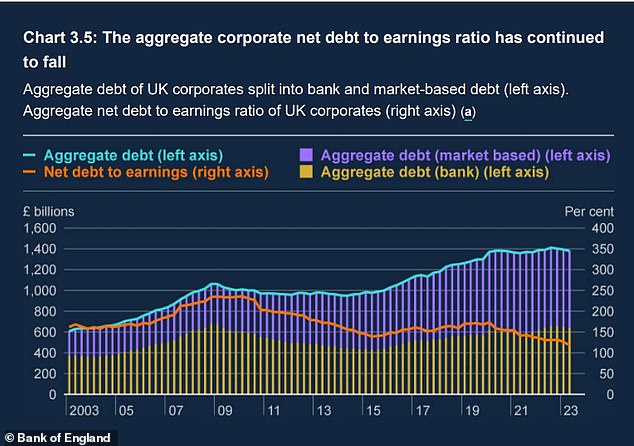

It found that strong growth in household income has reduced the share of households with a high cost of living, while the debt service ratio has been adjusted, while the ability of UK companies to service their debt has improved thanks to strong profit growth.

However, it warns: 'The adjustment to higher interest rates is making it increasingly difficult for households and businesses in advanced economies to pay off their debts.

'Ricker corporate loans in the financial markets, such as private credits and leveraged loans, appear particularly vulnerable.

'For example, deteriorating macroeconomic prospects can lead to sharp revaluations of credit risk.

'Higher defaults could also reduce investors' risk appetite in financial markets and reduce access to finance, including for UK companies.'

Profits have risen, allowing companies to survive higher debt loads

'Sources' of inflation loom, but banks are well positioned

The BoE also highlighted external factors, such as high government debt levels in major economies and vulnerabilities in China's property market, which have the potential to 'amplify shocks to the UK economy'.

In particular, the bank highlighted the geopolitical risks following the outbreak of war in the Middle East, which increase “uncertainty around the economic outlook regarding energy prices.”

The BoE said: 'If these risks were to crystallize, resulting in, for example, significant shocks to energy prices, this could impact the macroeconomic outlook in Britain and globally, and increase volatility in financial markets.

“Globally, potential sources of further inflationary pressure remain.

“In addition, U.S. growth forecasts have been revised upward since July, with the economy expected to grow by about 2.25 percent in 2023.”

But the bank gave a positive assessment of the strength of UK lenders, which it said are well capitalized and have high levels of liquidity.

According to the report, the banking sector has 'the capacity to support households and businesses even if economic and financial conditions were substantially worse than expected'.

The Chinese real estate market is a source of external risk, as highlighted by the BoE

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.