Bank branch news shock: Chase to OPEN 500 – including lavish locations with ‘living rooms and libraries’ under a new ‘JP Morgan’ branding

- Chase will open locations in Boston, Charlotte, Minneapolis and Philadelphia

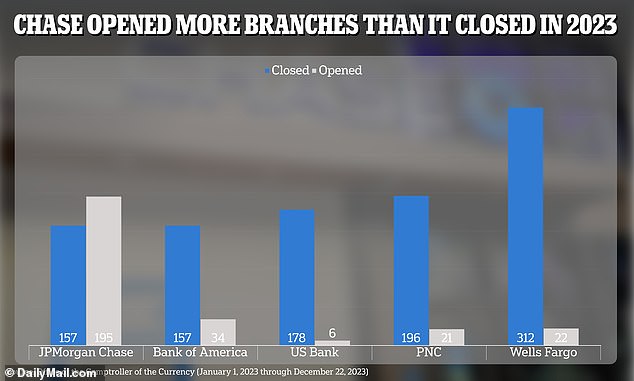

- In 2023, Chase was the only major bank to open more branches than it closed

- It will rebrand some old First Republic Bank branches as JP Morgan

Chase is bucking the trend of major U.S. banks closing their physical branches in cities across America over the past decade.

The bank said Tuesday it would open 500 branches by 2027 and invest billions in cities including Boston, Charlotte, Minneapolis, Philadelphia and the D.C. area.

About twenty of these branches will carry the brand name ‘JP Morgan’ and target wealthy customers. Many of those will be renovations of old stores owned by First Republic, the bankrupt bank that took over last May.

Chase’s planned expansion sets it apart from other banks such as Wells Fargo, Bank of America and US Bank, which have closed branches primarily to minimize costs as more Americans turn to online banking.

Chase is bucking the trend of major U.S. banks closing their physical branches in towns and cities across the country over the past decade

Chase was the only major bank to open more branches than last year, according to data from the Office of the Comptroller of the Monet (OCC).

However, it does mark a continuation of Chase’s existing strategy. A DailyMail.com analysis of data published by the regulator found that Chase was the only major bank to open more branches than it closed last year.

Between January 1 and December 22, 195 branches were opened – almost six times more than Bank of America, which came in second with just 32 branches opened.

In addition to the openings, a spokesperson for the bank said it would renovate approximately 1,700 locations and hire 3,500 employees “to bring affordable and convenient financial services to more customers and communities across the country.”

Chase had the largest physical network at the end of 2023, with 4,897 branches. Bank of America had 3,845.

JPMorgan posted record annual profits in 2023 on resilient consumers and raked in more revenue from higher interest payments as the Federal Reserve raised rates.

The bank’s new branches will typically have a consultation room where customers can have private conversations and will not use the counter as a central point of contact, said Jennifer Roberts, CEO of Chase Consumer Banking.

“Every day, approximately 900,000 people walk into a Chase branch to cash a check, make a down payment or talk to one of our experts about an important financial decision that could impact their lives,” Roberts said.

“This investment means we can continue to have branch locations that reflect the unique needs of the communities we aim to serve today, tomorrow and for many years to come.”

Marianne Lake, CEO of Consumer and Community Banking at JPMorgan, said at an investor conference in December that the bank continued to invest in its branch network and had a market share of less than 5 percent in 17 of the 50 largest markets where it tries to invest. to expand.

A handful of branches that JP Morgan Chase acquired in its acquisition of First Republic last May will be rebranded simply as “JP Morgan” and target wealthy customers

Chase Consumer Banking CEO Jennifer Roberts (pictured) said many of the new branches will have new configurations that don’t revolve around the checkout line

In the past five years, Chase has added 650 new locations, according to a news release. At the end of December, it had about 310,000 employees worldwide, more than any of its peers.

However, Chase will close at least 30 of the nearly 60 branches it acquired in its acquisition of First Republic Bank, Roberts said.

First Republic had 84 branches in eight states, and shortly after the acquisition, JPMorgan announced it would close about 21 of them.

The new JP Morgan-branded locations will feature “large living rooms, private meeting rooms and boardrooms, and a signature library,” Chase said Tuesday.

The first two locations at Columbus Circle in New York City and Pine Street in San Francisco are already under construction and the remainder will be completed by the end of 2024.