Average non-London rent up 10% in a year to £1,172, says Rightmove

>

The average rent demanded outside London rises to £1,172, up nearly 10% in a year…while those in the capital are paying almost 16% more for a home

- Demand for supply is still high despite an increase in the number of homes for rent

- Rightmove expects rents to rise another 5% in 2023

Average asking rent outside London has hit a record £1,172 per month, representing a 9.7 per cent increase from 2022, according to data from Rightmove.

There were still more tenants in need of housing than there were available, even though the number of rental properties increased by 13 percent over the year.

Rightmove predicts rents will rise another 5 percent in 2023 unless there is a “significant increase in available rental housing.”

It said the number of people inquiring about a rental was up 7 percent compared to the previous year, and 53 percent compared to pre-pandemic in 2019.

But with the rise in the number of available homes, overall competition among potential tenants for housing has fallen by 6 percent from January 2022 and by a third (33 percent) from its peak in September.

Tim Bannister, Rightmove’s director of real estate science, said: ‘While fierce competition among tenants to find a home has begun to subside, it is still double the level of 2019.

Rental agents see an extremely high number of requests from tenants and have to deal with dozens of potential tenants for every available home.

Landlords will have to weigh any rent increases against what tenants in their area can afford to continue to find tenants quickly and avoid periods when their home is vacant because tenants cannot pay the requested rent.

“We forecast that the rate of annual growth nationwide will slow to about 5 percent by the end of the year, although this will still be significantly higher than the 2 percent average we saw in the five years before the pandemic.”

In London, average asking rents rose by 5.8 percent in the last three months of the year. This took the average asking rent for new tenants to a new all-time high of £2,480 per month.

That is an increase of 15.7 percent compared to the previous year.

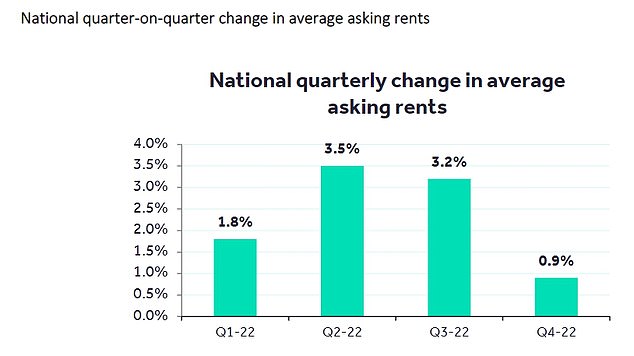

Asking rents rose every quarter last year, but slowed down in the last three months

Higher rents could lead to even more problems for those already struggling to cover the rising cost of living.

According to the Joseph Rowntree Foundation’s 2023 UK Poverty Report, more than half of private tenants living in poverty (51 per cent) are being pushed into poverty by their housing costs.

It said nearly a third (29 percent) of people living in poverty now live in the private rental sector, up from 17 percent in 1994-95.

Compared to 25 years ago, the private rented sector in the UK now houses three times as many families with children, from less than a tenth to just over a fifth of these families.

Rising rents are also detrimental to potential first-time buyers, who cannot put money aside from a down payment because a larger part of their income goes to their home.

The number of first-time buyers on the housing market shrank by 9 percent last year, while the average price they paid for a house rose, according to new figures from the Yorkshire Building Society.

Across Britain, the average return – or financial return – for landlords in the last three months of 2022 was 5.7 per cent, up 0.3 per cent on the previous year.

Landlords in the north east of the country saw the highest returns, averaging 7.9 per cent, while those in London saw the least at 5.1 per cent.