Average first-time buyer deposit now almost £62,500, Halifax data shows

>

New buyers are down 11% in 2022, Halifax says as data shows the average buyer needs a £62,500 down payment to get up the ladder

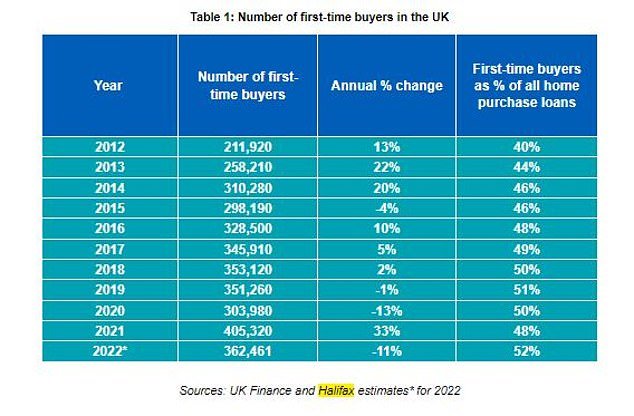

According to new data from Halifax, the number of new buyers in the UK fell by 11 per cent in 2022 as the average down payment required rose to nearly £62,500.

A total of 362,461 buyers made it up the housing ladder last year, with a year-on-year decline after a record high in 2021.

The average value of first-time buyers is now about 7.6 times the average UK salary, Halifax said.

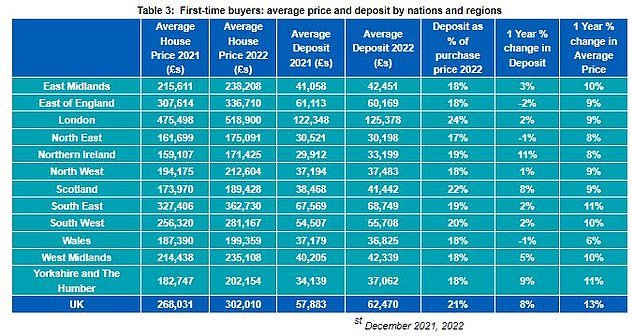

In 2022, the average cost of a home for a first-time buyer increased by 13 per cent to £302,010, with average deposits now representing 21 per cent of the purchase price.

This means a first-time buyer will need to raise an average of £62,470 for a down payment to buy a home, 8 per cent more than in 2021.

Nearly two-thirds of first home purchases are now made in joint names

In 2021, the “race for space,” the demand built up during the pandemic and the stamp duty holiday, led to a record number of buyers getting the key to their first home.

The number of first-time buyers in 2022 remained above pre-pandemic levels and was the highest since 2016.

However, Halifax’s data showed that buying a home is becoming less and less affordable. It said nearly two-thirds (63 percent) of mortgages taken out are now in joint names, with two or more people.

This may be due to the affordability of deposits and mortgages, which remain the biggest barrier for first-time homeowners.

Nationwide data has shown that homes for first-time buyers are the least affordable since 2008, as mortgage payments eat up 39 percent of a buyer’s salary.

Despite these hurdles, first-time buyers now account for more than half (52 percent) of all residential mortgages – the highest number in the past decade.

The number of new buyers in 2022 surpassed pre-pandemic numbers

The most affordable area for first-time buyers in the UK is West Dunbartonshire in Scotland, where buyers need to borrow about 2.7% of the median salary to buy.

The least affordable areas of the country are in London. New buyers face average house prices of 10 times the median salary if they want to buy in Westminster or Camden.

The need to make a bigger down payment means the average age of a first-time buyer is rising. Ten years ago the typical starter in the UK was 30 years old, but that has now risen to 32 years.

>> On the hunt for a home? The starter’s guide to getting a mortgage and climbing the real estate ladder

For starters, the average deposit required to get up the ladder is now over £62,000

Kim Kinnaird, director of mortgages at Halifax, said: ‘More than 362,000 people entered the real estate ladder in 2022, with first-time buyers now accounting for more than half of all home loans.

“Buyers looking to take their first step up the real estate ladder can welcome the expected fall in house prices this year, provided the supply is there. However, the cost of buying a home is still significant and saving for a down payment can be challenging for some first-time buyers.

“The time and cost of collecting a deposit is likely to affect the profile of the average first-time buyer over time. The first-time buyers on the housing ladder are now on average 32 years old – two years older than ten years ago – and almost two-thirds of people are now taking out their first mortgage in a joint name.’