Australia’s top investors give their eight best secret tips to set you up for life in 2025

Real estate and stock investors must use patience and strategy to achieve consistent cash flow and long-term prosperity, experts say.

Such an approach avoids the pitfalls of trying to make a quick buck from a passing fad.

Daily Mail Australia consulted some of the biggest names in investing to find out what you should be doing with your money in 2025.

With an Australian election looming and US President Donald Trump set to regain power and impose tariffs on Chinese imports, there is significant uncertainty about the regulatory framework.

Here are some proven investing tips that are sure to work no matter what happens in 2025.

1. Try not to choose a hotspot

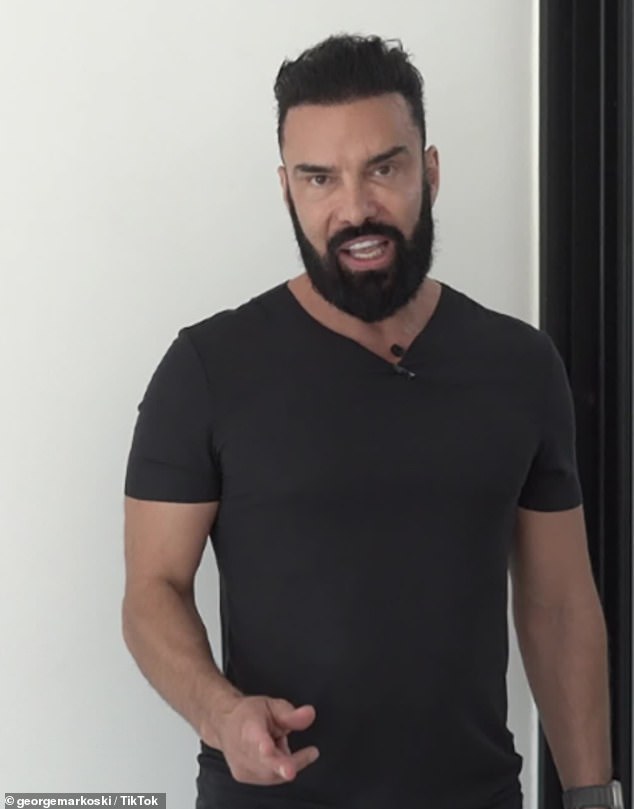

As house prices in Brisbane, Perth, Adelaide and parts of Western Sydney rose by double figures in the past year, best-selling author George Markoski said pinpointing the location of the next property boom was a no-brainer.

“Don’t try to pick the next hot spot, it’s almost impossible,” he said in a TikTok video.

While house prices in Brisbane, Perth, Adelaide and parts of Western Sydney have risen by double figures in the past year, bestselling author George Markoski said trying to find a hotspot was a cinch (pictured are houses in the suburb of Ipswich from Ipswich). Springfield)

Before the Covid pandemic, Australia’s hottest property markets had been flat for years.

There were few signs that a virus would boost housing demand in what were then more affordable capital markets, which now suffer high interstate migration rates.

House prices continued to rise in 2023 and 2024, even after the Reserve Bank raised interest rates thirteen times to combat high inflation.

2. Don’t rely on negative gearing

Real estate investors who rent out a home or unit can declare the losses on their tax returns.

But Mr Markoski said relying on negative gearing was a bad idea.

“Don’t go for those multiple, negatively geared properties just to lower your taxes,” he said. ‘This is stupid. You’re still losing money.”

Investors have lost money as rents have failed to keep pace with the most aggressive rate hikes since the late 1980s.

Bestselling author George Markoski said it’s a bad idea to pick a real estate hotspot or rely on negative gearing tax breaks

That increased the risk of falling behind on their loan payments, or worse, defaulting.

Homes in expensive suburbs typically have lower rental yields compared to the property price, which can make it particularly difficult to pay off a larger loan.

3. Avoid buying ultra-cheap homes

In some remote parts of Australia, houses and plots of land are still being sold for less than the price of a used car.

In Broken Hill, in far western New South Wales, homes are still selling for less than $100,000, with a three-bedroom house selling for just $40,000 last month.

A plot of land in South Boulder, near Kalgoorlie in Western Australia’s outback, sold in June for just $40,000.

Mr Markoski said ultra-cheap properties were unlikely to achieve capital growth due to very low demand.

‘Don’t buy properties because they look ridiculously cheap. There is a reason they are priced low: hidden repairs, poor location and no potential growth,” he said.

A plot of land in South Boulder in Western Australia sold for just $40,000 in June

4. Buy a house instead of a high-rise

CoreLogic’s Pain and Gain report for the September quarter found that council areas with a higher proportion of high-rise apartments had the worst share of owners selling at a loss.

“Units experienced a supply glut in the 2010s, particularly on the east coast of Australia,” the report said.

Parts of Sydney and Melbourne still have an oversupply of apartments as fewer investors are interested in buying off the scheme.

Nearly one in four, or 22.8 per cent, of homes in Parramatta in Sydney’s west sold at a loss in the September quarter, with sellers typically losing $50,000.

This local government area includes Sydney Olympic Park, home to the cracked Opal Tower, where apartment values have since fallen 1.5 per cent in the past year.

‘The East Coast apartment construction boom was later associated with a crisis of confidence around construction quality and potentially risky lending conditions, leading to a correction in demand in the late 2010s and a prolonged decline in unit markets with high density,’ CoreLogic said.

Melbourne’s city center was even worse, with almost half of all homes, 43.7 percent, sold at a loss.

Over the past year, average unit prices in South Melbourne fell 6.2 per cent to $603,602.

CoreLogic’s Pain and Gain report for the September quarter shows that council areas with a higher proportion of high-rise apartments are much more likely to sell at a loss (pictured shows Melbourne city center)

The same money could buy a house in Frankston North or Broadmeadows, with house prices likely to rise if the Reserve Bank eventually cuts interest rates.

“Homes consistently deliver better resale results for suppliers,” said CoreLogic.

5. Don’t panic sell stocks

The Australian stock market hit a record high in early December but has since fallen.

The benchmark S&P/ASX200 lost $50 billion in one day in the week before Christmas, with investors nervous about the US Federal Reserve’s statement that there would be fewer interest rate cuts in 2025 than previously thought due to persistent inflation.

AMP chief economist Shane Oliver said investors are likely to remain nervous in 2025 as they speculate about when the Reserve Bank of Australia will cut rates.

They were also divided over whether President Trump’s tariffs and U.S. corporate tax cuts will boost the world’s largest economy or keep inflation high by raising the prices of cheap consumer goods.

Dr. Oliver said stocks will likely continue to rise next year, but investors should be prepared for some bad weeks.

“Our overall assessment remains that the trend is still upward, including for Australian shares, but we expect more volatile and limited development in the coming year,” he said.

AMP chief economist Shane Oliver said investors were likely to remain nervous in 2025 as they also speculated about when the Reserve Bank of Australia would cut rates.

Medical imaging company Pro Medicus had an excellent performance in 2024, with its share price more than doubling from $95.83 on the last trading day of 2023 to a record high of $268.10 on December 6.

The price has since fallen back to $250, but it was the fourth best-performing stock of 2024, behind ZipCo, Life360 and Sigma Healthcare, the owner of Amcal chemists.

This happened after Pro Medicus’ share price almost doubled in 2023, but continued to rise in 2024 after US-based Visage signed new hospital contracts in the United States.

6. Be wary of Bitcoin

Bitcoin reached an all-time high of $100,000 or $A167,000 in early December.

But Dr. Oliver pointed out that the price is very volatile. Since trading in 2009, the price has fallen by 80 percent in four periods.

“The same thing will probably happen again after the current run ends, maybe next year,” he said.

“Bitcoin’s use case beyond an asset to speculate on remains unclear.”

The cryptocurrency would likely continue to rise in value, but perhaps not at the same dramatic pace as before.

“The gains on each upswing seem to slow as the easy gains diminish over time,” Dr. Oliver said.

Unlike other investments, Bitcoin and other cryptocurrencies do not produce any cash flow compared to a property that has rental income or stocks that pay dividends.

7. Put money in a term account

Investors who are concerned about an uncertain stock market can always put their money in a term deposit.

Savers receive a guaranteed return if they keep their money in such an account with terms ranging from one month to five years.

With the futures market expecting the first Australian interest rate cut in May, Canstar says banks are now offering better rates on shorter term accounts.

This meant that it now made sense to lock in a higher interest rate on term deposits before the financial markets changed their predictions about what the Reserve Bank will do in 2025.

The best rates now range from 5.15 percent for six months at and 5 percent for one year, both at Judo Bank.

“A term deposit may be worth considering if you are looking for a lower-risk investment that earns a fixed interest rate,” Canstar said.

8. Consider government bonds

When the Australian government borrows money, it issues bonds that guarantee an investor will get their money back at a fixed time with a fixed interest payment.

But when interest rates rise, the annual return for an investor, also known as yield, also rises.

The yield on three-year bonds was 4 percent in December 2024, compared to 0.9 percent three years earlier.

Ten-year bond yields stood at 4.5 per cent, compared with 1.6 per cent at the end of 2021, when the RBA cash rate was still at a record low of 0.1 per cent.

The Reserve Bank’s cash rate now stands at 4.35 percent, a level now higher than the equivalent policy rate in Canada and New Zealand.

Higher bond yields mean the government is spending more money on interest payments.

For investors, however, it means that they get a better annual return if they lend money to the government until a fixed maturity date.

Australia’s big four banks – Commonwealth, Westpac, ANZ and NAB – trade government bonds, as do foreign banks including Citi, BNP Paribas, Deutsche Bank, HSBC, JP Morgan and UBS.

The Australian Office of Financial Management issues government bonds on behalf of the Commonwealth.

Retail investors can purchase exchange-traded Australian government bonds on the Australian Securities Exchange, or buy and sell Australian government bonds directly using a holder reference number.